PNC Bank 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

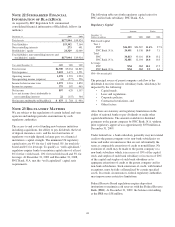

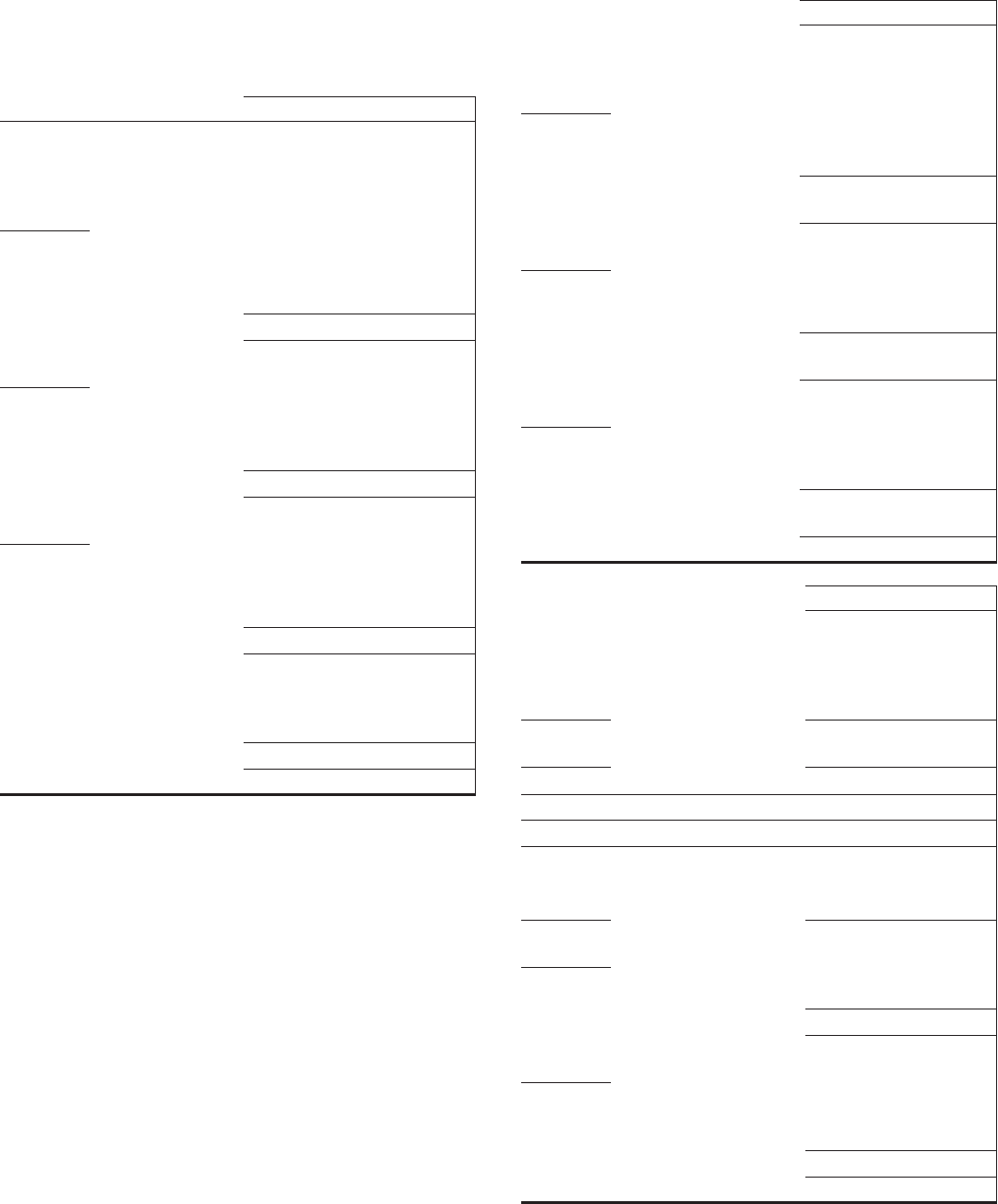

N

OTE

20 O

THER

C

OMPREHENSIVE

I

NCOME

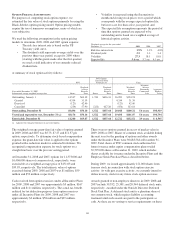

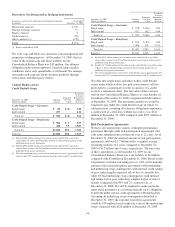

Details of other comprehensive income (loss) are as follows

(in millions):

