SunTrust 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

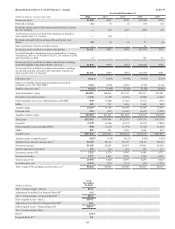

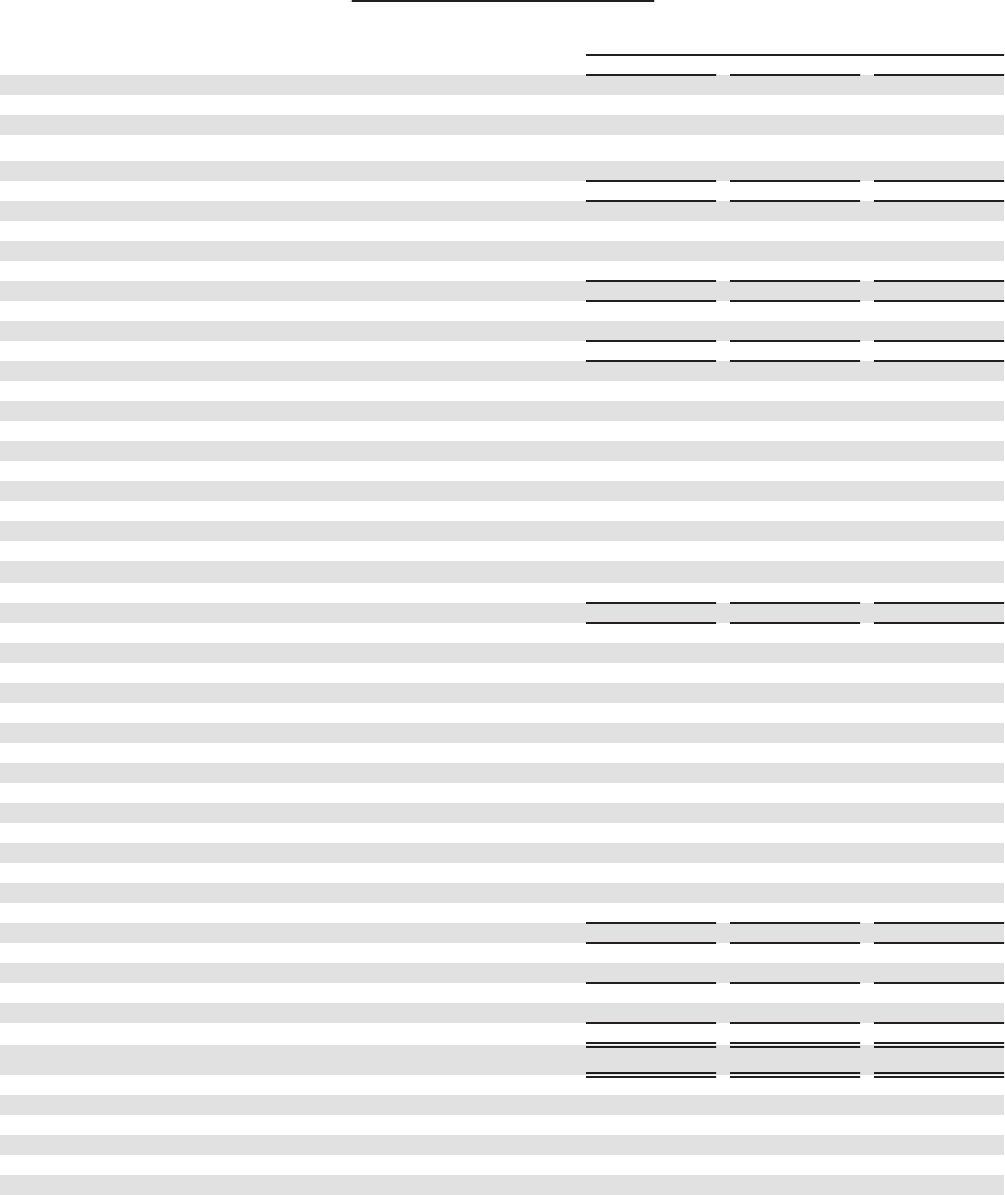

99

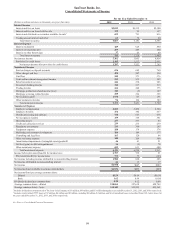

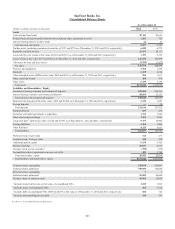

SunTrust Banks, Inc.

Consolidated Statements of Income

For the Year Ended December 31

(Dollars in millions and shares in thousands, except per share data) 2012 2011 2010

Interest Income

Interest and fees on loans $5,035 $5,219 $5,300

Interest and fees on loans held for sale 112 93 137

Interest and dividends on securities available for sale1655 791 816

Trading account interest and other 65 78 90

Total interest income 5,867 6,181 6,343

Interest Expense

Interest on deposits 429 624 860

Interest on long-term debt 299 449 580

Interest on other borrowings 37 43 49

Total interest expense 765 1,116 1,489

Net interest income 5,102 5,065 4,854

Provision for credit losses 1,395 1,513 2,651

Net interest income after provision for credit losses 3,707 3,552 2,203

Noninterest Income

Service charges on deposit accounts 676 685 760

Other charges and fees 478 507 534

Card fees 240 371 376

Trust and investment management income 512 531 503

Retail investment services 241 230 205

Investment banking income 342 317 313

Trading income 211 248 173

Mortgage production related income/(loss) 343 (5) 127

Mortgage servicing related income 260 224 358

Net securities gains21,974 117 191

Other noninterest income 96 196 189

Total noninterest income 5,373 3,421 3,729

Noninterest Expense

Employee compensation 2,603 2,494 2,364

Employee benefits 474 382 457

Outside processing and software 710 653 638

Net occupancy expense 359 356 361

Operating losses 277 377 83

Credit and collection services 239 275 279

Regulatory assessments 233 300 265

Equipment expense 188 178 174

Marketing and customer development 184 184 177

Consulting and legal fees 165 120 84

Other real estate expense 140 264 300

Amortization/impairment of intangible assets/goodwill 46 43 51

Net loss/(gain) on debt extinguishment 16 (3) 70

Other noninterest expense 689 611 608

Total noninterest expense 6,323 6,234 5,911

Income before provision/(benefit) for income taxes 2,757 739 21

Provision/(benefit) for income taxes 773 79 (185)

Net income including income attributable to noncontrolling interest 1,984 660 206

Net income attributable to noncontrolling interest 26 13 17

Net income $1,958 $647 $189

Net income/(loss) available to common shareholders $1,931 $495 ($87)

Net income/(loss) per average common share:

Diluted $3.59 $0.94 ($0.18)

Basic 3.62 0.94 (0.18)

Dividends declared per common share 0.20 0.12 0.04

Average common shares - diluted 538,061 527,618 498,744

Average common shares - basic 534,149 523,995 495,361

1 Includes dividends on common stock of The Coca-Cola Company of $31 million, $56 million, and $53 million during the years ended December 31, 2012, 2011, and 2010, respectively.

2 Includes credit-related OTTI losses of $7 million, $6 million and $2 million, including $6 million, $4 million, and $0 of unrealized losses reclassified from OCI, before taxes, for

the years ended December 31, 2012, 2011, and 2010, respectively.

See Notes to Consolidated Financial Statements.