SunTrust 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

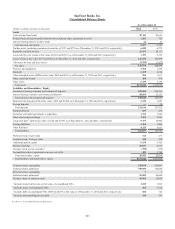

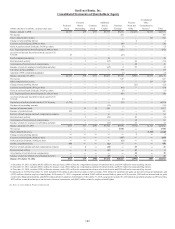

96

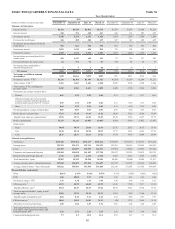

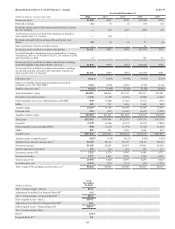

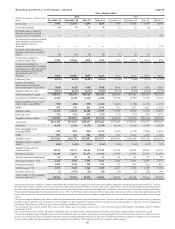

Reconcilement of Non-U.S. GAAP Measures – Quarterly Table 40

Three Months Ended

(Dollars in millions, except per share

data)

2012 2011

December 31 September 30 June 30 March 31 December 31 September 30 June 30 March 31

Net income $356 $1,077 $275 $250 $74 $215 $178 $180

Preferred dividends (4) (2) (3) (3) (2) (2) (2) (2)

Dividends and accretion of

discount on preferred stock

issued to the U.S. Treasury — — — — — — — (66)

Accelerated accretion associated

with repurchase of preferred

stock issued to the U.S.

Treasury — — — — — — — (74)

Dividends and undistributed

earnings allocated to unvested

shares (2) (9) (2) (2) (1) (2) (2) —

Net income available to

common shareholders $350 $1,066 $270 $245 $71 $211 $174 $38

Net income available to

common shareholders excluding

accelerated accretion associated

with repurchase of preferred

stock issued to the U.S.

Treasury 1$350 $1,066 $270 $245 $71 $211 $174 $112

Efficiency ratio 265.93% 44.90% 68.83% 69.50% 81.45% 71.05% 70.17% 67.83%

Impact of excluding

amortization of intangible

assets/impairment of goodwill (0.30) (0.43) (0.50) (0.48) (0.46) (0.50) (0.53) (0.51)

Tangible efficiency ratio 365.63% 44.47% 68.33% 69.02% 80.99% 70.55% 69.64% 67.32%

Total shareholders’ equity $20,985 $20,399 $20,568 $20,241 $20,066 $20,200 $19,660 $19,223

Goodwill, net of deferred taxes 4(6,206) (6,210) (6,220) (6,180) (6,190) (6,195) (6,199) (6,185)

Other intangible assets, net of

deferred taxes, and MSRs 5(949) (888) (929) (1,142) (1,001) (1,120) (1,518) (1,635)

MSRs 899 831 865 1,070 921 1,033 1,423 1,538

Tangible equity 14,729 14,132 14,284 13,989 13,796 13,918 13,366 12,941

Preferred stock (725) (275) (275) (275) (275) (172) (172) (172)

Tangible common equity $14,004 $13,857 $14,009 $13,714 $13,521 $13,746 $13,194 $12,769

Total assets $173,442 $173,181 $178,257 $178,226 $176,859 $172,553 $172,173 $170,794

Goodwill (6,369) (6,369) (6,376) (6,344) (6,344) (6,344) (6,343) (6,324)

Other intangible assets

including MSRs (956) (896) (939) (1,155) (1,017) (1,138) (1,539) (1,659)

MSRs 899 831 865 1,070 921 1,033 1,423 1,538

Tangible assets $167,016 $166,747 $171,807 $171,797 $170,419 $166,104 $165,714 $164,349

Tangible equity to tangible

assets 68.82% 8.48% 8.31% 8.14% 8.10% 8.38% 8.07% 7.87%

Tangible book value per

common share 7$25.98 $25.72 $26.02 $25.49 $25.18 $25.60 $24.57 $23.79

Net interest income $1,246 $1,271 $1,274 $1,311 $1,294 $1,263 $1,259 $1,249

Taxable-equivalent adjustment 30 30 32 31 30 30 27 28

Net interest income - FTE 1,276 1,301 1,306 1,342 1,324 1,293 1,286 1,277

Noninterest income 1,015 2,542 940 876 723 903 912 883

Total revenue - FTE 2,291 3,843 2,246 2,218 2,047 2,196 2,198 2,160

Securities gains, net (1) (1,941) (14) (18) (19) (2) (32) (64)

Total revenue - FTE excluding

securities gains, net 8$2,290 $1,902 $2,232 $2,200 $2,028 $2,194 $2,166 $2,096

1We present net income available to common shareholders that excludes the accelerated accretion associated with the repurchase of preferred stock issued to the U.S. Treasury.

We believe this measure is useful to investors, because removing the non-cash accelerated accretion provides a more representative view of normalized operations and the measure

also allows better comparability with peers in the industry who also provide a similar presentation when applicable. In addition, we use this measure internally to analyze performance.

2Computed by dividing noninterest expense by total revenue - FTE. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments. We

believe this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt

sources.

3We present a tangible efficiency ratio which excludes the impairment/amortization of goodwill/intangible assets. We believe this measure is useful to investors because, by removing

the effect of these intangible asset costs (the level of which may vary from company to company), it allows investors to more easily compare our efficiency to other companies in

the industry. This measure is utilized by us to assess our efficiency and that of our lines of business.

4Net of deferred taxes of $163 million, $159 million, $156 million, and $164 million, respectively, in 2012; and $154 million, $149 million, $144 million, and $139 million,

respectively, in 2011.

5Net of deferred taxes of $7 million, $8 million, $10 million, and $14 million in 2012; and $16 million, $18 million, $21 million, and $24 million, respectively, in 2011.

6We present a tangible equity to tangible assets ratio that excludes the after-tax impact of purchase accounting intangible assets. We believe this measure is useful to investors

because, by removing the effect of intangible assets that result from merger and acquisition activity (the level of which may vary from company to company), it allows investors

to more easily compare our capital adequacy to other companies in the industry. This measure is used by us to analyze capital adequacy.