PNC Bank 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

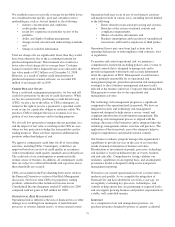

We seek to achieve our credit portfolio objectives by

maintaining a customer base that is diverse in borrower

exposure and industry types. We use loan participations with

third parties, loan sales and syndications, and the purchase of

credit derivatives to reduce risk concentrations. Corporate

Credit personnel also participate in loan underwriting and

approval processes to help ensure that newly approved loans

meet policy and portfolio objectives.

The credit granting businesses maintain direct responsibility

for monitoring credit risk within PNC. The Corporate Credit

Policy area provides independent oversight to the

measurement, monitoring and reporting of our credit risk and

reports to the Chief Risk Officer. Corporate Audit also

provides an independent assessment of the effectiveness of the

credit risk management process. We also manage credit risk in

accordance with regulatory guidance.

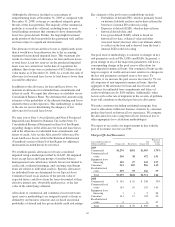

Nonperforming, Past Due And Potential Problem Assets

See the Nonperforming Assets And Related Information table

in the Statistical Information (Unaudited) section of Item 8 of

this Report and included here by reference for details of the

types of nonperforming assets that we held at December 31 of

each of the past five years. In addition, certain performing

assets have interest payments that are past due or have the

potential for future repayment problems.

Credit quality deterioration continued during 2009 as

expected, reflecting further economic weakening and resulting

in net additions to loan loss reserves. However, past due loans

appear to be stabilizing and while nonperforming loans

increased in the fourth quarter of 2009, the growth rate was

lower than in prior 2009 quarters.

Nonperforming assets increased $4.1 billion to $6.3 billion at

December 31, 2009 compared with $2.2 billion at

December 31, 2008. The increase resulted from recessionary

conditions in the economy and reflected a $2.6 billion increase

in commercial lending nonperforming loans and a $1.4 billion

increase in consumer lending nonperforming loans. The

increase in nonperforming commercial lending was primarily

from real estate, including residential real estate development

and commercial real estate exposure; manufacturing; and

service providers. The increase in nonperforming consumer

lending was mainly due to residential mortgage loans. While

nonperforming assets increased across all applicable business

segments during 2009, the largest increases were $2.0 billion

in Corporate & Institutional Banking and $854 million in

Distressed Assets Portfolio.

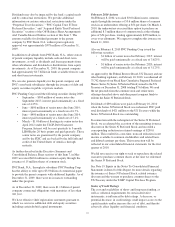

Purchased impaired loans are excluded from nonperforming

loans. Any decrease in expected cash flows of individual

commercial or pooled consumer purchased impaired loans

would result in a charge to the provision for loan losses in the

period in which the change becomes probable. Any increase in

the expected cash flows of purchased impaired loans would

first result in a recovery of previously recorded allowance for

loan losses and then an increase to accretable interest income

for the remaining life of the impaired loans. See Note 6

Purchased Impaired Loans Related to National City in the

Notes To Consolidated Financial Statements in Item 8 for

additional information.

The portion of the allowance for loan and lease losses allocated

to commercial lending nonperforming loans was 29% at

December 31, 2009 and 34% at December 31, 2008.

Approximately 60% of these nonperforming loans are secured

by collateral that is expected to reduce credit losses and require

less reserves in the event of default. Additionally, the allowance

for loan and lease losses was reduced by $112 million during

2009 relating to additional loans deemed to be within the scope

of FASB ASC 310-30 as of December 31, 2008.

Nonperforming assets were 3.99% of total loans and

foreclosed and other assets at December 31, 2009 compared

with 1.24% at December 31, 2008.

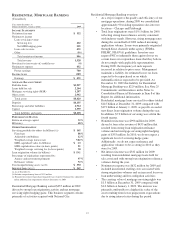

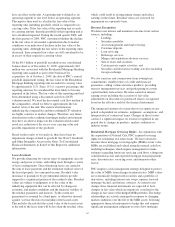

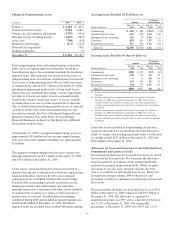

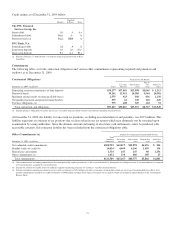

Nonperforming Assets By Type

In millions

Dec. 31

2009

Dec. 31

2008

Nonaccrual loans

Commercial

Retail/wholesale $ 231 $88

Manufacturing 423 141

Other service providers 394 114

Real estate related (a) 419 151

Financial services 117 23

Health care 41 37

Other 181 22

Total commercial 1,806 576

Commercial real estate

Real estate projects 1,754 659

Commercial mortgage 386 107

Total commercial real estate 2,140 766

Equipment lease financing 130 97

TOTAL COMMERCIAL LENDING 4,076 1,439

Consumer

Home equity 356 66

Other 36 4

Total consumer 392 70

Residential real estate

Residential mortgage 955 139

Residential construction 248 14

Total residential real estate 1,203 153

TOTAL CONSUMER LENDING 1,595 223

Total nonperforming loans 5,671 1,662

Foreclosed and other assets

Commercial lending 266 50

Consumer lending 379 469

Total foreclosed and other assets 645 519

Total nonperforming assets (b) $6,316 $2,181

(a) Includes loans related to customers in the real estate and construction industries.

(b) Amounts at December 31, 2009 and December 31, 2008 included $3.8 billion and

$738 million, respectively, of nonperforming assets related to National City,

excluding those loans that we impaired.

67