PNC Bank 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

M

ARKET

R

ISK

M

ANAGEMENT

O

VERVIEW

Market risk is the risk of a loss in earnings or economic value

due to adverse movements in market factors such as interest

rates, credit spreads, foreign exchange rates, and equity prices.

We are exposed to market risk primarily by our involvement

in the following activities, among others:

• Traditional banking activities of taking deposits and

extending loans,

• Private equity and other investments and activities

whose economic values are directly impacted by

market factors, and

• Trading in fixed income products, equities,

derivatives, and foreign exchange, as a result of

customer activities, underwriting, and proprietary

trading.

We have established enterprise-wide policies and

methodologies to identify, measure, monitor, and report

market risk. Market Risk Management provides independent

oversight by monitoring compliance with these limits and

guidelines, and reporting significant risks in the business to

the Risk Committee of the Board.

M

ARKET

R

ISK

M

ANAGEMENT

–I

NTEREST

R

ATE

R

ISK

Interest rate risk results primarily from our traditional banking

activities of gathering deposits and extending loans. Many

factors, including economic and financial conditions,

movements in interest rates, and consumer preferences, affect

the difference between the interest that we earn on assets and

the interest that we pay on liabilities and the level of our

noninterest-bearing funding sources. Due to the repricing term

mismatches and embedded options inherent in certain of these

products, changes in market interest rates not only affect

expected near-term earnings, but also the economic values of

these assets and liabilities.

Asset and Liability Management centrally manages interest

rate risk within limits and guidelines set forth in our risk

management policies approved by management’s Asset and

Liability Committee and the Joint Risk Committee of the

Board. Sensitivity results and market interest rate benchmarks

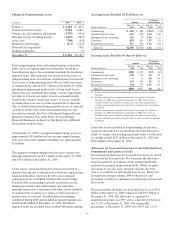

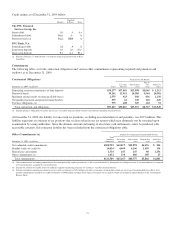

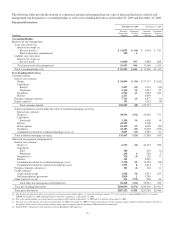

for the fourth quarters of 2009 and 2008 follow:

Interest Sensitivity Analysis

Fourth

Quarter

2009

Fourth

Quarter

2008

Net Interest Income Sensitivity Simulation

Effect on net interest income in first year

from gradual interest rate change over

following 12 months of:

100 basis point increase 1.1% (0.7)%

100 basis point decrease (a) (2.0)% (0.5)%

Effect on net interest income in second year

from gradual interest rate change over the

preceding 12 months of:

100 basis point increase 1.4% 1.9%

100 basis point decrease (a) (6.0)% (3.1)%

Duration of Equity Model (a)

Base case duration of equity (in years): (1.2) (5.2)

Key Period-End Interest Rates

One month LIBOR .23% .44%

Three-year swap 2.06% 1.76%

(a) Not meaningful. Given the inherent limitations in certain of these measurement tools

and techniques, results become less meaningful as interest rates approach zero.

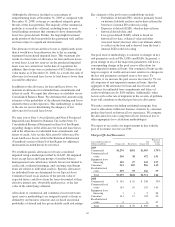

In addition to measuring the effect on net interest income

assuming parallel changes in current interest rates, we

routinely simulate the effects of a number of nonparallel

interest rate environments. The following Net Interest Income

Sensitivity To Alternative Rate Scenarios table reflects the

percentage change in net interest income over the next two

12-month periods assuming (i) the PNC Economist’s most

likely rate forecast, (ii) implied market forward rates, and

(iii) a Two-Ten Inversion (a 200 basis point inversion between

two-year and ten-year rates superimposed on current base

rates) scenario.

74