SunTrust 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual Report

SUNTRUST BANKS, INC.

Table of contents

-

Page 1

SUNTRUST BANKS, INC. 2012 Annual Report -

Page 2

-

Page 3

... in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. In addition, SunTrust provides customers with a full selection of technology-based banking channels including online, state-of-the-art client service centers, and through mobile devices... -

Page 4

... debt crisis, we executed strategic plans that fostered growth and improved our corporate and competitive positions. We capitalized on revenue opportunities and improved our efficiency, realizing benefits from our ongoing investments and efforts to transform our businesses for long-term success... -

Page 5

... 1 common equity ratio reached an all-time high of 10%. The result of our proactive efforts to improve our competitive position was apparent in the favorable trends in our primary business segments. Consumer Banking and Private Wealth Management • A hallmark of SunTrust is our service quality and... -

Page 6

... by increased capital markets fees and higher net interest income associated with loan growth and favorable deposit trends. • This revenue growth, together with improved credit quality, led to net income in 2012 that was more than double that of 2011. Mortgage Banking • During 2012 we originated... -

Page 7

.... Of course, improving efficiency is at the center of everything we do as we work to achieve our long-term goal of reducing our efficiency ratio below 60%. Over the course of 2012, we made tangible progress. Revenue increased, we eliminated certain core operating costs, and cyclically high expenses... -

Page 8

...am pleased with the improving performance we demonstrated in 2012, and I look forward to updating you on our progress in 2013. Thank you for your investment and continued support. William H. Rogers, Jr. Chairman and Chief Executive Officer February 27, 2013 SUNTRUST BANKS, INC. 2012 ANNUAL REPORT -

Page 9

..., Virginia 2, 4 MARK A. CHANCY Wholesale Banking Executive A. D. CORRELL 1, 3, 5 Chairman Atlanta Equity Investors, LLC Atlanta, Georgia ANIL T. CHERIYAN Chief Information Officer DONNA S. MOREA 2, 4 JEFFREY C. CROWE 1, 3, 5 Chief Executive Officer Adesso Group Royal Oak, Maryland HUGH... -

Page 10

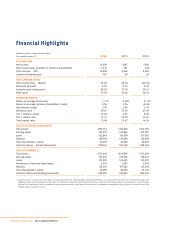

... stock closing price Book value FINANCIAL RATIOS Return on average total assets Return on average common shareholders' equity Net interest margin 1 Efficiency ratio 1 Tier 1 common equity Tier 1 capital ratio Total capital ratio SELECTED AVERAGE BALANCES Total assets Earning assets Loans Deposits... -

Page 11

... No Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes The aggregate market value of the voting Common Stock held by non-affiliates at June 29, 2012 was approximately $13.0 billion, based on the New York Stock Exchange closing price for such... -

Page 12

... 1A: Item 1B: Item 2: Item 3: Item 4: PART II Item 5: Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities. Item 6: Selected Financial Data. Item 7: Management's Discussion and Analysis of Financial Condition and Results of Operations. Item 7A... -

Page 13

... Capital Analysis and Review. CDO - Collateralized debt obligation. CD - Certificate of deposit. CDS - Credit default swaps. CEO - Chief Executive Officer. CFO - Chief Financial Officer. CFPB - Bureau of Consumer Financial Protection. CFTC - Commodities Futures Trading Commission. CIB - Corporate... -

Page 14

.... HARP - Home Affordable Refinance Program. HOEPA - Home Owner's Equity Protection Act. HUD - U.S. Department of Housing and Urban Development. IFRS - International Financial Reporting Standards. IIS - Institutional Investment Solutions. IPO - Initial public offering. IRLC - Interest rate lock... -

Page 15

... Corporation. NEO - Named executive officers. NII - Net interest income. NOL - Net operating loss. NOW - Negotiable order of withdrawal account. NPL - Nonperforming loan. NPR - Notice of Proposed Rulemaking. NSF - Non-sufficient funds. NSFR - Net stable funding ratio. NYSE - New York Stock Exchange... -

Page 16

...- Small Business Administration. SCAP - Supervisory Capital Assessment Program. SEC - U.S. Securities and Exchange Commission. SERP - Supplemental Executive Retirement Plan. SPE - Special purpose entity. STIS - SunTrust Investment Services, Inc. STM - SunTrust Mortgage, Inc. STRH - SunTrust Robinson... -

Page 17

...and businesses including deposit, credit, and trust and investment services. Additional subsidiaries provide mortgage banking, asset management, securities brokerage, and capital market services. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee... -

Page 18

... of the Federal Reserve and the FDIC; (v) limiting debit card interchange fees; (vi) adopting certain changes to shareholder rights and responsibilities, including a shareholder "say on pay" vote on executive compensation; (vii) strengthening the SEC's powers to regulate securities markets; (viii... -

Page 19

... be tied to the level of Tier 1 common equity, and that bank holding companies must consult with the Federal Reserve's staff before taking any actions, such as stock repurchases, capital redemptions, or dividend increases, which might result in a diminished capital base. Capital Framework and Basel... -

Page 20

... a one-year time horizon. To comply with these requirements, banks will take a number of actions which may include increasing their asset holdings of U.S. Treasury securities and other sovereign debt, increasing the use of long-term debt as a funding source, and adopting new business practices that... -

Page 21

... in such activities, although the Company will still be allowed to engage in activities closely related to banking and make investments in the ordinary course of conducting such expanded banking activities. Federal banking regulators, as required under the GLB Act, have adopted rules limiting the... -

Page 22

..., and we continue to enhance our anti-money laundering compliance programs. During the fourth quarter of 2011, the Federal Reserve's final rules related to debit card interchange fees became effective. These rules significantly limit the amount of interchange fees that we may charge for electronic... -

Page 23

...'s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge on the Company's web site at www.suntrust.com under the Investor Relations... -

Page 24

...for our credit products, including our mortgages, may fall, which would adversely affect our interest and fee income and our earnings. A deterioration in business and economic conditions that erodes consumer and investor confidence levels, and/or increased volatility of financial markets, also could... -

Page 25

...business strategy, product offerings, and profitability may change as these rules are developed, become effective, and are interpreted by the regulators and courts. The Dodd-Frank Act (through provisions commonly known as the "Volcker Rule") prohibits banks from engaging in some types of proprietary... -

Page 26

...ordinary course or to trade on behalf of customers or conduct related market making activities would adversely affect our business and results of operations. During the course of 2012, we disposed of substantially all of our holdings of our interests in private equity and hedge funds which we expect... -

Page 27

... expected net cash outflow for a 30-day time horizon under an acute liquidity stress scenario, and a NSFR, designed to promote more medium and long-term funding based on the liquidity characteristics of the assets and activities of banking entities over a one-year time horizon. If we are not able to... -

Page 28

...U.S. federal banking agencies have been taking into account expectations regarding the ability of banks to meet these new requirements, including under stressed conditions, in approving actions that represent uses of capital, such as dividend increases and acquisitions. Loss of customer deposits and... -

Page 29

... banking state in terms of loans and deposits, further deterioration in real estate values and underlying economic conditions in those markets or elsewhere could result in materially higher credit losses. Florida and other states in our footprint have suffered significant declines in home values... -

