SunTrust 2012 Annual Report Download - page 122

Download and view the complete annual report

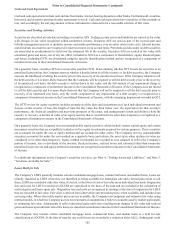

Please find page 122 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

106

losses, as well as incremental interest rate or liquidity related valuation adjustments are recorded as a component of noninterest

income in the Consolidated Statements of Income. The Company may also transfer loans from held for sale to held for

investment. At the time of transfer, any difference between the carrying amount of the loan and its outstanding principal

balance is recognized as an adjustment to yield using the interest method, unless the loan was elected upon origination to be

accounted for at fair value. If a held for sale loan is transferred to held for investment for which fair value accounting was

elected, it will continue to be accounted for at fair value in the held for investment portfolio. For additional information on

the Company’s LHFS activities, see Note 6, “Loans.”

Loans

Loans that management has the intent and ability to hold for the foreseeable future or until maturity or pay-off are considered

LHFI. The Company’s loan balance is comprised of loans held in portfolio, including commercial loans, consumer loans, and

residential loans. Interest income on all types of loans, except those classified as nonaccrual, is accrued based upon the

outstanding principal amounts using the effective yield method.

Commercial loans (commercial & industrial, commercial real estate, and commercial construction) are considered to be past

due when payment is not received from the borrower by the contractually specified due date. The Company typically classifies

commercial loans as nonaccrual when one of the following events occurs: (i) interest or principal has been past due 90 days

or more, unless the loan is both well secured and in the process of collection; (ii) collection of recorded interest or principal

is not anticipated; or (iii) income for the loan is recognized on a cash basis due to the deterioration in the financial condition

of the debtor. When a loan is placed on nonaccrual, unpaid interest is reversed against interest income. Interest income on

nonaccrual loans, if recognized, is recognized after the principal has been reduced to zero. If and when commercial borrowers

demonstrate the ability to repay a loan in accordance with the contractual terms of a loan classified as nonaccrual, the loan

may be returned to accrual status upon meeting all regulatory, accounting, and internal policy requirements.

Consumer loans (guaranteed and private student loans, other direct, indirect, and credit card) are considered to be past due

when payment is not received from the borrower by the contractually specified due date. Guaranteed student loans continue

to accrue interest regardless of delinquency status because collection of principal and interest is reasonably assured. Other

direct and indirect loans are typically placed on nonaccrual when payments have been past due for 90 days or more except

when the borrower has declared bankruptcy, in which case, they are moved to nonaccrual status once they become 60 days

past due. When a loan is placed on nonaccrual, unpaid interest is reversed against interest income. Interest income on nonaccrual

loans, if recognized, is recognized on a cash basis. Nonaccrual consumer loans are typically returned to accrual status once

they are no longer past due.

Residential loans (guaranteed and nonguaranteed residential mortgages, home equity products, and residential construction)

are considered to be past due when a monthly payment is due and unpaid for one month. Guaranteed residential mortgages

continue to accrue interest regardless of delinquency status because collection of principal and interest is reasonably assured.

Nonguaranteed residential mortgages and residential construction loans are generally placed on nonaccrual when three

payments are past due. Home equity products are generally placed on nonaccrual when payments are 90 days past due. The

exceptions for nonguaranteed residential mortgages, residential construction loans, and home equity products are: (i) when

the borrower has declared bankruptcy, in which case, they are moved to nonaccrual status once they become 60 days past due;

(ii) loans discharged in Chapter 7 bankruptcy that have not been reaffirmed by the borrower, in which case, they are moved

to nonaccrual status immediately; and (iii) second lien loans which are classified as nonaccrual when the first lien loan is

classified as nonaccrual even if the second lien loan is performing. When a loan is placed on nonaccrual, unpaid interest is

reversed against interest income. Interest income on nonaccrual loans, if recognized, is recognized on a cash basis. Generally,

nonaccrual residential loans are typically returned to accrual status once they no longer meet the delinquency threshold that

resulted in them initially being moved to nonaccrual status, with the exception of the aforementioned Chapter 7 bankruptcy

loans, which remain on nonaccrual, regardless of payment status.

TDRs are loans in which the borrower is experiencing financial difficulty at the time of restructure and the borrower received

an economic concession either from the Company or as the product of a bankruptcy court order. To date, the Company’s TDRs

have been predominantly first and second lien residential mortgages and home equity lines of credit. Prior to granting a

modification of a borrower’s loan terms, the Company performs an evaluation of the borrower’s financial condition and ability

to service under the potential modified loan terms. The types of concessions generally granted are extensions of the loan

maturity date and/or reductions in the original contractual interest rate. Typically, if a loan is accruing interest at the time of

modification, the loan remains on accrual status and is subject to the Company’s charge-off and nonaccrual policies. See the

“Allowance for Credit Losses” section within this Note for further information regarding these policies. If a loan is on nonaccrual

before it is determined to be a TDR then the loan remains on nonaccrual. Typically, TDRs may be returned to accrual status

if there has been at least a six month sustained period of repayment performance by the borrower. Generally, once a residential

loan becomes a TDR, the Company expects that the loan will likely continue to be reported as a TDR for its remaining life