Pretax Tax After-tax

Net unrealized securities gains

(losses) and net OTTI losses on

debt securities

Balance at January 1, 2007 $ (91)

2007 activity

Increase in net unrealized gain for

securities held at year-end $ (134) $ 52 (82)

Less: net losses realized in net

income (a) (9) 3 (6)

Net unrealized securities gains (125) 49 (76)

Balance at December 31, 2007 (167)

2008 activity

Increase in net unrealized losses for

securities held at year-end (5,423) 1,992 (3,431)

Less: net losses realized in net

income (a) 44 (16) 28

Net unrealized securities losses (5,467) 2,008 (3,459)

Balance at December 31, 2008 (3,626)

2009 activity

Decrease in net unrealized losses

for securities held at year-end 4,692 (1,721) 2,971

Less: net gains realized in net

income (a) 167 (62) 105

Net unrealized securities gains 4,525 (1,659) 2,866

Cumulative effect of adopting

FASB ASC 320-10 (174) 64 (110)

Net increase in OTTI losses on

debt securities (1,122) 416 (706)

Net OTTI losses on debt securities (1,296) 480 (816)

Balance at December 31, 2009 $(1,576)

(a) Pretax amounts represent net unrealized gains (losses) as of the prior year-end date

that were realized in the subsequent year when the related securities were sold.

These amounts differ from net securities losses included on the Consolidated

Income Statement primarily because they do not include gains or losses realized on

securities that were purchased and then sold during the same year.

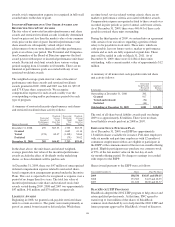

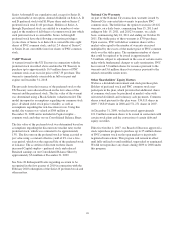

Pretax Tax After-tax

Net unrealized gains (losses) on cash

flow hedge derivatives

Balance at January 1, 2007 $ (13)

2007 activity

Increase in net unrealized gains on cash

flow hedge derivatives $ 283 $(104) 179

Less: net gains realized in net income (14) 5 (9)

Net unrealized gains on cash

flow hedge derivatives 297 (109) 188

Balance at December 31, 2007 175

2008 activity

Increase in net unrealized gains on cash

flow hedge derivatives 344 (127) 217

Less: net gains realized in net income 29 (11) 18

Net unrealized gains on cash flow hedge

derivatives 315 (116) 199

Balance at December 31, 2008 374

2009 activity

Decrease in net unrealized gains on cash

flow hedge derivatives (178) 66 (112)

Less: net gains realized in net income 151 (55) 96

Net unrealized losses on cash flow

hedge derivatives (329) 121 (208)

Balance at December 31, 2009 $ 166

Pretax Tax After-tax

Pension, other postretirement and

postemployment benefit plan

adjustments

Balance at January 1, 2007 $(148)

2007 activity $ (49) $ 20 (29)

Balance at December 31, 2007 (177)

2008 activity (775) 285 (490)

Balance at December 31, 2008 (667)

2009 activity 198 (73) 125

Balance at December 31, 2009 $(542)

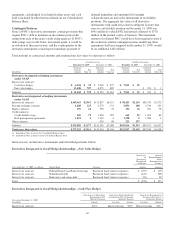

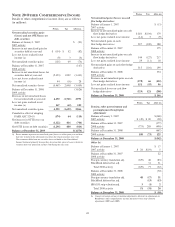

Other (b)

Balance at January 1, 2007 $ 17

2007 activity $ 24 $ (19) 5

Balance at December 31, 2007 22

2008 activity

Foreign currency translation adj. (129) 46 (83)

BlackRock deferred tax adj. 31 31

Total 2008 activity (129) 77 (52)

Balance at December 31, 2008 (30)

2009 activity

Foreign currency translation adj. 48 (17) 31

BlackRock deferred tax adj. (13) (13)

SBA I/O strip valuation adj. 3 (1) 2

Total 2009 activity 51 (31) 20

Balance at December 31, 2009 $ (10)

(b) Consists of foreign currency translation adjustments, deferred tax adjustments on

BlackRock’s other comprehensive income and interest-only strip valuation

adjustments (2007) and (2009).

152