PNC Bank 2009 Annual Report Download - page 55

Download and view the complete annual report

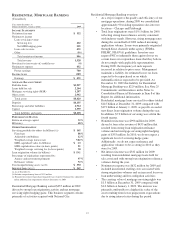

Please find page 55 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Highlights of Retail Banking’s performance for 2009:

• The acquisition of National City added

approximately $29 billion of loans and $81 billion of

deposits to Retail Banking. Other salient points

related to this acquisition include the following:

– Added over 1,400 branches,

– Expanded our ATMs by over 2,100 locations,

– Established or significantly increased our

branch presence in Ohio, Kentucky, Indiana,

Illinois, Pennsylvania, Michigan, Wisconsin,

Missouri and Florida – giving PNC one of the

largest branch distribution networks among

banks in the country,

– Expanded our customer base with the addition

of approximately 2.7 million checking

relationships, and

– Added $12 billion in brokerage account assets.

We successfully completed the required divestiture

of 61 branches and 73 ATMs from the National City

acquisition by early September and the first major

conversion of National City customers to the PNC

platform in November 2009, with three remaining

conversions on schedule to be completed by June

2010.

• Retail Banking expanded the number of customers it

serves and grew checking relationships. Excluding

relationships added from acquisitions and the impact

of the required divestitures, net new consumer and

business checking relationships for legacy PNC grew

by 119,000 since December 31, 2008 compared with

70,000 during the same period last year.

• Our investment in online banking capabilities

continued to pay off. Excluding customers added

from acquisitions and the impact of the required

divestitures, active online bill pay and active online

banking customers have increased 18% and 17%,

respectively, since December 31, 2008. We continue

to seek customer growth by expanding our use of

technology, such as our “Virtual Wallet” online

banking product. We leveraged our understanding of

this market along with our extensive university

banking program and launched a new product in the

second quarter of 2009 for college students and their

parents, called “Virtual Wallet Student.”

• Employee engagement and customer satisfaction/

loyalty results are tracking at all time highs. In 2009,

we received the “Gallup Great Workplace Award” in

recognition of our extraordinary ability to create an

engaged workplace culture.

• At December 31, 2009, Retail Banking had 2,512

branches and an ATM network of 6,473 machines

giving PNC one of the largest distribution networks

among US banks. We continued to invest in the

branch network, albeit at a slower pace than in prior

years given the current economic conditions. We are

optimizing our network by opening new branches in

high growth areas, relocating branches to areas of

higher market opportunity, and consolidating

branches in areas of declining opportunity. In 2009,

we opened 27 traditional branches and 45 in-store

branches, added 313 ATMs, and divested 61

branches and 73 ATMs. To continue to optimize our

network, we also consolidated 79 and relocated 11

branches in 2009. The in-store branches and the

ATMs were primarily opened under our previously

reported exclusive banking services agreement with

Giant Food LLC supermarkets.

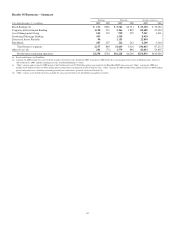

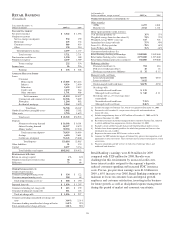

Total revenue for 2009 was $5.7 billion compared with $2.7

billion in 2008. Net interest income of $3.5 billion increased

$1.9 billion compared with 2008. The increase in net interest

income was driven by the National City acquisition and was

partially offset by declines in legacy net interest income as a

result of the negative impact of lower interest credits assigned

to the segment’s deposits in this low rate environment.

Noninterest income for 2009 was $2.2 billion, an increase of

$1.1 billion over the prior year. The National City acquisition

was the major factor for the increase, partially offset by a $95

million gain from the redemption of Visa common shares in

the first quarter of 2008. In addition, core growth in brokerage

account activities and consumer related fees have been

negatively impacted by current economic conditions. The

Market Risk Management – Equity and Other Investment Risk

section of this Item 7 includes further information regarding

our investment in Visa.

In 2010, Retail Banking revenue will be negatively impacted

in a more significant manner by 1) the new rules set forth in

Regulation E related to overdraft charges and 2) the Credit

CARD Act. Current estimates are that 2010 earnings will be

impacted by approximately $115 million related to Regulation

E and by approximately $40 million attributable to the Credit

CARD Act. These estimates do not include any additional

negative impact to revenue for other changes that may be

made in 2010 responding to market conditions or other/

additional regulatory requirements, or any offsetting impact of

changes to products and/or pricing.

In 2009, the provision for credit losses was $1.3 billion

compared with $388 million in 2008. Net charge-offs were

$1.0 billion for 2009 and $257 million last year. The increases

in provision and net charge-offs were primarily a result of a

loan portfolio that has increased 117%, including a

significantly larger credit card portfolio, and the continued

credit deterioration in both the commercial and consumer loan

portfolios which has required an increase to loan loss reserves.

Noninterest expense for 2009 totaled $4.2 billion, an increase

of $2.4 billion over last year. The increase was primarily

attributable to the impact of acquisitions, as well as increased

FDIC insurance costs and continued investments in the

business.

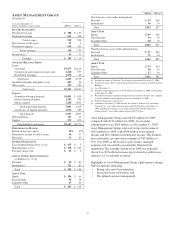

Growing core checking deposits as a lower-cost funding

source and as the cornerstone product to build customer

51