Page 30

... on mortgage-related loans. These conditions have resulted in losses, write downs and impairment charges in our mortgage and other lines of business. Continuing declines in real estate values, low home sales volumes, financial stress on borrowers as a result of unemployment, interest rate resets... -

Page 31

... from GSE service levels. In most cases, this is related to delays in the foreclosure process. Additionally, we have received indemnification requests where an investor or insurer has suffered a loss due to a breach of the servicing agreement. While the number of such claims has been small, these... -

Page 32

... filed the Consent Order as Exhibit 10.25 to our Annual Report on Form 10-K for the year ended December 31, 2011. As a result of the Federal Reserve's review of the Company's residential mortgage loan servicing and foreclosure processing practices that preceded the Consent Order, the Federal Reserve... -

Page 33

... of assets for which we provide processing services could decline; The value of our pension plan assets could decline, thereby potentially requiring us to further fund the plan; or To the extent we access capital markets to raise funds to support our business, such changes could affect the cost of... -

Page 34

... at fair value prime mortgages held for sale for which an active secondary market and readily available market prices exist. We also measure at fair value certain other interests we hold related to residential loan sales and securitizations. Similar to other interest-bearing securities, the value of... -

Page 35

... recently expanded HARP, may cause us to reevaluate repayment assumptions related to the prepayment speed assumptions related to loans that we service, and this may adversely affect the fair value of our MSR asset. Federal Reserve policies can also adversely affect borrowers, potentially increasing... -

Page 36

... crisis and other matters affecting the financial services industry, including mortgage foreclosure issues. Negative public opinion regarding us could result from our actual or alleged conduct in any number of activities, including lending practices, the failure of any product or service sold by us... -

Page 37

...or failures in the physical infrastructure or operating systems that support our businesses and clients, or cyber attacks or security breaches of the networks, systems or devices that our clients use to access our products and services could result in client attrition, regulatory fines, penalties or... -

Page 38

... of contingent funding available to us includes inter-bank borrowings, repurchase agreements, FHLB capacity, and borrowings from the Federal Reserve discount window. Any occurrence that may limit our access to the capital markets, such as a decline in the confidence of debt investors, our depositors... -

Page 39

...primary source of retail funding is bank deposits, most of which are insured by the FDIC. During the most recent financial market crisis and economic recession, our senior debt credit spread to the matched maturity 5-year swap rate widened before we received any credit ratings downgrades in 2009 and... -

Page 40

... to execute the business strategy and provide high quality service may suffer if we are unable to recruit or retain a sufficient number of qualified employees or if the costs of employee compensation or benefits increase substantially. Further, in June, 2010, the Federal Reserve, the OCC, the Office... -

Page 41

...instruments carried at fair value expose us to certain market risks. We maintain at fair value a securities AFS portfolio and trading assets and liabilities which include various types of instruments and maturities. In addition, we elected to record selected fixed-rate debt, mortgage loans, MSRs and... -

Page 42

... sheet entities, accounting rules may require us to consolidate the financial results of these entities with our financial results. Item 1B. None. UNRESOLVED STAFF COMMENTS Item 2. PROPERTIES The Company's headquarters is located in Atlanta, Georgia. As of December 31, 2012, the Bank owned 600... -

Page 43

...'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES The principal market in which the common stock of the Company is traded is the NYSE. See Item 6 and Table 36 in the MD&A for information on the high and the low sales prices of SunTrust common stock on the... -

Page 44

... that were issued to the U.S. Treasury in connection with its investment in SunTrust Banks, Inc. under the CPP. On September 28, 2011, the Company purchased and retired 4 million warrants to purchase SunTrust common stock in connection with the U.S. Treasury's resale, via a public secondary offering... -

Page 45

... (thousands) As of December 31 Total assets Earning assets Loans ALLL Consumer and commercial deposits Brokered time and foreign deposits Long-term debt Total shareholders' equity Financial Ratios and Other Data ROA ROE Net interest margin - FTE Efficiency ratio - FTE Tangible efficiency ratio2 29 -

Page 46

... foreclosure review, the Consent Order, or to cover the estimated losses on loans sold to GSEs prior to 2009; (iii) the timing and impact of planned future asset sales, including sales of student loans, Ginnie Mae securities, non-performing residential and commercial loans, and affordable housing... -

Page 47

... its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. Within our geographic footprint, we operate under three business segments: Consumer Banking and Private Wealth Management, Wholesale Banking, and Mortgage... -

Page 48

...business segments and a discussion of the change in our segment reporting structure during 2012. In addition to deposit, credit, and trust and investment services offered by the Bank, our other subsidiaries provide mortgage banking, asset management, securities brokerage, and capital market services... -

Page 49

...Our results in 2012 were driven by increased revenue, notably in fee income, and also by ongoing credit improvement. Specifically, the year ended December 31, 2012 included improved net interest income and mortgage origination income, as well as continued favorable trends in loans, deposits, capital... -

Page 50

... losses decreased 8% and net charge-offs decreased 18% for the year ended December 31, 2012 compared to the same period in 2011, both as a result of improved credit quality. Charge-offs declined during the year despite charge-off increases related to the strategic loan sales and policy changes. See... -

Page 51

... due to the regulations on debit card interchange fees that became effective in 2011. Other income was lower due to losses related to the transfer and sale of guaranteed student and mortgage loans during 2012. Noninterest expense increased 1% during the year ended December 31, 2012 compared to the... -

Page 52

Mortgage Banking reported a net loss in 2012, primarily due to the increase in the mortgage repurchase reserve, the impacts from the mortgage NPL and government-guaranteed loan sales, and other legacy-related costs; however, core trends continued to markedly improve. Mortgage production volume was ... -

Page 53

... Money market accounts Savings Consumer time Other time Total interest-bearing consumer and commercial deposits Brokered time deposits Foreign deposits Total interest-bearing deposits Funds purchased Securities sold under agreements to repurchase Interest-bearing trading liabilities Other short-term... -

Page 54

... Expense NOW accounts Money market accounts Savings Consumer time Other time Brokered time deposits Foreign deposits Funds purchased Securities sold under agreements to repurchase Interest-bearing trading liabilities Other short-term borrowings Long-term debt Total (decrease)/increase in interest... -

Page 55

... student loans, guaranteed residential mortgages, consumer-indirect loans, high credit quality nonguaranteed residential mortgages, and other direct consumer loans. These increases were partially offset by declines in nonaccrual loans, home equity products, commercial real estate loans... -

Page 56

... mortgage-related and investment banking income, partially offset by lower card fees and other income, which was due to losses from loan sales primarily during the second half of 2012. Net securities gains increased by $1.9 billion for 2012 compared to the prior year due to pre-tax gains resulting... -

Page 57

... 2012, compared to the prior year primarily due to $99 million of net losses, relating to sales of government-guaranteed mortgage loans. Trading income decreased by $37 million, or 15%, compared to 2011. The decrease was primarily due to mark-to-market losses on fair value debt and index-linked CDs... -

Page 58

... 4 Year Ended December 31 (Dollars in millions) Employee compensation Employee benefits Personnel expenses Outside processing and software Net occupancy expense Operating losses Credit and collection services Regulatory assessments Equipment expense Marketing and customer development Consulting and... -

Page 59

... loan type includes loans secured by owner-occupied properties, corporate credit cards, and other wholesale lending activities. Commercial real estate and commercial construction loan types are based on investor exposures where repayment is largely dependent upon the operation, refinance, or sale... -

