SunTrust 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

136

loans that were consolidated at that time, resulting in an immaterial transition adjustment, which was recorded in the

Company’s Consolidated Statements of Shareholders’ Equity.

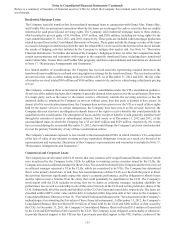

The Company’s involvement with Three Pillars included the following activities: services related to the administration

of Three Pillars’ activities and client referrals to Three Pillars; issuance of letters of credit, which provided partial

credit protection to the CP holders; and providing liquidity arrangements that provided funding to Three Pillars in

the event it can no longer issue CP or in certain other circumstances. The Company’s activities with Three Pillars

generated total revenue for the Company, net of direct salary and administrative costs, of $65 million and $68 million

for the years ended December 31, 2011, and 2010, respectively. Before liquidation in 2012, Three Pillars generated

$11 million of total revenue for the Company, net of direct salary and administrative costs. Subsequent to liquidation,

the Bank continued to recognize revenue from the commitments and outstanding loans that were transferred to the

Bank by Three Pillars.

At December 31, 2011, the Company’s Consolidated Balance Sheets included approximately $2.9 billion of secured

loans held by Three Pillars, which were included within commercial loans. Other assets and liabilities were not

material to the Company's Consolidated Balance Sheets, and no CP was outstanding at December 31, 2011. No losses

on any of Three Pillars’ assets were incurred during the years ended December 31, 2012, 2011, and 2010.

For further discussion on the activities of Three Pillars in 2011 and 2010, see Note 11, "Certain Transfers of Financial

Assets and Variable Interest Entities", to the Consolidated Financial Statements in the Company's Annual Report on

Form 10-K for the year ended December 31, 2011.

Total Return Swaps

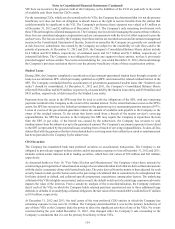

The Company has involvement with various VIEs related to its TRS business. Under the matched book TRS business

model, the VIEs purchase assets (typically commercial leveraged loans) from the market, which are identified by

third party clients, that serve as the underlying reference assets for a TRS between the VIE and the Company and a

mirror TRS between the Company and its third party clients. The TRS contracts between the VIEs and the Company

hedge the Company’s exposure to the TRS contracts with its third party clients. These third parties are not related

parties to the Company, nor are they and the Company de facto agents of each other. In order for the VIEs to purchase

the reference assets, the Company provides senior financing, in the form of demand notes, to these VIEs. The TRS

contracts pass through interest and other cash flows on the assets owned by the VIEs to the third parties, along with

exposing the third parties to depreciation on the assets and providing them with the rights to appreciation on the

assets. The terms of the TRS contracts require the third parties to post initial collateral, in addition to ongoing margin

as the fair values of the underlying assets change. Although the Company has always caused the VIEs to purchase a

reference asset in response to the addition of a reference asset by its third party clients, there is no legal obligation

between the Company and its third party clients for the Company to purchase the reference assets or for the Company

to cause the VIEs to purchase the assets.

The Company considered the VIE consolidation guidance, which requires an evaluation of the substantive contractual

and non-contractual aspects of transactions involving VIEs established subsequent to January 1, 2010. The Company

and its third party clients are the only VI holders. As such, the Company evaluated the nature of all VIs and other

interests and involvement with the VIEs, in addition to the purpose and design of the VIEs, relative to the risks they

were designed to create. The purpose and design of a VIE are key components of a consolidation analysis and any

power should be analyzed based on the substance of that power relative to the purpose and design of the VIE. The

VIEs were designed for the benefit of the third parties and would not exist if the Company did not enter into the TRS

contracts with the third parties. The activities of the VIEs are restricted to buying and selling reference assets with

respect to the TRS contracts entered into between the Company and its third party clients and the risks/benefits of

any such assets owned by the VIEs are passed to the third party clients via the TRS contracts. The TRS contracts

between the Company and its third party clients have a substantive effect on the design of the overall transaction and

the VIEs. Based on its evaluation, the Company has determined that it is not the primary beneficiary of the VIEs, as

the design of the TRS business results in the Company having no substantive power to direct the significant activities

of the VIEs.

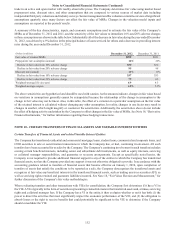

At December 31, 2012 and 2011, the Company had $1.9 billion and $1.7 billion, respectively, in senior financing

outstanding to VIEs, which were classified within trading assets on the Consolidated Balance Sheets and carried at

fair value. These VIEs had entered into TRS contracts with the Company with outstanding notional amounts of $1.9

billion and $1.6 billion at December 31, 2012 and 2011, respectively, and the Company had entered into mirror TRS

contracts with its third parties with the same outstanding notional amounts. At December 31, 2012, the fair values

of these TRS assets and liabilities were $51 million and $46 million, respectively, and at December 31, 2011, the fair

values of these TRS assets and liabilities were $20 million and $17 million, respectively, reflecting the pass-through

nature of these structures. The notional amounts of the TRS contracts with the VIEs represent the Company’s maximum