PNC Bank 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

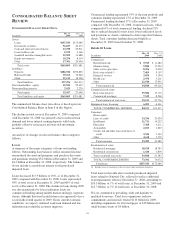

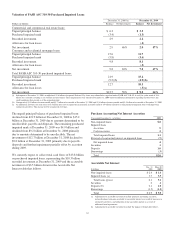

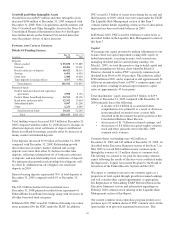

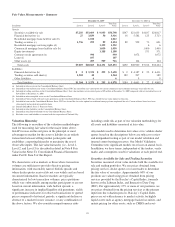

The following table provides detail regarding the vintage, current credit rating, and FICO score of the underlying collateral at

origination for residential mortgage-backed, commercial mortgage-backed and other asset-backed securities held in the available

for sale and held to maturity portfolios:

December 31, 2009

Agency Non-agency

Dollars in millions

Residential

Mortgage-

Backed

Securities

Commercial

Mortgage-

Backed

Securities

Residential

Mortgage-

Backed

Securities

Commercial

Mortgage-

Backed

Securities

Asset-

Backed

Securities

Fair Value – Available for Sale $24,438 $1,297 $8,302 $3,848 $1,668

Fair Value – Held to Maturity 2,225 3,136

Total Fair Value $24,438 $1,297 $8,302 $6,073 $4,804

% of Fair Value:

By Vintage

2009 40% 73% 2% 34%

2008 17% 2% 11%

2007 9% 16% 16% 17%

2006 11% 3% 23% 33% 18%

2005 and earlier 23% 22% 61% 49% 20%

Total 100% 100% 100% 100% 100%

By Credit Rating

Agency 100% 100%

AAA 12% 91% 74%

AA 7% 2% 5%

A8% 3%

BBB 12% 3% 1%

BB 16% 1% 5%

B15% 5%

Lower than B 30% 8%

No rating 2%

Total 100% 100% 100% 100% 100%

By FICO Score

>720 61% 4%

<720 and >660 30% 10%

<660 4%

No FICO score N/A N/A 9% N/A 82%

Total 100% 100%

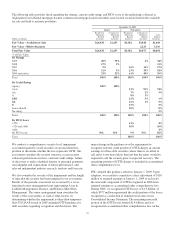

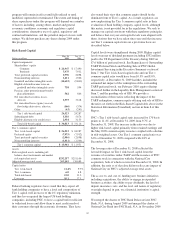

We conduct a comprehensive security-level impairment

assessment quarterly on all securities in an unrealized loss

position to determine whether the loss represents OTTI. Our

assessment considers the security structure, recent security

collateral performance metrics, external credit ratings, failure

of the issuer to make scheduled interest or principal payments,

our judgment and expectations of future performance, and

relevant independent industry research, analysis and forecasts.

We also consider the severity of the impairment and the length

of time that the security has been impaired in our assessment.

Results of the periodic assessment are reviewed by a cross-

functional senior management team representing Asset &

Liability Management, Finance, and Balance Sheet Risk

Management. The senior management team considers the

results of the assessments, as well as other factors, in

determining whether the impairment is other-than-temporary.

New US GAAP issued in 2009 amended OTTI guidance for

debt securities regarding recognition and disclosure. The

major change in the guidance was the requirement to

recognize only the credit portion of OTTI charges in current

earnings for those debt securities where there is no intent to

sell and it is not more likely than not that the entity would be

required to sell the security prior to expected recovery. The

remaining portion of OTTI charges is included in accumulated

other comprehensive loss.

PNC adopted this guidance effective January 1, 2009. Upon

adoption, we recorded a cumulative effect adjustment of $110

million to retained earnings at January 1, 2009 to reclassify

the noncredit component of OTTI recognized in 2008 from

retained earnings to accumulated other comprehensive loss.

During 2009, we recognized OTTI losses of $1.9 billion, of

which $577 million represented the credit portion of the losses

recognized as a reduction of noninterest income on our

Consolidated Income Statement. The remaining noncredit

portion of the OTTI losses totaled $1.4 billion and was

recognized in accumulated other comprehensive loss on the

35