Page 60

... 92%. Based on guidance from our primary federal banking regulator in 2012, we elected to revise our credit policy related to the nonaccrual status of performing second lien loans and began classifying performing home equity lines, loans, and mortgages that are subordinate to nonaccrual first lien... -

Page 61

...construction Total commercial loans Residential loans: Residential mortgages - guaranteed Residential mortgages - nonguaranteed1 Home equity products Residential construction Total residential loans Consumer loans: Guaranteed student loans Other direct Indirect Credit cards Total consumer loans LHFI... -

Page 62

... management of the balance sheet, as recent quarters have yielded organic growth and the higher-risk loan balances have declined. Consumer loans decreased $580 million, or 3%, during 2012, driven by the sale of $2.2 billion, net of write-downs, in government-guaranteed student loans during the year... -

Page 63

... of the country. See Note 6, "Loans," to the Consolidated Financial Statements in this Form 10-K for more information. The following table shows our wholesale lending exposure at December 31 to selected industries: Funded Exposures by Selected Industries 2012 (Dollars in millions) Table 8 2011 % of... -

Page 64

... items, coupled with our loan sales during 2012 and our level of government-guaranteed loans at December 31, 2012, have resulted in an improved risk profile and a loan portfolio that more closely aligns with our longer-term balance sheet targets. Our nonperforming loans have declined significantly... -

Page 65

... 31, 2011. The ALLL represented 1.80% of total loans at December 31, 2012, down 21 basis points from December 31, 2011. See Note 1, "Significant Accounting Policies," and Note 7, "Allowance for Credit Losses," to the Consolidated Financial Statements in this Form 10-K, as well as the "Allowance for... -

Page 66

... quarters. The ratio of net charge-offs to average loans was 1.37% during 2012, a reduction of 38 basis points from 2011. Refer to Note 1, "Significant Accounting Policies," to the Consolidated Financial Statements in this Form 10-K for additional policy information. Provision for Credit Losses The... -

Page 67

... Home equity lines Construction Residential mortgages Commercial real estate Consumer loans: Direct Indirect Credit cards Total recoveries Net charge-offs Balance-end of period Components: ALLL Unfunded commitments reserve Allowance for credit losses Average loans Period-end loans outstanding Ratios... -

Page 68

... to be unemployment, residential real estate property values, and the variability and relative strength of the housing market. At December 31, 2012, the ALLL to period-end loans ratio was 1.80%, down 21 basis points from December 31, 2011, consistent with continued improvement in asset quality. When... -

Page 69

... assets (post-adoption): Table 14 (Dollars in millions) 2012 2011 2010 2009 Nonaccrual/NPLs: Commercial loans Commercial & industrial Commercial real estate Commercial construction Total commercial NPLs Residential loans Residential mortgages - nonguaranteed Home equity products Residential... -

Page 70

... 10-K and a copy of it was filed as Exhibit 10.25 to the Company's Annual Report on Form 10-K for the year ended December 31, 2011. The Consent Order required us to improve certain processes related to residential mortgage loan servicing. Under the Consent Order, we agreed to retain an independent... -

Page 71

...reasonably support a modified loan, we may pursue short sales and/ or deed-in-lieu arrangements. For loans secured by income producing commercial properties, we perform a rigorous and ongoing programmatic review. We review a number of factors, including cash flows, loan structures, collateral values... -

Page 72

... first and second lien residential mortgages and home equity lines of credit), $201 million, or 6%, of commercial loans (predominantly income-producing properties), and $81 million, or 3%, of direct consumer loans. Total TDRs decreased $482 million as accruing TDRs declined $319 million, or 11%, and... -

Page 73

... Treasury securities Federal agency securities U.S. states and political subdivisions MBS - agency CDO/CLO securities ABS Corporate and other debt securities CP Equity securities Derivatives 1 Trading loans 2 Total trading assets Trading Liabilities: U.S. Treasury securities Corporate and other debt... -

Page 74

...in Federal Reserve Bank stock, $69 million in mutual fund investments, and $2 million of other. (Dollars in millions) U.S. Treasury securities Federal agency securities U.S. states and political subdivisions MBS - agency MBS - private CDO/CLO securities ABS Corporate and other debt securities Coke... -

Page 75

... 31, 2012 (Dollars in millions) Distribution of Maturities: Amortized Cost: U.S. Treasury securities Federal agency securities U.S. states and political subdivisions MBS - agency MBS - private ABS Corporate and other debt securities Total debt securities Fair Value: U.S. Treasury securities Federal... -

Page 76

... valuation assumptions related to securities AFS, see Note 5, "Securities Available for Sale," and the "Trading Assets and Securities Available for Sale" section of Note 18, "Fair Value Election and Measurement," to the Consolidated Financial Statements in this Form 10-K. For the year ended December... -

Page 77

... Composition of Average Deposits December 31 (Dollars in millions) Noninterest-bearing NOW accounts Money market accounts Savings Consumer time Other time Total consumer and commercial deposits Brokered time deposits Foreign deposits Total deposits 2012 $37,329 25,155 42,101 5,113 10,597 5,954... -

Page 78

... 2 Year Ended December 31, 2010 Daily Average Balance $1,226 2,416 3,014 Rate 0.19% 0.15 0.43 Maximum Outstanding at any Month-End $3,163 2,830 4,894 (Dollars in millions) Rate 0.18% 0.17 0.70 Funds purchased 1 Securities sold under agreements to repurchase 1 Other short-term borrowings 1 Funds... -

Page 79

... gain on equity securities. Additionally, mark-to-market adjustments related to our estimated credit spreads for debt and index linked CDs accounted for at fair value are excluded from regulatory capital. Both the Company and the Bank are subject to minimum Tier 1 capital and Total capital ratios of... -

Page 80

... Parent Company under these regulations at December 31, 2011. During the year ended December 31, 2012, we submitted our 2012 CCAR capital plans for review by the Federal Reserve. The Federal Reserve's review indicated that our capital exceeded requirements throughout the Supervisory Stress Test time... -

Page 81

... Fixed Rate Cumulative Preferred Stock, Series D, that we had issued to the U.S. Treasury under the TARP's CPP in 2008. As a result of the repurchase of Series C and D Preferred Stock, we incurred a one-time non-cash charge to net income/(loss) available to common shareholders of $74 million related... -

Page 82

...data supporting such assumptions has limitations, our judgment and experience play a key role in enhancing the specific ALLL estimates. Key judgments used in determining the ALLL include internal risk ratings, market and collateral values, discount rates, loss rates, and our view of current economic... -

Page 83

... well as Note 6, "Loans," and Note 7, "Allowance for Credit Losses," to the Consolidated Financial Statements in this Form 10-K. Mortgage Repurchase Reserve We sell residential mortgage loans to investors through whole loan sales in the normal course of our business. The investors are primarily GSEs... -

Page 84

claims and losses related to loans sold since 2009 as a result of stronger credit performance, more stringent credit guidelines, and underwriting process improvements. Repurchase requests received since 2005 have totaled $7.1 billion which includes Ginnie Mae repurchase demands. The following table ... -

Page 85

... their current volume and timing of requests. During 2012, we increased the reserve as a result of recent information received from the GSEs, as well as our recent experience related to full file requests and repurchase demands, which enhanced our ability to estimate future losses attributable to... -

