PNC Bank 2009 Annual Report Download - page 98

Download and view the complete annual report

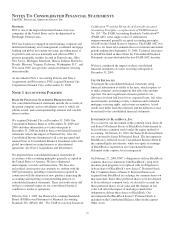

Please find page 98 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in the fair value of residential mortgage servicing rights,

which are measured at fair value.

We recognize revenue from servicing residential mortgages,

commercial mortgages and other consumer loans as earned

based on the specific contractual terms. We recognize revenue

from securities, derivatives and foreign exchange trading as

well as securities underwriting activities as these transactions

occur or as services are provided. We recognize gains from

the sale of loans upon cash settlement of the transaction.

When appropriate, revenue is reported net of associated

expenses in accordance with GAAP.

C

ASH AND

C

ASH

E

QUIVALENTS

Cash and due from banks are considered “cash and cash

equivalents” for financial reporting purposes.

I

NVESTMENTS

We hold interests in various types of investments. The

accounting for these investments is dependent on a number of

factors including, but not limited to, items such as:

• Ownership interest,

• Our plans for the investment, and

• The nature of the investment.

Debt Securities

Debt securities are recorded on a trade-date basis. We classify

debt securities as held to maturity and carry them at amortized

cost if we have the positive intent and ability to hold the

securities to maturity. Debt securities that we purchase for

short-term appreciation or other trading purposes are carried at

fair value and classified as trading securities and other assets

on our Consolidated Balance Sheet. Realized and unrealized

gains and losses on trading securities are included in other

noninterest income.

Debt securities not classified as held to maturity or trading are

designated as securities available for sale and carried at fair

value with unrealized gains and losses, net of income taxes,

reflected in Accumulated other comprehensive income (loss).

We review all debt securities that are in an unrealized loss

position for other-than-temporary impairment. We evaluate

outstanding available for sale and held to maturity securities

for other-than-temporary impairment on at least a quarterly

basis. An investment security is deemed impaired if the fair

value of the investment is less than its amortized cost.

Amortized cost includes adjustments (if any) made to the cost

basis of an investment for accretion, amortization, previous

other-than-temporary impairments and hedging gains and

losses. After an investment security is determined to be

impaired, we evaluate whether the decline in value is other-

than-temporary. As part of this evaluation, we take into

consideration whether we intend to sell the security or whether

it is more likely than not that we will be required to sell the

security before expected recovery of its amortized cost. We

also consider whether or not we expect to receive all of the

contractual cash flows from the investment based on factors

that include, but are not limited to: the creditworthiness of the

issuer and, in the case of non-agency mortgage-backed

securities, the historical and projected performance of the

underlying collateral; and the length of time and extent that

fair value has been less than amortized cost. In addition, we

may also evaluate the business and financial outlook of the

issuer, as well as broader industry and sector performance

indicators. Declines in the fair value of available for sale debt

securities that are deemed other-than-temporary and are

attributable to credit deterioration are recognized on our

Consolidated Income Statement in the period in which the

determination is made. Declines in fair value which are

deemed other–than-temporary and attributable to factors other

than credit deterioration are recognized in Accumulated other

comprehensive income (loss) on our Consolidated Balance

Sheet.

We include all interest on debt securities, including

amortization of premiums and accretion of discounts, in net

interest income using the constant effective yield method. We

compute gains and losses realized on the sale of available for

sale debt securities on a specific security basis. These

securities gains/ (losses) are included in the caption Net gains

on sales of securities on the Consolidated Income Statement.

In very limited situations, due to market conditions,

management may elect to transfer certain debt securities from

the securities available for sale to the held to maturity

classification. In such cases, any unrealized gain or loss at the

date of transfer included in Accumulated other comprehensive

income (loss) is amortized over the remaining life of the

security as a yield adjustment. This amortization effectively

offsets or mitigates the effect on interest income of the

amortization of the premium or accretion of the discount on

the security.

Equity Securities and Partnership Interests

We account for equity securities and equity investments other

than BlackRock and private equity investments under one of

the following methods:

• Marketable equity securities are recorded on a trade-

date basis and are accounted for based on the

securities’ quoted market prices from a national

securities exchange. Dividend income on these

securities is recognized in net interest income. Those

purchased with the intention of recognizing short-

term profits are classified as trading and included in

trading securities and other assets on our

Consolidated Balance Sheet. Both realized and

unrealized gains and losses on trading securities are

included in noninterest income. Marketable equity

securities not classified as trading are designated as

securities available for sale with unrealized gains and

losses, net of income taxes, reflected in accumulated

other comprehensive income (loss). Any unrealized

losses that we have determined to be other-than-

94