PNC Bank 2009 Annual Report Download - page 47

Download and view the complete annual report

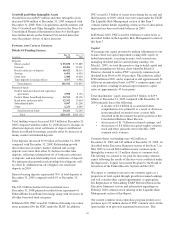

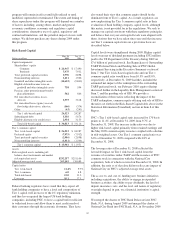

Please find page 47 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.equity associated with the note tranches held by us are

intercompany balances and are eliminated in consolidation.

Nonconforming mortgage loans, including foreclosed

properties, pledged as collateral to the SPE remain on the

balance sheet at a net carrying value of $587 million at

December 31, 2009.

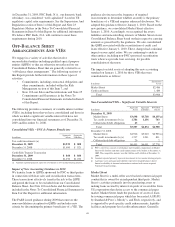

In connection with the credit risk transfer agreement, we held

the right to put the mezzanine notes to the independent third-

party once credit losses in the mortgage loan pool exceeded

the principal balance of the subordinated equity notes. During

2009, cumulative credit losses in the mortgage loan pool

surpassed the principal balance of the subordinated equity

notes which resulted in us exercising our put option on two of

the subordinate mezzanine notes. Cash proceeds received

from the third party for the exercise of these put options

totaled $36 million. In addition, during 2009 we entered into

an agreement with the third party to terminate each party’s

rights and obligations under the credit risk transfer agreement

for the remaining mezzanine notes. We agreed to terminate

our contractual right to put the remaining mezzanine notes to

the third party for a cash payment of $126 million. A pretax

gain of $10 million was recognized in noninterest income as a

result of these transactions.

We assessed what impact the reconsideration events above

had on determining whether we would remain the primary

beneficiary of the SPE. Management concluded that we would

remain the primary beneficiary and accordingly should

continue to consolidate the SPE.

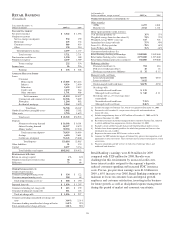

Perpetual Trust Securities

We issue certain hybrid capital vehicles that qualify as capital

for regulatory and rating agency purposes.

In February 2008, PNC Preferred Funding LLC (the LLC),

one of our indirect subsidiaries, sold $375 million of 8.700%

Fixed-to-Floating Rate Non-Cumulative Exchangeable

Perpetual Trust Securities of PNC Preferred Funding Trust III

(Trust III) to third parties in a private placement. In

connection with the private placement, Trust III acquired $375

million of Fixed-to-Floating Rate Non-Cumulative Perpetual

Preferred Securities of the LLC (the LLC Preferred

Securities). The sale was similar to the March 2007 private

placement by the LLC of $500 million of 6.113%

Fixed-to-Floating Rate Non-Cumulative Exchangeable Trust

Securities (the Trust II Securities) of PNC Preferred Funding

Trust II (Trust II) in which Trust II acquired $500 million of

LLC Preferred Securities and to the December 2006 private

placement by PNC REIT Corp. of $500 million of 6.517%

Fixed-to-Floating Rate Non-Cumulative Exchangeable

Perpetual Trust Securities (the Trust I Securities) of PNC

Preferred Funding Trust I (Trust I) in which Trust I acquired

$500 million of LLC Preferred Securities.

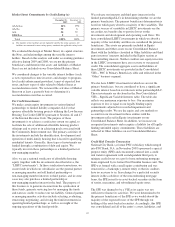

Each Trust III Security is automatically exchangeable into a

share of Series J Non-Cumulative Perpetual Preferred Stock of

PNC, each Trust II Security is automatically exchangeable

into a share of Series I Non-Cumulative Perpetual Preferred

Stock of PNC (Series I Preferred Stock), and each Trust I

Security is automatically exchangeable into a share of Series F

Non-Cumulative Perpetual Preferred Stock of PNC Bank,

N.A. (PNC Bank Preferred Stock), in each case under certain

conditions relating to the capitalization or the financial

condition of PNC Bank, N.A. and upon the direction of the

Office of the Comptroller of the Currency.

We entered into a replacement capital covenant in connection

with the closing of the Trust I Securities sale (the Trust RCC)

whereby we agreed that neither we nor our subsidiaries (other

than PNC Bank, N.A. and its subsidiaries) would purchase the

Trust Securities, the LLC Preferred Securities or the PNC

Bank Preferred Stock unless such repurchases or redemptions

are made from the proceeds of the issuance of certain

qualified securities and pursuant to the other terms and

conditions set forth in the replacement capital covenant with

respect to the Trust RCC.

We also entered into a replacement capital covenant in

connection with the closing of the Trust II Securities sale (the

Trust II RCC) whereby we agreed until March 29, 2017 that

neither we nor our subsidiaries would purchase or redeem the

Trust II Securities, the LLC Preferred Securities or the Series I

Preferred Stock unless such repurchases or redemptions are

made from the proceeds of the issuance of certain qualified

securities and pursuant to the other terms and conditions set

forth in the replacement capital covenant with respect to the

Trust RCC.

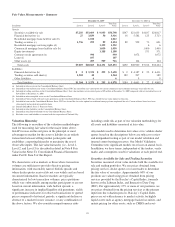

As of December 31, 2009, each of the Trust RCC and the

Trust II RCC are for the benefit of holders of our $200 million

of Floating Rate Junior Subordinated Notes issued in June

1998. We filed a copy of each of the Trust RCC and the Trust

II RCC with the SEC as Exhibit 99.1 to PNC’s Form 8-K filed

on December 8, 2006 and as Exhibit 99.1 to PNC’s Form 8-K

filed on March 30, 2007, respectively.

PNC has contractually committed to Trust II and Trust III that

if full dividends are not paid in a dividend period on the Trust

II Securities or the Trust III Securities, as applicable, or the

LLC Preferred Securities held by Trust II or Trust III, as

applicable, PNC will not declare or pay dividends with respect

to, or redeem, purchase or acquire, any of its equity capital

securities during the next succeeding dividend period, other

than: (i) purchases, redemptions or other acquisitions of shares

of capital stock of PNC in connection with any employment

contract, benefit plan or other similar arrangement with or for

the benefit of employees, officers, directors or consultants,

(ii) purchases of shares of common stock of PNC pursuant to a

contractually binding requirement to buy stock existing prior

to the commencement of the extension period, including under

a contractually binding stock repurchase plan, (iii) any

dividend in connection with the implementation of a

shareholders’ rights plan, or the redemption or repurchase of

any rights under any such plan, (iv) as a result of an exchange

or conversion of any class or series of PNC’s capital stock for

43