Page 86

... between market participants. Certain of our assets and liabilities are measured at fair value on a recurring basis. Examples of recurring uses of fair value include derivative instruments, AFS and trading securities, certain LHFI and LHFS, certain issuances of long term debt and brokered CDs, and... -

Page 87

... estimate of the instrument's fair value after evaluating all available information pertaining to fair value. This process involves the gathering of multiple sources of information, including broker quotes, values provided by pricing services, trading activity in other similar instruments, market... -

Page 88

...fair value of these instruments particularly when pricing service information or observable market trades are not available. In most cases, the current market conditions caused the broker quotes to be indicative and the price indications and broker quotes to be supported by very limited to no recent... -

Page 89

... offset by net unrealized mark-to-market gains and a small amount of FHLB of Atlanta stock purchases. During the year ended December 31, 2012, we recognized through earnings $300 million in net losses related to trading assets and liabilities and securities AFS classified as level 3, primarily due... -

Page 90

...quarter of 2012 for all reporting units, of which no events gave rise to an additional impairment test. Valuation Techniques In determining the fair value of our reporting units, we use discounted cash flow analyses, which require assumptions about short and long-term net cash flow, growth rates for... -

Page 91

.... The fair value of the reporting unit's net assets is estimated using a variety of valuation techniques including the following recent data observed in the market, including similar assets, cash flow modeling based on projected cash flows and market discount rates, market indices, estimated net... -

Page 92

... 35 years. See Note 15, "Employee Benefit Plans," to the Consolidated Financial Statements in this Form 10-K for details on changes in the pension benefit obligation and the fair value of plan assets. If we were to assume a 0.25% increase/decrease in the expected long-term rate of return for... -

Page 93

...secondary market meet our risk and business objectives. PMC also oversees progress towards long-term balance sheet objectives. The CEO, CFO, and the CRO are members of each governance committee to promote consistency and communication. Additionally, other executive and senior officers of the Company... -

Page 94

... Chief Wholesale Credit Officer and the Chief Retail Credit Officer; market risk and liquidity programs are overseen by the Corporate Market Risk Officer; operational risk programs, including the enterprise Bank Secrecy Act/Anti-Money Laundering program, are overseen by the CORO; Compliance programs... -

Page 95

...structure includes an operational risk manager and support staff within each line of business and corporate function. These risk managers are responsible for execution of risk management within their areas in compliance with CRM's policies and procedures. Market Risk Management Market risk refers to... -

Page 96

... (Basis points) Rate Change +200 +100 -25 Asset sensitivity has slightly increased from December 31, 2011 to December 31, 2012 primarily due to projected balance sheet growth of floating rate assets and fixed rate deposits. We also perform valuation analysis, which we use for discerning levels of... -

Page 97

... a material investment portfolio of publicly traded securities. We manage the Parent Company cash balance to provide sufficient liquidity to fund all forecasted obligations (primarily debt and capital service) for an extended period of months in accordance with our risk limits. We assess liquidity... -

Page 98

... month-end data, except excess reserves, which is based upon a daily average. Uses of Funds. Our primary uses of funds include the extension of loans and credit, the purchase of investment securities, working capital, and debt and capital service. The Bank and the Parent Company borrow in the money... -

Page 99

..., and loans to our subsidiaries. We fund corporate dividends primarily with dividends from our banking subsidiary. We are subject to both state and federal banking regulations that limit our ability to pay common stock dividends in certain circumstances. Recent Developments. During 2012 we executed... -

Page 100

... governance processes. We recorded declines of $353 million and $733 million in the fair value of our MSRs for the years ended December 31, 2012 and 2011, respectively. Increases or decreases in fair value include the decay resulting from the realization of expected monthly net servicing cash flows... -

Page 101

... required to purchase capital stock in the FHLB. In exchange, members take advantage of competitively priced advances as a wholesale funding source and access grants and low-cost loans for affordable housing and community-development projects, amongst other benefits. As of December 31, 2012, we held... -

Page 102

...: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered time and foreign deposits Total shareholders' equity Average common shares - diluted (thousands) Average common shares - basic (thousands) Financial Ratios (Annualized) ROA ROE Net... -

Page 103

... with higher core loan production income in the fourth quarter of 2012. Mortgage servicing income increased by $23 million compared to the fourth quarter of 2011 as a result of a $38 million decline in the fair value of the MSRs recognized in the prior year related to the HARP 2.0 program, partially... -

Page 104

... auto loans, commercial loans, and consumer direct loans, partially offset by decreases in equity lines and residential mortgages. Other funding costs related to other assets and other liabilities improved by $24 million, driven primarily by a decline in funding rates. Net interest income related... -

Page 105

... was driven by declines in net charge-offs of: $70 million in home equity lines, $17 million in consumer indirect, $16 million in credit card, $10 million in residential mortgage loans, and $11 million in commercial. Included in these amounts were: $43 million of incremental charge-offs related to... -

Page 106

... on our public debt and index linked CDs carried at fair value, and a $83 million decrease in net gains on the sale of other AFS securities. Total noninterest expenses decreased $45 million compared to the same period in 2011. The decrease was mainly due to the potential national mortgage servicing... -

Page 107

...$1.7 billion of consumer auto loans in the third and fourth quarters of 2010, and the purchase of $1.6 billion of guaranteed student loans during 2011. Partially offsetting the increases were decreases in home equity lines and residential mortgages. Net interest income related to client deposits was... -

Page 108

... predominantly due to the potential national mortgage servicing settlement and claims expense, partially offset by increased net interest income and favorable mark-to-market valuations on our public debt and index-linked CDs, which are carried at fair value. Net interest income was $502 million, an... -

Page 109

... associated with repurchase of preferred stock issued to the U.S. Treasury 1 Efficiency ratio 2 Impact of excluding impairment/amortization of goodwill/ intangible assets other than MSRs Tangible efficiency ratio 3 Total shareholders' equity Goodwill, net of deferred taxes 4 Other intangible... -

Page 110

... on sale of Coke common stock Coke stock contribution expense Losses on sales of loans and write-down of certain affordable housing investments being marketed for sale Mortgage repurchase provision on GSE loans Net income available to common shareholders, excluding strategic actions12 (Dollars in... -

Page 111

... for mortgage, home equity, and commercial real estate loans. 12 Amounts are presented net of tax and include the impact to net income available to common shareholders of the strategic items announced during the third quarter of 2012. See announcement of strategic actions in Form 8-K filed with... -

Page 112

... equity to tangible assets ratio that excludes the after-tax impact of purchase accounting intangible assets. We believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity (the level of which may vary from company... -

Page 113

.... Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders of SunTrust Banks, Inc. We have audited the accompanying consolidated balance sheets of SunTrust Banks, Inc. (the Company) as of December 31, 2012... -

Page 114

... related consolidated statements of income, comprehensive income, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2012 of SunTrust Banks, Inc. and our report dated February 27, 2013 expressed an unqualified opinion thereon. Atlanta, Georgia February... -

Page 115

...Trading income Mortgage production related income/(loss) Mortgage servicing related income Net securities gains2 Other noninterest income Total noninterest income Noninterest Expense Employee compensation Employee benefits Outside processing and software Net occupancy expense Operating losses Credit... -

