PNC Bank 2009 Annual Report Download - page 167

Download and view the complete annual report

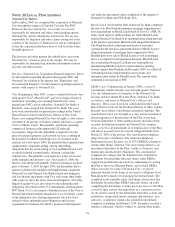

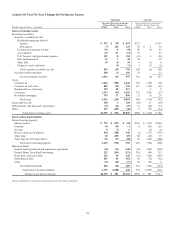

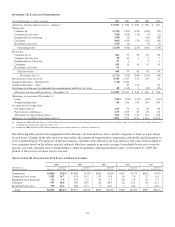

Please find page 167 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In July 2009, Visa funded $700 million to an escrow account

and reduced the conversion ratio of Visa B to A shares. We

consequently recognized our estimated $66 million share of

the $700 million as a reduction of our indemnification liability

and a reduction of noninterest expense.

Our Visa indemnification liability included on our

Consolidated Balance Sheet at December 31, 2009 totaled

$194 million as a result of the indemnification provision in

Section 2.05j of the Visa By-Laws and/or the indemnification

provided through the judgment and loss sharing agreements.

Any ultimate exposure to the specified Visa litigation may be

different than this amount.

R

ECOURSE

A

GREEMENTS

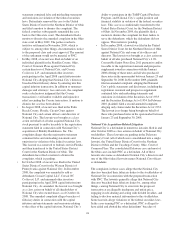

We are authorized to underwrite, originate, fund, sell and

service commercial mortgage loans and then sell them to

FNMA under FNMA’s DUS program. We have similar

arrangements with FHLMC.

Under these programs, we generally assume up to one-third of

the risk of loss on unpaid principal balances through a loss

share arrangement. At December 31, 2009, the potential

exposure to loss was $6.0 billion. Accordingly, we maintain a

reserve for such potential losses which approximates the fair

value of this exposure. At December 31, 2009, the unpaid

principal balance outstanding of loans sold as a participant in

these programs was $19.7 billion. The approximate fair value

of the loss share arrangement in the form of reserves for losses

under these programs, totaled $71 million as of December 31,

2009 and is included in other liabilities on our Consolidated

Balance Sheet. If payment is required under these programs,

we would not have a contractual interest in the collateral

underlying the mortgage loans on which losses occurred,

although the value of the collateral is taken into account in

determining our share of such losses. The serviced loans are

not included on our Consolidated Balance Sheet.

We sell residential mortgage loans pursuant to agreements

which contain representations concerning subjects such as

credit information, loan documentation, collateral, and

insurability. Prior to the acquisition, National City also sold

home equity loans/lines of credit pursuant to such agreements.

On a regular basis, investors may request PNC to indemnify

them against losses on certain loans or to repurchase loans

which the investors believe do not comply with applicable

representations. During 2009 the frequency of such requests

increased in relation to prior years. This increase was driven

by higher loan delinquencies, resulting from deterioration in

overall economic conditions and trends, particularly those

impacting the residential housing sector.

Upon completion of its own investigation as to the validity of

the claim, PNC will repurchase or provide indemnification on

such loans. This may take the form of an outright repurchase

of the loan or a settlement payment to the investor. If the loan

is repurchased it is properly considered in our nonperforming

loan disclosures and statistics. Indemnification requests are

generally received within two years subsequent to the date of

sale.

Management maintains a liability for estimated losses on

loans expected to be repurchased, or on which indemnification

is expected to be provided, and regularly evaluates the

adequacy of this recourse liability based on trends in

repurchase and indemnification requests, actual loss

experience, known and inherent risks in the loans, and current

economic conditions. As part of its evaluation of the adequacy

of this recourse liability, management considers estimated loss

projections over the life of the subject loan portfolio. At

December 31, 2009 the liability for estimated losses on

repurchase and indemnification claims was $275 million,

which is reported in other liabilities on the Consolidated

Balance Sheet.

R

EINSURANCE

A

GREEMENTS

We have two wholly-owned captive insurance subsidiaries

which provide reinsurance to third-party insurers related to

insurance sold to our customers. These subsidiaries enter into

various types of reinsurance agreements with third-party

insurers where the subsidiary assumes the risk of loss through

either an excess of loss or quota share agreement up to 100%

reinsurance. In excess of loss agreements, these subsidiaries

assume the risk of loss for an excess layer of coverage up to

specified limits, once a defined first loss percentage is met. In

quota share agreements, the subsidiaries and third-party

insurers share the responsibility for payment of all claims.

Reserves were recognized for probable losses on these

policies of $220 million at December 31, 2009 and $207

million at December 31, 2008. The aggregate maximum

exposure up to the specified limits for all reinsurance contracts

was $1.7 billion as of December 31, 2009.

163