PNC Bank 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

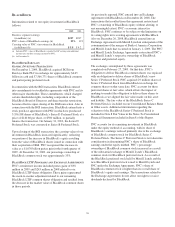

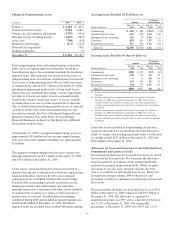

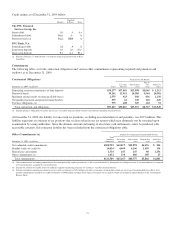

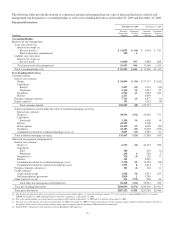

Change In Nonperforming Assets

In millions 2009 2008

January 1 $ 2,181 $ 495

Transferred from accrual 8,501 1,981

Charge-offs and valuation adjustments (1,770) (491)

Principal activity including payoffs (1,127) (381)

Asset sales (798) (43)

Returned to performing (671) (127)

National City acquisition 738

Sterling acquisition 9

December 31 $ 6,316 $2,181

Total nonperforming loans and nonperforming assets in the

tables above are significantly lower than they would have

been otherwise due to the accounting treatment for purchased

impaired loans. This treatment also results in lower ratios of

nonperforming loans to total loans and allowance for loan and

lease losses to nonperforming loans. We recorded such loans

at estimated fair value of $12.7 billion at December 31, 2008,

including an impairment mark for life of loan credit losses.

These loans are considered performing, even if contractually

past due (or if we do not expect to receive payment in full

based on the original contractual terms), as we are currently

accreting interest income over the expected life of the loans.

The accretable interest/yield represents the excess of expected

cash flows on the loans at the measurement date over the

recorded investment. See Note 6 Purchased Impaired Loans

Related to National City in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information on those loans.

At December 31, 2009, our largest nonperforming asset was

approximately $49 million and our average nonperforming

loan associated with commercial lending was approximately

$1 million.

The amount of nonperforming loans that were current as to

principal and interest was $1.7 billion at December 31, 2009

and $555 million at December 31, 2008.

Loans whose contractual terms have been restructured in a

manner which grants a concession to a borrower experiencing

financial difficulties where we do not receive adequate

compensation are considered troubled debt restructurings.

Troubled debt restructurings typically result from our loss

mitigation activities and could include rate reductions,

principal forgiveness, forbearance and other actions intended

to minimize the economic loss and to avoid foreclosure or

repossession of collateral. Troubled debt restructurings

completed during 2009 and included in nonperforming loans

totaled $440 million at December 31, 2009. Purchased

impaired loans are excluded from troubled debt restructurings.

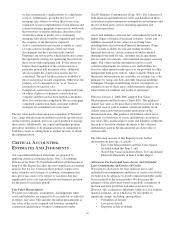

Accruing Loans Past Due 30 To 89 Days (a)

Amount

Percent of

Outstandings

Dollars in millions

Dec. 31

2009

Dec. 31

2008

Dec. 31

2009

Dec. 31

2008

Commercial $ 684 $ 489 1.26% .72%

Commercial real estate 666 400 3.10 1.68

Equipment lease financing 128 74 2.06 1.15

Consumer 438 451 .87 .93

Residential real estate 472 506 3.12 3.23

Total (b) $2,388 $1,920 1.62 1.18

Accruing Loans Past Due 90 Days Or More (a)

Amount

Percent of

Outstandings

Dollars in millions

Dec. 31

2009

Dec. 31

2008

Dec. 31

2009

Dec. 31

2008

Commercial $188 $90 .35% .13%

Commercial real estate 150 52 .70 .22

Equipment lease financing 62.10 .03

Consumer 226 154 .45 .32

Residential real estate 314 97 2.07 .62

Total (c) $884 $395 .60 .24

(a) Excludes loans that are government insured/guaranteed, primarily residential

mortgages.

(b) Excludes impaired loans acquired from National City totaling $.8 billion at

December 31, 2009 and $1.6 billion at December 31, 2008. These loans are

excluded as they were recorded at estimated fair value when acquired and are

currently considered performing loans due to the accretion of interest in purchase

accounting.

(c) Excludes impaired loans acquired from National City totaling $2.7 billion at

December 31, 2009 and $2.0 billion at December 31, 2008. These loans are

excluded as they were recorded at estimated fair value when acquired and are

currently considered performing loans due to the accretion of interest in purchase

accounting.

Loans that are not included in nonperforming or past due

categories and which we are uncertain about the borrower’s

ability to comply with existing repayment terms over the next

six months totaled $811 million at December 31, 2009 and

$745 million at December 31, 2008.

Allowances for Loan and Lease Losses and Unfunded Loan

Commitments and Letters of Credit

We maintain an allowance for loan and lease losses to absorb

losses from the loan portfolio. We determine the allowance

based on quarterly assessments of the estimated probable

credit losses incurred in the loan portfolio. While we make

allocations to specific loans and pools of loans, the total

reserve is available for all loan and lease losses. There were

no significant changes during 2009 to the process and

procedures we follow to determine our allowance of loan and

lease losses.

We increased the allowance for loan and lease losses to $5.1

billion at December 31, 2009 compared with $3.9 billion at

December 31, 2008. The allowance as a percent of

nonperforming loans was 89% and as a percent of total loans

was 3.22% at December 31, 2009. The comparable

percentages at December 31, 2008 were 236% and 2.23%.

68