Page 116

SunTrust Banks, Inc. Consolidated Statements of Comprehensive Income For the Year Ended December 31 (Dollars in millions) 2012 $1,958 2011 $647 2010 $189 Net income Components of other comprehensive (loss)/income: Change in net unrealized gains on securities, net of tax of ($738), $199, and $... -

Page 117

... consumer and commercial deposits Brokered time deposits (CDs at fair value: $832 and $1,018 as of December 31, 2012 and 2011, respectively) Foreign deposits Total deposits Funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term debt 3 (debt at fair value... -

Page 118

...discount for preferred stock issued to U.S. Treasury Stock compensation expense Restricted stock activity Amortization of restricted stock compensation Issuance of stock for employee benefit plans and other Fair value election of MSRs Adoption of VIE consolidation guidance Balance, December 31, 2010... -

Page 119

... servicing rights Provisions for credit losses and foreclosed property Mortgage repurchase provision Deferred income tax expense/(benefit) Stock option compensation and amortization of restricted stock compensation Net loss/(gain) on extinguishment of debt Net securities gains Net gain on sale... -

Page 120

...and businesses including deposit, credit, and trust and investment services. Additional subsidiaries provide mortgage banking, asset management, securities brokerage, and capital market services. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee... -

Page 121

... and losses resulting from changes in fair value and realized gains and losses upon ultimate sale of the loans are classified as noninterest income in the Consolidated Statements of Income. The Company may transfer certain residential mortgage loans, commercial loans, and student loans to a held... -

Page 122

... an economic concession either from the Company or as the product of a bankruptcy court order. To date, the Company's TDRs have been predominantly first and second lien residential mortgages and home equity lines of credit. Prior to granting a modification of a borrower's loan terms, the Company... -

Page 123

...pricing process, as well as premiums and discounts, are deferred and amortized as level yield adjustments over the respective loan terms. Premiums for purchased credit cards are amortized on a straight-line basis over one year. Fees received for providing loan commitments that result in funded loans... -

Page 124

...ALLL, the Company also estimates probable losses related to unfunded lending commitments, such as letters of credit and binding unfunded loan commitments. Unfunded lending commitments are analyzed and segregated by risk similar to funded loans based on the Company's internal risk rating scale. These... -

Page 125

...not available, fair value is calculated using management's best estimates of key assumptions, including credit losses, loan repayment speeds and discount rates commensurate with the risks involved. For additional information on the Company's securitization activities, see Note 10, "Certain Transfers... -

Page 126

... and as a risk management tool to economically hedge certain identified market risks, along with certain IRLCs on residential mortgage loans that are a normal part of the Company's operations. The Company also evaluates contracts, such as brokered deposits and short-term debt, to determine whether... -

Page 127

... employees. The Company accounts for stock-based compensation under the fair value recognition provisions whereby the fair value of the award at grant date is expensed over the award's vesting period. Additionally, the Company estimates the number of awards for which it is probable that service... -

Page 128

... Consolidated Financial Statements (Continued) The Company applies the following fair value hierarchy: • Level 1 - Assets or liabilities valued using unadjusted quoted prices in active markets for identical assets or liabilities that the Company can access at the measurement date, such as publicly... -

Page 129

... are tax-deductible. 2012 Acquisition of assets of FirstAgain, LLC 2011 Acquisition of certain additional assets of CSI Capital Management 2010 Disposition of certain money market fund management business various 7 - 11 18 5/9/2011 (19) 20 7 - NOTE 3 - FEDERAL FUNDS SOLD AND SECURITIES BORROWED OR... -

Page 130

...Includes loans related to TRS. Various trading products and instruments are used as part of the Company's overall balance sheet management strategies and to support client requirements executed through the Bank and/or its broker/dealer subsidiary. The Company manages the potential market volatility... -

Page 131

...agency MBS - private CDO/CLO securities ABS Corporate and other debt securities Coke common stock Other equity securities1 Total securities AFS 1 At December 31, 2012, other equity securities was comprised of the following: $229 million in FHLB of Atlanta stock, $402 million in Federal Reserve Bank... -

Page 132

... be required to sell these securities before their anticipated recovery or maturity. The Company has reviewed its portfolio for OTTI in accordance with the accounting policies outlined in Note 1, "Significant Accounting Policies." December 31, 2012 Twelve months or longer Fair Value $- 24 - 13 37... -

Page 133

...Company has reviewed for credit-related OTTI, credit information is available and modeled for the collateral underlying each security. As part of that analysis, the model incorporates loan level information such as loan to collateral values, FICO scores, and home price appreciation/depreciation data... -

Page 134

... that the Company will be required to sell as of the end of each year presented. Subsequent credit losses may be recorded on securities without a corresponding further decline in fair value when there has been a decline in expected cash flows. Year Ended December 31 (Dollars in millions) 2012 $25... -

Page 135

... including consumer credit risk scores, rating agency information, borrower/guarantor financial capacity, LTV ratios, collateral type, debt service coverage ratios, collection experience, other internal metrics/analysis, and qualitative assessments. For the commercial portfolio, the Company believes... -

Page 136

... such as market conditions, loan characteristics, and portfolio trends. Additionally, management routinely reviews portfolio risk ratings, trends, and concentrations to support risk identification and mitigation activities. For consumer and residential loans, the Company monitors credit risk based... -

Page 137

... mortgages - guaranteed Residential mortgages - nonguaranteed1 Home equity products Residential construction Total residential loans Consumer loans: Guaranteed student loans Other direct Indirect Credit cards Total consumer loans Total LHFI 1 2 Includes $379 million of loans carried at fair value... -

Page 138

... loans: Commercial & industrial Commercial real estate Commercial construction Total commercial loans Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Total residential loans Consumer loans: Other direct Indirect Credit cards Total consumer loans... -

Page 139

...: Commercial loans: Commercial & industrial Commercial real estate Commercial construction Total commercial loans Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Total residential loans Consumer loans: Other direct Credit cards Total consumer... -

Page 140

... for Credit Losses" sections of Note 1, "Significant Accounting Policies," for further information regarding Chapter 7 bankruptcy loans. At December 31, 2012 and 2011, the Company had $1 million and $5 million, respectively, in commitments to lend additional funds to debtors whose terms have... -

Page 141

... $819 Commercial loans: Commercial & industrial Commercial real estate Commercial construction Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Consumer loans: Other direct Credit cards Total TDRs 1 2 Includes loans modified under the terms of... -

Page 142

... 22 28 108 22 7 - 3 $204 Commercial loans: Commercial & industrial Commercial real estate Commercial construction Residential loans: Residential mortgages Home equity products Residential construction Consumer loans: Other direct Credit cards Total TDRs 1 For the year ended December 31, 2011, this... -

Page 143

...in limited international banking activities. The Company's total cross-border outstanding loans were $562 million and $630 million at December 31, 2012 and 2011, respectively. The major concentrations of credit risk for the Company arise by collateral type in relation to loans and credit commitments... -

Page 144

... at fair value. Additionally, the Company records an immaterial allowance for loan products that are guaranteed by government agencies, as there is nominal risk of principal loss. The Company's LHFI portfolio and related ALLL at December 31 is shown in the tables below: 2012 Commercial (Dollars in... -

