SunTrust 2012 Annual Report Download - page 193

Download and view the complete annual report

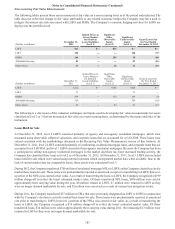

Please find page 193 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

177

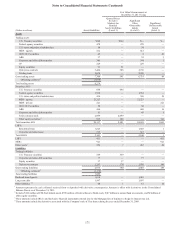

Trading loans

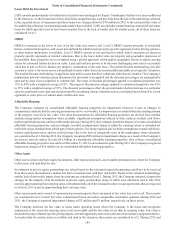

The Company engages in certain businesses whereby the election to carry loans at fair value for financial reporting

aligns with the underlying business purpose. Specifically, the loans that are included within this classification are:

(i) loans made or acquired in connection with the Company’s TRS business (see Note 10, "Certain Transfers of

Financial Assets and Variable Interest Entities," and Note 16, “Derivative Financial Instruments,” for further

discussion of this business), (ii) loans backed by the SBA, and (iii) the loan sales and trading business within the

Company’s Wholesale Banking segment. All of these loans are classified as level 2, due to the market data that the

Company uses in the estimate of fair value.

The loans made in connection with the Company’s TRS business are short-term, demand loans, whereby the repayment

is senior in priority and whose value is collateralized. While these loans do not trade in the market, the Company

believes that the par amount of the loans approximates fair value and no unobservable assumptions are made by the

Company to arrive at this conclusion. At December 31, 2012 and 2011, the Company had outstanding $1.9 billion

and $1.7 billion, respectively, of such short-term loans carried at fair value.

SBA loans are similar to SBA securities discussed herein under “Federal agency securities,” except for their legal

form. In both cases, the Company trades instruments that are fully guaranteed by the U.S. government as to contractual

principal and interest and there is sufficient observable trading activity upon which to base the estimate of fair value.

The loans from the Company’s sales and trading business are commercial and corporate leveraged loans that are

either traded in the market or for which similar loans trade. The Company elected to carry these loans at fair value

since they are actively traded. The Company is able to obtain fair value estimates for substantially all of these loans

through a third party valuation service that is broadly used by market participants. While most of the loans are traded

in the market, the Company does not believe that trading activity qualifies the loans as level 1 instruments, as the

volume and level of trading activity is subject to variability and the loans are not exchange-traded, such that the

Company believes that level 2 is a more appropriate presentation of the underlying market activity for the loans. At

December 31, 2012 and 2011, $357 million and $323 million, respectively, of loans related to the Company’s trading

business were held in inventory.

All recognized gains or losses due to changes in fair value are attributable to instrument-specific credit risk.

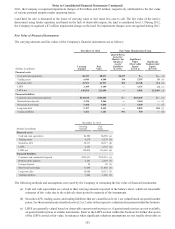

Loans Held for Sale and Loans Held for Investment

Residential LHFS

The Company values certain newly-originated mortgage LHFS predominantly at fair value based upon defined

product criteria. The Company chooses to fair value these mortgage LHFS to eliminate the complexities and inherent

difficulties of achieving hedge accounting and to better align reported results with the underlying economic changes

in value of the loans and related hedge instruments. Origination fees and costs are recognized in earnings when earned

or incurred. The servicing value is included in the fair value of the loan and initially recognized at the time the

Company enters into IRLCs with borrowers. The Company uses derivatives to economically hedge changes in

servicing value as a result of including the servicing value in the fair value of the loan. The mark-to-market adjustments

related to LHFS and the associated economic hedges are captured in mortgage production related income/(loss).

Level 2 LHFS are primarily agency loans which trade in active secondary markets and are priced using current market

pricing for similar securities adjusted for servicing and risk and also include non-agency residential mortgages. Due

to the non-agency residential loan market disruption, which began during the third quarter of 2007, there was little

to no observable trading activity of similar instruments and the Company previously classified these LHFS as level

3. Due to increased trading activity in the secondary loan market, where the Company has been a market participant,

the Company has been able to obtain observable pricing and therefore, the Company reclassified these LHFS as level

2. As disclosed in the tabular level 3 rollforwards, transfers of certain mortgage LHFS into level 3 during 2012 and

2011 were not due to using alternative valuation approaches, but were largely due to borrower defaults or the

identification of other loan defects impacting the marketability of the loans.

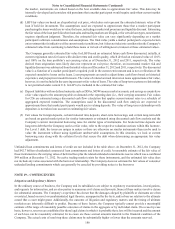

For residential loans that the Company has elected to carry at fair value, the Company considers the component of

the fair value changes due to instrument-specific credit risk, which is intended to be an approximation of the fair

value change attributable to changes in borrower-specific credit risk. For the year ended December 31, 2012, the

Company recognized gains in the Consolidated Statements of Income of $12 million, due to changes in fair value

attributable to borrower-specific credit risk. For the years ended December 31, 2011 and 2010, the Company

recognized losses in the Consolidated Statements of Income of $15 million and $18 million, respectively, due to

changes in fair value attributable to borrower-specific credit risk. In addition to borrower-specific credit risk, there