PNC Bank 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.we have transferred a small portfolio to a third party

servicer. Additionally, given the low level of

mortgage rates relative to where these loans were

originated, we have implemented several internal and

external refinance programs to proactively work with

the borrowers to explore refinance alternatives that

would allow them to qualify for a conforming

mortgage loan which would be originated and sold by

the company or the third party originator.

• Active construction loans remain available as a part

of some construction phases of the real estate

development and have not been fully funded.

Properties are reviewed by a dedicated team to assess

the appropriate strategy for optimizing the return on

these assets while mitigating risk. To the extent we

believe that completion of the construction on a

particular project will maximize value, additional

advances under the construction facility may be

considered. The goal for these projects would be to

move such project toward completion. Otherwise, the

property is to be managed on an “as is” basis or

returned to raw land for sale.

• Completed construction loans are comprised of loans

on which all phases of property construction are

complete and the loan has been funded as needed to

allow for construction completion. We are managing

completed construction loans consistent with the

strategies for residential real estate loans.

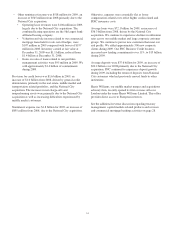

The fair value marks taken upon our acquisition of National

City, along with the team assembled to provide specific focus

on this business segment, put us in a good position to manage

these assets. Additionally, our capital and liquidity position

provide us flexibility to be prudent in terms of continuing to

hold these assets or selling them to another investor to obtain

the optimum return.

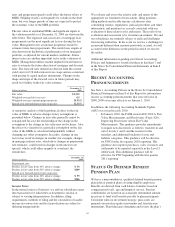

C

RITICAL

A

CCOUNTING

E

STIMATES

A

ND

J

UDGMENTS

Our consolidated financial statements are prepared by

applying certain accounting policies. Note 1 Accounting

Policies in the Notes To Consolidated Financial Statements in

Item 8 of this Report describes the most significant accounting

policies that we use. Certain of these policies require us to

make estimates and strategic or economic assumptions that

may prove inaccurate or be subject to variations that may

significantly affect our reported results and financial position

for the period or in future periods.

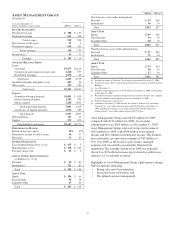

Fair Value Measurements

We must use estimates, assumptions, and judgments when

assets and liabilities are required to be recorded at, or adjusted

to reflect, fair value. This includes the initial measurement at

fair value of the assets acquired and liabilities assumed in

acquisitions qualifying as business combinations under

GAAP, Business Combinations (Topic 805). The valuation of

both financial and nonfinancial assets and liabilities in these

transactions requires numerous assumptions and estimates and

the use of third-party sources including appraisers and

valuation specialists.

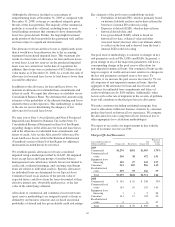

Assets and liabilities carried at fair value inherently result in a

higher degree of financial statement volatility. Assets and

liabilities measured at fair value on a recurring basis,

including those elected under Financial Instruments (Topic

825), include available for sale and trading securities,

financial derivatives, certain commercial and residential

mortgage loans held for sale, customer resale agreements,

private equity investments, and residential mortgage servicing

rights. Fair values and the information used to record

valuation adjustments for certain assets and liabilities are

based on either quoted market prices or are provided by other

independent third-party sources, when available. When such

third-party information is not available, we estimate fair value

primarily by using cash flow and other financial modeling

techniques. Changes in underlying factors, assumptions, or

estimates in any of these areas could materially impact our

future financial condition and results of operations.

Effective January 1, 2008, PNC adopted Fair Value

Measurements and Disclosures (Topic 820). This guidance

defines fair value as the price that would be received to sell a

financial asset or paid to transfer a financial liability in an

orderly transaction between market participants at the

measurement date. This guidance established a three level

hierarchy for disclosure of assets and liabilities recorded at

fair value. The classification of assets and liabilities within the

hierarchy is based on whether the inputs to the valuation

methodology used in the measurement are observable or

unobservable.

The following sections of this Report provide further

information on this type of activity:

• Fair Value Measurements and Fair Value Option

included within this Item 7, and

• Note 8 Fair Value included in Notes To Consolidated

Financial Statements in Item 8 of this Report.

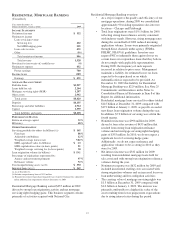

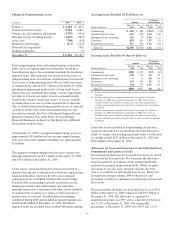

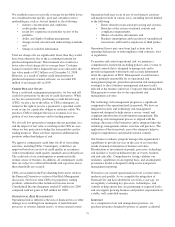

Allowances For Loan And Lease Losses And Unfunded

Loan Commitments And Letters Of Credit

We maintain allowances for loan and lease losses and

unfunded loan commitments and letters of credit at levels that

we believe to be adequate to absorb estimated probable credit

losses incurred in the loan portfolio. We determine the

adequacy of the allowances based on periodic evaluations of

the loan and lease portfolios and other relevant factors.

However, this evaluation is inherently subjective as it requires

material estimates, all of which may be susceptible to

significant change, including, among others:

• Probability of default,

• Loss given default,

• Exposure at date of default,

60