Page 145

...and equipment subject to mortgage indebtedness (included in long-term debt) were immaterial as of December 31, 2012 and 2011. Various Company facilities are leased under both capital and noncancelable operating leases with initial remaining terms in excess of one year. Minimum payments, by year and... -

Page 146

... the respective carrying value by the following percentages: Consumer Banking and Private Wealth Management Wholesale Banking RidgeWorth Capital Management 21% 31% 147% The fair value of the GenSpring reporting unit, however, was less than its carrying value. As a result, the Company performed the... -

Page 147

...the year ended December 31, 2012, the Company sold MSRs on residential loans with an unpaid principal balance of $2.1 billion. At the end of each quarter, the Company determines the fair value of the MSRs using a valuation model that calculates the present value of the estimated future net servicing... -

Page 148

... loans serviced for others and a decrease in prevailing interest rates during the year ended December 31, 2012. (Dollars in millions) Fair value of retained MSRs Prepayment rate assumption (annual) Decline in fair value from 10% adverse change Decline in fair value from 20% adverse change Discount... -

Page 149

... issued debt, respectively. The loans are classified within LHFS at fair value and the debt is included within long-term debt at fair value on the Company's Consolidated Balance Sheets (see Note 18, "Fair Value Election and Measurement," for a discussion of the Company's methodologies for estimating... -

Page 150

... further in Note 18, "Fair Value Election and Measurement," the Company values these interests by constructing a pricing matrix of values based on a range of overcollateralization levels that are derived from discussions with the dealer community along with limited trade data. The price derived from... -

Page 151

... years ended December 31, related to the Company's asset transfers in which it has continuing economic involvement. (Dollars in millions) Cash flows on interests held : Residential Mortgage Loans Commercial and Corporate Loans Student Loans CDO Securities Total cash flows on interests held Servicing... -

Page 152

... Company's Annual Report on Form 10-K for the year ended December 31, 2011. Total Return Swaps The Company has involvement with various VIEs related to its TRS business. Under the matched book TRS business model, the VIEs purchase assets (typically commercial leveraged loans) from the market, which... -

Page 153

... of its community reinvestment initiatives, the Company invests almost exclusively within its footprint in multi-family affordable housing developments and other community development entities as a limited and/or general partner and/or a debt provider. The Company receives tax credits for various... -

Page 154

... outstanding at any month-end during the years ended December 31, 2012 and 2011 were $10.7 billion and $9.0 billion, respectively. As of December 31, 2012, the Company had collateral pledged to the Federal Reserve discount window to support $23.8 billion of available, unused borrowing capacity... -

Page 155

..., consolidations, certain leases, sales or transfers of assets, minimum shareholders' equity, and maximum borrowings by the Company. As of December 31, 2012, the Company was in compliance with all covenants and provisions of long-term debt agreements. As currently defined by federal bank regulators... -

Page 156

...18) NOTE 13 - CAPITAL During the year ended December 31, 2012, the Company submitted its 2012 CCAR capital plans for review by the Federal Reserve. The Federal Reserve's review indicated that the Company's capital exceeded requirements throughout the Supervisory Stress Test time horizon without any... -

Page 157

... Rate Cumulative Preferred Stock, Series D, that was issued to the U.S. Treasury under the TARP's CPP in 2008. As a result of the repurchase of Series C and D Preferred Stock, the Company incurred a one-time non-cash charge to net income/(loss) available to common shareholders of $74 million related... -

Page 158

... to which the Company raises its dividend. The formulas are contained in the warrant agreements which were filed as exhibits to Form 8-K as filed on September 23, 2011. During the years ended December 31, 2012, 2011, and 2010, SunTrust paid cash dividends on perpetual preferred stock totaling $12... -

Page 159

... tax expense at federal statutory rate Increase (decrease) resulting from: Tax-exempt interest Dividends received deduction Income tax credits, net State income taxes, net Completion of audit examinations by taxing authorities Other Total income tax expense/(benefit) and rate 1 "NM" - Calculated... -

Page 160

...) Federal credits and other carryforwards Other Total gross DTAs Valuation allowance Total DTAs DTLs: Net unrealized gains in AOCI Leasing Compensation and employee benefits MSRs Loans Goodwill and intangible assets Fixed assets Other Total DTLs Net DTL The net DTL decreased significantly in 2012... -

Page 161

...'s short-term cash incentive plan for key employees that provides for potential annual cash awards based on the Company's performance and/or the achievement of business unit and individual performance objectives. For the year ended December 31, 2012, the Company's AIP plan included a higher number... -

Page 162

...The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model based on the following assumptions: Year Ended December 31 2012 2011 2010 0.91% 0.75% 0.17% 39.88 34.87 56.09 1.07 2.48 2.80 6 years 6 years 6 years Dividend yield Expected stock price... -

Page 163

...57 $64.58 to 150.45 The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the Company's closing stock price on the last trading day of 2012 and the exercise price, multiplied by the number of in-the-money stock options) that would have... -

Page 164

... pension benefit formula, a cash balance formula (the Personal Pension Account) or a combination of both. Participants are 100% vested after 3 years of service. The interest crediting rate applied to each Personal Pension Account was 3% for 2012. SunTrust monitors the funded status of the plan... -

Page 165

... long-term, high quality fixed income debt instruments available as of the measurement date. A series of benefit payments projected to be paid by the plan is developed based on the most recent census data, plan provisions, and assumptions. The benefit payments at each future maturity are discounted... -

Page 166

..., "Fair Value Election and Measurement." The valuations are based on third party data received as of the balance sheet date. Level 1 assets such as equity securities, mutual funds, and REITs are instruments that are traded in active markets and are valued based on identical instruments. Fixed income... -

Page 167

...(Level 3 (Dollars in millions) Money market funds Mutual funds: International diversified funds Large cap funds Small and mid cap funds Equity securities: Consumer Energy and utilities Financials Healthcare Industrials Information technology Materials Exchange traded funds Fixed income securities... -

Page 168

..., but normal market activity may result in deviations. During 2012 and 2011, there was no SunTrust common stock held in the Pension Plans. The basis for determining the overall expected long-term rate of return on plan assets considers past experience, current market conditions, and expectations... -

Page 169

...) corporate bonds and U.S. Treasuries), and expenses. Capital market simulations from internal and external sources, survey data, economic forecasts, and actuarial judgment are all used in this process. The expected long-term rate of return on plan assets for the SunTrust Retirement Plan and... -

Page 170

... service credit Recognized net actuarial loss Curtailment gain Settlement loss Net periodic (benefit)/cost Weighted average assumptions used to determine net cost: Discount rate Expected return on plan assets Rate of compensation increase 1 2012 $- 119 (173) - 25 - 2 ($27) Pension Benefits 2011... -

Page 171

... more realistic economic measure of the plan's funded status and cost. Assumed discount rates and expected returns on plan assets affect the amounts of net periodic benefit cost. A 25 basis point decrease in the discount rate or expected long-term return on plan assets would increase all Pension and... -

Page 172

... each CSA. At December 31, 2012, the Bank carried senior long-term debt ratings of A3/BBB+ from three of the major ratings agencies. At the current rating level, ATEs have been triggered for approximately $9 million in fair value liabilities as of December 31, 2012. For illustrative purposes, if the... -

