SunTrust 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228

|

|

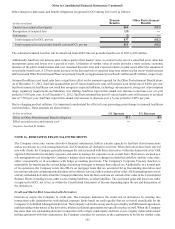

Notes to Consolidated Financial Statements (Continued)

150

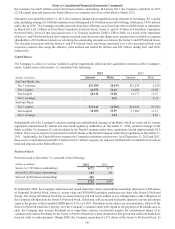

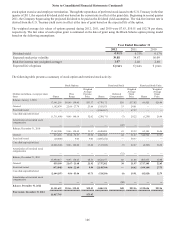

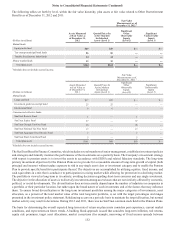

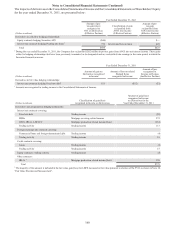

Pension benefits with a projected benefit obligation, in excess of plan assets as of December 31, were as follows:

(Dollars in millions) 2012 2011

Projected benefit obligation $2,701 $2,530

Accumulated benefit obligation 2,701 2,530

Pension Benefits Other Postretirement

Benefits

(Weighted average assumptions used to

determine benefit obligations, end of year) 2012 2011 2012 2011

Discount rate 4.08% 4.63% 3.45% 4.10%

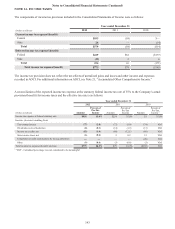

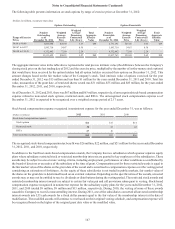

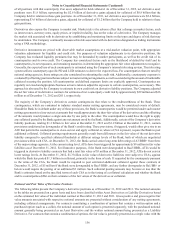

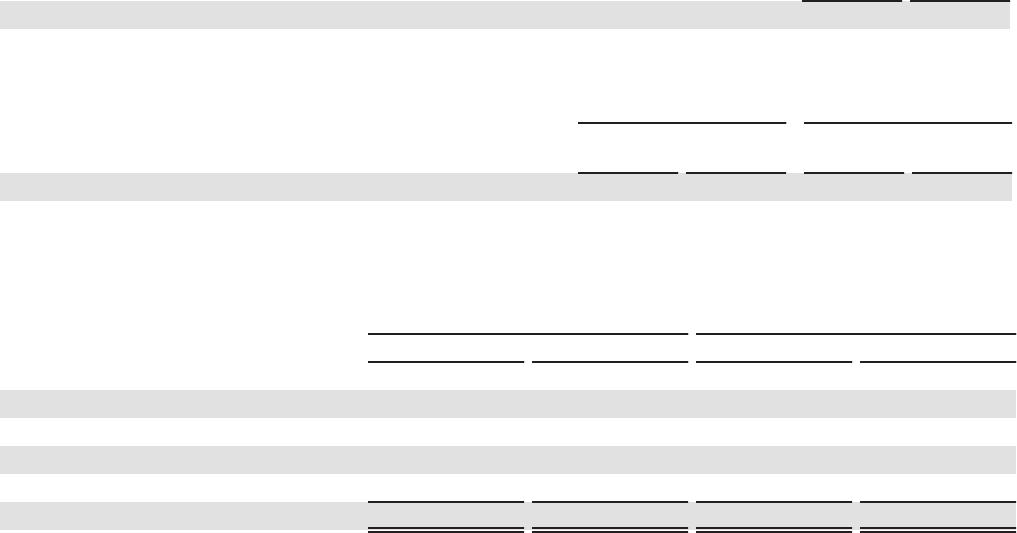

The changes in plan assets during the year ended December 31,were as follows:

Pension Benefits Other Postretirement Benefits

(Dollars in millions) 2012 2011 2012 2011

Fair value of plan assets, beginning of year $2,550 $2,522 $161 $165

Actual return on plan assets 350 129 17 7

Employer contributions 26 8——

Plan participants’ contributions ——22 22

Benefits paid (184)(109)(36)(33)

Fair value of plan assets, end of year $2,742 $2,550 $164 $161

Employer contributions indicated under pension benefits represent the benefits that were paid to nonqualified plan participants.

SERPs are not funded through plan assets.

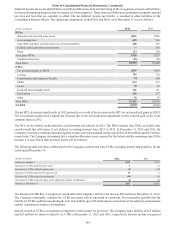

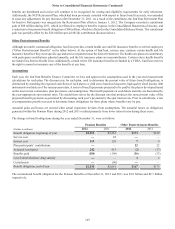

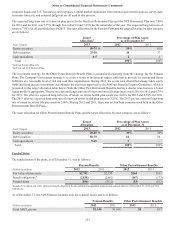

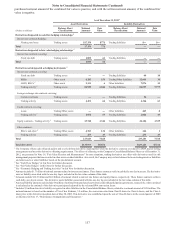

The fair value of plan assets is measured based on the fair value hierarchy which is discussed in Note 18, “Fair Value Election and

Measurement.” The valuations are based on third party data received as of the balance sheet date. Level 1 assets such as equity

securities, mutual funds, and REITs are instruments that are traded in active markets and are valued based on identical instruments.

Fixed income securities and common and collective trust funds are classified as level 2 assets because there is not an identical

asset in the market upon which to base the valuation; however, there are no significant unobservable assumptions used to value

level 2 instruments. The common and collective funds are valued each business day at its reported net asset value, as determined

by the issuer, based on the underlying assets of the fund. Corporate, foreign bonds, and preferred securities are valued based on

quoted market prices obtained from external pricing sources where trading in an active market exists for level 2 assets. Level 3

assets primarily consist of private placement and noninvestment grade bonds. Limited visible market activity exists for these

instruments or similar instruments, and therefore, significant unobservable assumptions are used to value the securities.