SunTrust 2012 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

127

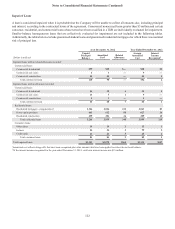

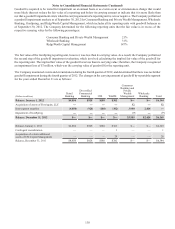

Concentrations of Credit Risk

The Company does not have a significant concentration of risk to any individual client except for the U.S. government and its

agencies. However, a geographic concentration arises because the Company operates primarily in the Southeastern and Mid-

Atlantic regions of the U.S. The Company engages in limited international banking activities. The Company’s total cross-border

outstanding loans were $562 million and $630 million at December 31, 2012 and 2011, respectively.

The major concentrations of credit risk for the Company arise by collateral type in relation to loans and credit commitments. The

only significant concentration that exists is in loans secured by residential real estate. At December 31, 2012, the Company owned

$43.2 billion in residential loans, representing 36% of total LHFI, and had $11.7 billion in commitments to extend credit on home

equity lines and $9.2 billion in mortgage loan commitments. Of the residential loans owned at December 31, 2012, 10% were

guaranteed by a federal agency or a GSE. At December 31, 2011, the Company owned $46.7 billion in residential loans, representing

38% of total LHFI, and had $12.7 billion in commitments to extend credit on home equity lines and $7.8 billion in mortgage loan

commitments. Of the residential loans owned at December 31, 2011, 14% were guaranteed by a federal agency or a GSE.

Included in the residential mortgage portfolio were $13.3 billion and $14.7 billion of mortgage loans at December 31, 2012 and

2011, respectively, that included terms such as an interest only feature, a high LTV ratio, or a second lien position that may increase

the Company’s exposure to credit risk and result in a concentration of credit risk. Of these mortgage loans, $7.6 billion and $9.4

billion, respectively, were interest only loans, primarily with a ten year interest only period. Approximately $1.5 billion of those

interest only loans as of December 31, 2012, and $1.9 billion as of December 31, 2011, were loans with no mortgage insurance

and were either first liens with combined original LTV ratios in excess of 80% or were second liens. Additionally, the Company

owned approximately $5.7 billion and $5.3 billion of amortizing loans with no mortgage insurance at December 31, 2012 and

2011, respectively, comprised of first liens with combined original LTV ratios in excess of 80% and second liens. Despite changes

in underwriting guidelines that have curtailed the origination of high LTV loans, the balances of such loans with no mortgage

insurance have increased as the benefits of mortgage insurance covering certain second lien mortgage loans have been exhausted,

resulting in the loans effectively no longer being insured.

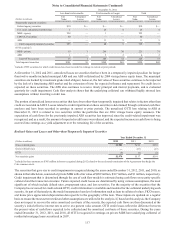

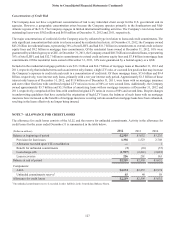

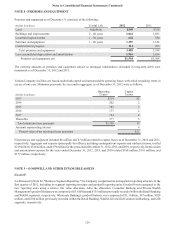

NOTE 7 - ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses consists of the ALLL and the reserve for unfunded commitments. Activity in the allowance for

credit losses for the years ended December 31 is summarized in the table below:

(Dollars in millions) 2012 2011 2010

Balance at beginning of period $2,505 $3,032 $3,235

Provision for loan losses 1,398 1,523 2,708

Allowance recorded upon VIE consolidation —— 1

Benefit for unfunded commitments (3)(10)(57)

Loan charge-offs (1,907)(2,241)(3,018)

Loan recoveries 226 201 163

Balance at end of period $2,219 $2,505 $3,032

Components:

ALLL $2,174 $2,457 $2,974

Unfunded commitments reserve145 48 58

Allowance for credit losses $2,219 $2,505 $3,032

1 The unfunded commitments reserve is recorded in other liabilities in the Consolidated Balance Sheets.