Page 173

... discussion. 3 See "Fair Value Hedges" in this Note for further discussion. 4 See "Economic Hedging and Trading Activities" in this Note for further discussion. 5 Amount includes $1.7 billion of notional amounts related to interest rate futures. These futures contracts settle in cash daily, one day... -

Page 174

...loans Total Derivatives designated in fair value hedging relationships 3 Interest rate contracts covering: Securities AFS Fixed rate debt Total Derivatives not designated as hedging instruments 4 Interest rate contracts covering: Fixed rate debt MSRs LHFS, IRLCs, LHFI-FV 5 Trading activity 6 Trading... -

Page 175

... exchange rate contracts covering: Commercial loans and foreign-denominated debt Trading activity Credit contracts covering: Loans Trading activity Equity contracts - trading activity Other contracts: IRLCs 2 Total 1 2 Trading income Mortgage servicing related income Mortgage production related... -

Page 176

... Trading activity Foreign exchange rate contracts covering: Commercial loans and foreign-denominated debt Trading activity Credit contracts covering: Loans Trading activity Equity contracts - trading activity Other contracts: IRLCs 1 Total 1 Trading income Mortgage servicing related income Mortgage... -

Page 177

...exchange rate contracts covering: Foreign-denominated debt and commercial loans Trading activity Credit contracts covering: Loans Trading activity Equity contracts - trading activity Other contracts: IRLCs 1 Total 1 Trading income Trading income Mortgage servicing related income Mortgage production... -

Page 178

... credit default. In all cases where the Company made resulting cash payments to settle, the Company collected like amounts from the counterparties to the offsetting purchased CDS. At December 31, 2012 and 2011, the written CDS had remaining terms ranging from less than one year to three years... -

Page 179

... until the sale of the Coke shares, at which time, the amounts were reclassified to net securities gains in the Consolidated Statements of Income. Fair Value Hedges During 2011, the Company entered into interest rate swap agreements, as part of the Company's risk management objectives for hedging... -

Page 180

... period, while fair value changes on the derivatives and valuation adjustments on the debt are both recognized within trading income. The Company enters into CDS to hedge credit risk associated with certain loans held within its Wholesale Banking segment. The Company accounts for these contracts... -

Page 181

.... The net carrying amount of unearned fees was immaterial as of December 31, 2012 and 2011. Loan Sales STM, a consolidated subsidiary of SunTrust, originates and purchases residential mortgage loans, a portion of which are sold to outside investors in the normal course of business, through... -

Page 182

...is inclusive of a reserve for costs associated with foreclosure delays of loans serviced for GSEs. Contingent Consideration The Company has contingent payment obligations related to certain business combination transactions. Payments are calculated using certain post-acquisition performance criteria... -

Page 183

... in affordable housing developments. SunTrust Community Capital or its subsidiaries are limited and/or general partners in various partnerships established for the properties. Some of the investments that generate state tax credits may be sold to outside investors. As of December 31, 2012, SunTrust... -

Page 184

..., including broker quotes, values provided by pricing services, trading activity in other similar securities, market indices, pricing matrices along with employing various modeling techniques, such as discounted cash flow analyses, in arriving at the best estimate of fair value. Any model used to... -

Page 185

...that significant adjustments to the trades in the market are being made by the pricing services. The Company maintains a cross-functional approach when the fair value estimates for level 3 securities AFS and trading assets and liabilities are internally developed, since the selection of unobservable... -

Page 186

..., 2012. 2 Includes $229 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank stock, $69 million in mutual fund investments, and $2 million of other equity securities. 3 These amounts include IRLCs and derivative financial instruments entered into by the Mortgage line of business to... -

Page 187

...342 million of FHLB of Atlanta stock, $398 million of Federal Reserve Bank stock, $187 million in mutual fund investments, and $2 million of other equity securities. 3 These amounts include IRLCs and derivative financial instruments entered into by the Mortgage line of business to hedge its interest... -

Page 188

...$2,285 3,109 5 12 371 3 28 825 1,462 (Dollars in millions) Trading loans LHFS Past due loans of 90 days or more Nonaccrual loans LHFI Past due loans of 90 days or more Nonaccrual loans Brokered time deposits Long-term debt Aggregate Fair Value December 31, 2012 $2,319 3,237 3 3 360 1 18 832 1,622... -

Page 189

...Brokered time deposits Long-term debt 1 5 (65) - - - - 5 (65) For the year ended December 31, 2012, income related to LHFS includes $882 million from IRLCs, which includes $304 million related to MSRs recognized upon the sale of loans reported at fair value. For the year ended December 31, 2012... -

Page 190

... Fair Values Production Mortgage Included in Related Servicing CurrentTrading Income/ Related Period 1 income (Loss) Income Earnings 2 ($3) 26 - - $- 568 7 15 $- - - (513) ($3) 594 7 (498) (Dollars in millions) Assets Trading loans LHFS LHFI MSRs Liabilities Brokered time deposits Long-term debt... -

Page 191

... pricing service to obtain fair values for publicly traded securities and similar securities for estimating the fair value of the privately placed bonds. No significant unobservable assumptions were used in pricing the auto loan ABS; therefore, the Company classified these bonds as level 2. Level... -

Page 192

... Level 3 equity securities classified as securities AFS include FHLB stock and Federal Reserve Bank stock, which are redeemable with the issuer at cost and cannot be traded in the market. As such, no significant observable market data for these instruments is available. The Company accounts... -

Page 193

...iii) the loan sales and trading business within the Company's Wholesale Banking segment. All of these loans are classified as level 2, due to the market data that the Company uses in the estimate of fair value. The loans made in connection with the Company's TRS business are short-term, demand loans... -

Page 194

... market, is highly dependent on the ultimate closing of the loans. These "pull-through" rates are based on the Company's historical data and reflect the Company's best estimate of the likelihood that a commitment will ultimately result in a closed loan. As pull-through rates increase, the fair value... -

Page 195

...time deposits carried at fair value, the Company estimated credit spreads above LIBOR, based on credit spreads from actual or estimated trading levels of the debt or other relevant market data. The Company recognized losses of $15 million, gains of $2 million, and losses of $41 million for the years... -

Page 196

... rate Discount rate Pull through rate MSR value Loan production volume Revenue run rate $33-$45 ($40) 34-45% (39%) $45 ($45) ABS Corporate and other debt securities Securities AFS: U.S. states and political subdivisions MBS - private ABS Corporate and other debt securities Other equity securities... -

Page 197

...line items Included in earnings (held at December 31, 2012) 1 (Dollars in millions) Beginning balance January 1, 2012 Included in earnings OCI Purchases Sales Settlements Transfers into Level 3 Transfers out of Level 3 Fair value December 31, 2012 Assets Trading assets: CDO/CLO securities... -

Page 198

... sheet line items Fair value December 31, 2011 Included in earnings (held at December 31, 2011) 1 (Dollars in millions) Included in earnings OCI Purchases Sales Settlements Transfers into Level 3 Transfers out of Level 3 Assets Trading assets: CDO/CLO securities ABS Corporate and other debt... -

Page 199

... mortgages in the market and there has been increased trading activity, the Company has classified these loans as level 2 as of December 31, 2012. At December 31, 2011, level 3 LHFS also included leases held for sale which were valued using internal estimates which incorporated market data... -

