SunTrust 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

113

beginning on or after January 1, 2012. The Company adopted the standard as of January 1, 2012. The adoption did not have

an impact on the Company's financial position, results of operations, or EPS.

In December 2011, the FASB issued ASU 2011-11, "Balance Sheet (Topic 210): Disclosures about Offsetting Assets and

Liabilities." The ASU requires additional disclosures about financial instruments and derivative instruments that are offset or

subject to an enforceable master netting arrangement or similar agreement. In January 2013, the FASB issued ASU 2013-01,

“Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities” which more narrowly

defined the scope of financial instruments to only include derivatives, repurchase agreements and reverse repurchase

agreements, and securities borrowing and securities lending transactions. The ASUs are effective for the interim reporting

period ending March 31, 2013 with retrospective disclosure for all comparative periods presented. Since the ASUs only impact

financial statement disclosures, its adoption will not impact the Company's financial position, results of operations, or EPS.

In July 2012, the FASB issued ASU 2012-02, “Intangibles-Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible

Assets for Impairment." The ASU permits entities to perform an optional qualitative assessment for determining whether it

is more likely than not that an indefinite-lived intangible asset is impaired. The guidance is effective for annual and interim

impairment tests performed for fiscal years beginning after September 15, 2012. As early adoption is permitted, the Company

adopted the ASU as of October 1, 2012 and the adoption did not have an impact on the Company's financial position, results

of operations, or EPS when adopted.

In October 2012, the FASB issued ASU 2012-04, “Technical Corrections and Improvements." The ASU prescribes technical

corrections and improvements to the Accounting Standards Codification for source literature amendments, guidance

clarification and reference corrections, and relocated guidance within the Accounting Standards Codification. The ASU is

effective for fiscal periods beginning after December 15, 2012. The Company has adopted the ASU as of January 1, 2013 and

the adoption did not have an impact on the Company's financial position, results of operations, or EPS.

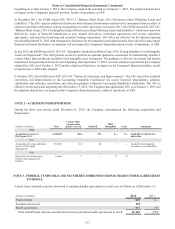

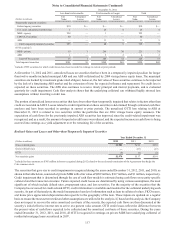

NOTE 2 - ACQUISITIONS/DISPOSITIONS

During the three year period ended December 31, 2012, the Company consummated the following acquisitions and

dispositions:

(Dollars in millions) Date

Cash or other

consideration

(paid)/ received Goodwill Other

Intangibles Gain Comments

2012

Acquisition of assets of

FirstAgain, LLC 6/22/2012 ($12) $32 $— $— Goodwill recorded is tax-

deductible.

2011

Acquisition of certain additional

assets of CSI Capital

Management

5/9/2011 (19) 20 7 — Goodwill and intangibles

recorded are tax-deductible.

2010

Disposition of certain money

market fund management

business

various 7 — 11 18

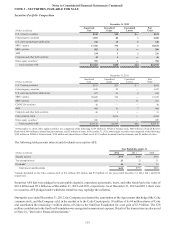

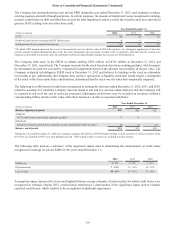

NOTE 3 - FEDERAL FUNDS SOLD AND SECURITIES BORROWED OR PURCHASED UNDER AGREEMENTS

TO RESELL

Federal funds sold and securities borrowed or purchased under agreements to resell were as follows as of December 31:

(Dollars in millions) 2012 2011

Federal funds $29 $—

Securities borrowed 155 —

Resell agreements 917 792

Total federal funds sold and securities borrowed or purchased under agreements to resell $1,101 $792