PNC Bank 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2009, PNC Bank, N.A., our domestic bank

subsidiary, was considered “well capitalized” based on US

regulatory capital ratio requirements. See the Supervision And

Regulation section of Item 1 of this Report and Note 23

Regulatory Matters in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information.

We believe PNC Bank, N.A. will continue to meet these

requirements during 2010.

O

FF

-B

ALANCE

S

HEET

A

RRANGEMENTS

A

ND

VIE

S

We engage in a variety of activities that involve

unconsolidated entities including qualified special purpose

entities (QSPEs) or that are otherwise not reflected on our

Consolidated Balance Sheet that are generally referred to as

“off-balance sheet arrangements.” The following sections of

this Report provide further information on these types of

activities:

• Commitments, including contractual obligations and

other commitments, included within the Risk

Management section of this Item 7, and

• Note 10 Loan Sales and Securitizations and Note 25

Commitments and Guarantees in the Notes To

Consolidated Financial Statements included in Item 8

of this Report.

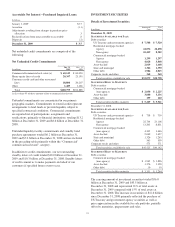

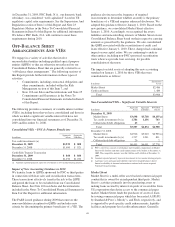

The following provides a summary of variable interest entities

(VIEs), including those that we have consolidated and those in

which we hold a significant variable interest but have not

consolidated into our financial statements as of December 31,

2009 and December 31, 2008.

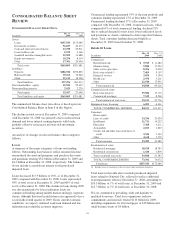

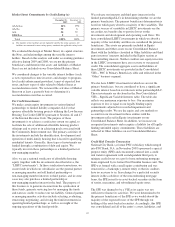

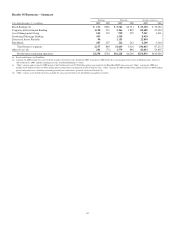

Consolidated VIEs – PNC Is Primary Beneficiary

In millions

Aggregate

Assets

Aggregate

Liabilities

Tax credit investments (a)

December 31, 2009 $1,933 $ 808

December 31, 2008 $1,690 $ 921

Credit Risk Transfer Transaction

December 31, 2009 $ 860 $ 860

December 31, 2008 $1,070 $1,070

(a) Amounts reported primarily represent investments in low income housing projects.

Impact of New Accounting Guidance in 2010

We transfer loans to QSPEs sponsored by PNC or third parties

in connection with loan sales and securitization transactions.

These transactions effectively transfer the risk to the QSPE

and permit the loans to be excluded from our Consolidated

Balance Sheet. See Note 10 Loan Sales and Securitizations

included in the Notes To Consolidated Financial Statements in

Item 8 of this Report for additional information.

The FASB issued guidance during 2009 that removes the

nonconsolidation exception for QSPEs and includes new

criteria for determining the primary beneficiary of a VIE. The

guidance also increases the frequency of required

reassessments to determine whether an entity is the primary

beneficiary of a VIE and requires enhanced disclosures. We

adopted this guidance effective January 1, 2010. Based on the

new guidance, we consolidated Market Street effective

January 1, 2010. Accordingly, we recognized the assets,

liabilities and noncontrolling interests of Market Street on our

Consolidated Balance Sheet based on their respective carrying

amounts as prescribed by the guidance. We also consolidated

the QSPE associated with the securitization of credit card

loans effective January 1, 2010. These changes had a minimal

impact on our capital ratios. We are continuing to analyze

other entities, including non-PNC sponsored securitization

trusts where we provide loan servicing, for possible

consolidation of the trusts.

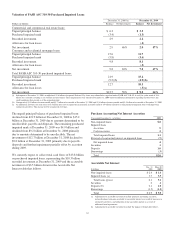

The impact on total assets of adopting this new accounting

standard on January 1, 2010 for those VIEs that were

consolidated is as follows:

In millions

Incremental

Assets

Market Street $2,486

Credit card loans 1,480

Total $3,966

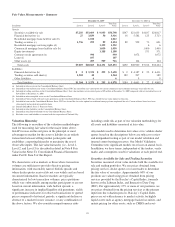

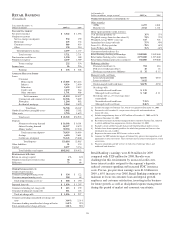

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss

December 31, 2009

Market Street $3,698 $3,718 $6,155(a)

Tax credit investments (b) (c) 1,786 1,156 743

Collateralized debt obligations 23 2

Total $5,507 $4,874 $6,900

December 31, 2008

Market Street $4,916 $5,010 $6,965(a)

Tax credit investments (b) (c) 1,517 1,041 811

Collateralized debt obligations 20 2

Total $6,453 $6,051 $7,778

(a) PNC’s risk of loss consists of off-balance sheet liquidity commitments to Market

Street of $5.6 billion and other credit enhancements of $.6 billion at December 31,

2009. The comparable amounts were $6.4 billion and $.6 billion at December 31,

2008.

(b) Amounts reported primarily represent investments in low income housing projects.

(c) Aggregate assets and aggregate liabilities represent estimated balances due to

limited availability of financial information associated with certain acquired

National City partnerships.

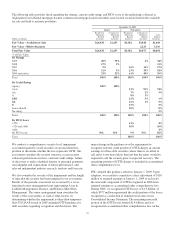

Market Street

Market Street is a multi-seller asset-backed commercial paper

conduit that is owned by an independent third party. Market

Street’s activities primarily involve purchasing assets or

making loans secured by interests in pools of receivables from

US corporations that desire access to the commercial paper

market. Market Street funds the purchases of assets or loans

by issuing commercial paper which has been rated A1/P1/F1

by Standard & Poor’s, Moody’s, and Fitch, respectively, and

is supported by pool-specific credit enhancements, liquidity

facilities and program-level credit enhancement. Generally,

40