Page 200

... value. Fair value measurements for affordable housing properties are derived from internal analyses using market assumptions when available. Significant assumptions utilized in these analyses include cash flows, market capitalization rates, and tax credit market pricing. During 2012, the Company... -

Page 201

... Markets for Identical Assets/ Liabilities (Level 1) $8,257 394 291 591 (Dollars in millions) Financial assets Cash and cash equivalents Trading assets Securities AFS LHFS LHFI, net Financial liabilities Consumer and commercial deposits Brokered time deposits Short-term borrowings Long-term debt... -

Page 202

... long-term debt are based on quoted market prices for similar instruments or estimated using discounted cash flow analysis and the Company's current incremental borrowing rates for similar types of instruments. For brokered time deposits and long-term debt that the Company carries at fair value... -

Page 203

... injuries they suffered as a result of the method of posting order used by the Company, which allegedly resulted in overdraft fees being assessed to their joint checking account, and purport to bring their action on behalf of a putative class of "all SunTrust Bank account holders who incurred an... -

Page 204

.... SunTrust Mortgage, Inc. v. United Guaranty Residential Insurance Company of North Carolina STM filed suit in the Eastern District of Virginia in July of 2009 against United Guaranty Residential Insurance Company of North Carolina ("UGRIC") seeking payment of denied mortgage insurance claims on... -

Page 205

...a Consent Order with the Federal Reserve in which SunTrust Banks, Inc., SunTrust Bank, and STM agreed to strengthen oversight of and improve risk management, internal audit, and compliance programs concerning the residential mortgage loan servicing, loss mitigation, and foreclosure activities of STM... -

Page 206

... Order is available on the Federal Reserve's website and was filed as Exhibit 10.25 to the Company's Annual Report on Form 10-K for the year ended December 31, 2011. As a result of the Federal Reserve's review of the Company's residential mortgage loan servicing and foreclosure processing practices... -

Page 207

... through the Department of Justice, and Attorneys General for several states regarding various potential claims relating to the Company's mortgage servicing activities. While these discussions are continuing, the Company has not reached any agreement with such parties. The Company has estimated the... -

Page 208

... the internet (www.suntrust.com), and telephone (1-800-SUNTRUST). Financial products and services offered to consumers include consumer deposits, home equity lines, consumer lines, indirect auto, student lending, bank card, and other consumer loan and fee-based products. Consumer Banking also serves... -

Page 209

... (1-800-SUNTRUST). These products are either sold in the secondary market, primarily with servicing rights retained, or held in the Company's loan portfolio. Mortgage Banking services loans for itself and for other investors and includes ValuTree Real Estate Services, LLC, a tax service subsidiary... -

Page 210

Notes to Consolidated Financial Statements (Continued) Year Ended December 31, 2012 Consumer Banking and Private Wealth Management $46,126 77,539 - $2,534 - 2,534 596 1,938 1,369 2,930 377 140 237 - $237 (Dollars in millions) Wholesale Banking $64,499 54,069 - $1,753 119 1,872 315 1,557 1,543 1,... -

Page 211

Notes to Consolidated Financial Statements (Continued) Year Ended December 31, 2010 Consumer Banking and Private Wealth Management $41,910 74,914 - $2,449 - 2,449 891 1,558 1,539 2,917 180 65 115 - $115 (Dollars in millions) Wholesale Banking $62,268 51,925 - $1,475 106 1,581 777 804 1,442 1,941 ... -

Page 212

...293) (46) 70 228 (915) (242) (253) 141 43 231 (995) (269) 143 35 1,007 (118) ($197) (Dollars in millions) AOCI, January 1, 2010 Unrealized net gain on securities Unrealized net gain on derivatives Change related to employee benefit plans Reclassification adjustment for realized gains and losses on... -

Page 213

...) (Dollars in millions) Income Dividends1 Interest on loans Trading income Other income Total income Expense Interest on short-term borrowings Interest on long-term debt Employee compensation and benefits2 Service fees to subsidiaries Other expense Total expense Loss before income tax benefit and... -

Page 214

...deposits held at SunTrust Bank Interest-bearing deposits held at other banks Cash and cash equivalents Trading assets Securities available for sale Loans to subsidiaries Investment in capital stock of subsidiaries stated on the basis of the Company's equity in subsidiaries' capital accounts: Banking... -

Page 215

... of restricted stock compensation Net loss/(gain) on extinguishment of debt Net securities gains Net gain on sale of assets Contributions to retirement plans Net (increase)/decrease in other assets Net increase in other liabilities Net cash provided by/(used in) operating activities Cash Flows from... -

Page 216

...our consolidated financial statements as of and for the year ended December 31, 2012, has issued a report on the effectiveness of the Company's internal control over financial reporting as of December 31, 2012. The report of Ernst & Young LLP is included under Item 8 of this Annual Report on Form 10... -

Page 217

... be filed with the Commission is incorporated by reference into this Item 11. Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. The information at the captions "Equity Compensation Plans," "Stock Ownership of Certain Persons," "Stock Ownership... -

Page 218

... Financial Corporation, SunTrust Banks, Inc. and The Bank of New York, as Trustee, dated September 22, 2004, incorporated by reference to Exhibit 4.9 to Registrant's 2004 Annual Report on Form 10-K. First Supplemental Indenture between National Commerce Financial Corporation and the Bank of New York... -

Page 219

...filed December 20, 2012. SunTrust Banks, Inc. Annual Incentive Plan (formerly Management Incentive Plan), amended and restated as of January 1, 2012, incorporated by reference to Exhibit 10.1 to the Registrant's Annual Report on Form 10-K filed February 24, 2012. SunTrust Banks, Inc. 2009 Stock Plan... -

Page 220

...'s Annual Report on Form 10-K filed February 23, 2010; (iv), Exhibit 10.12 to the Registrant's Annual Report on Form 10K filed February 23, 2010; and (v) Exhibit 10.16 to the Registrant's Annual Report on Form 10K filed February 24, 2012. SunTrust Banks, Inc. Deferred Compensation Plan, amended... -

Page 221

... to Exhibit 10.23 to the Registrant's Annual Report on Form 10-K filed February 24, 2012. Consent Order dated April 13, 2011 by and among the Board of Governors of the Federal Reserve System, SunTrust Banks, Inc.; SunTrust Bank; and SunTrust Mortgage, Inc., incorporated by reference to Exhibit 10... -

Page 222

... Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SUNTRUST BANKS, INC. Dated: February 27, 2013 By: /s/ William H. Rogers, Jr. William H. Rogers, Jr., Chairman and Chief Executive Officer POWER... -

Page 223

... Chief Executive Officer February 27, 2013 Date Corporate Executive Vice President and Chief Financial Officer February 27, 2013 Date Senior Vice President and Director of Corporate Finance & Controller February 12, 2013 Date February 12, 2013 Date February 12, 2013 Date February 12, 2013 Date... -

Page 224

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 225

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 226

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 227

... contact: Kristopher Dickson Director of Investor Relations SunTrust Banks, Inc. P.O. Box 4418 Mail Code: GA-ATL-0634 Atlanta, GA 30302-4418 877.930.8971 [email protected] DEBT RATINGS Ratings as of December 31, 2012. Moody's Standard Investors & Poor's corporate ratings Long Term... -

Page 228

SUNTRUST BANKS, INC. 303 PEACHTREE STREET ATLANTA, GEORGIA 30308 suntrust.com