PNC Bank 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The guidelines also indicate which investments and strategies

the manager is permitted to use to achieve its performance

objectives, and which investments and strategies it is

prohibited from using.

Where public market investment strategies may include the

use of derivatives and/or currency management, language is

incorporated in the managers’ guidelines to define allowable

and prohibited transactions and/or strategies. Derivatives are

typically employed by investment managers to modify risk/

return characteristics of their portfolio(s), implement asset

allocation changes in a cost-effective manner, or reduce

transaction costs. Under the managers’ investment guidelines,

derivatives may not be used solely for speculation or leverage.

Derivatives are used only in circumstances where they offer

the most efficient economic means of improving the risk/

reward profile of the portfolio.

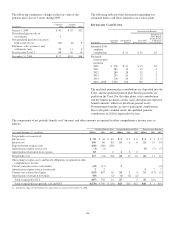

BlackRock and the Asset Management Group business

segment receive compensation for providing investment

management and trustee services for the majority of the Trust

portfolio. Compensation for such services is paid by PNC.

Non-affiliate service providers for the Trust are compensated

from plan assets.

F

AIR

V

ALUE

M

EASUREMENTS

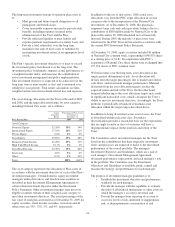

Effective January 1, 2008, the PNC Pension Plan adopted fair

value measurements and disclosures.

As further described in Note 8 Fair Value, GAAP establishes

the framework for measuring fair value, including a hierarchy

used to classify the inputs used in measuring fair value.

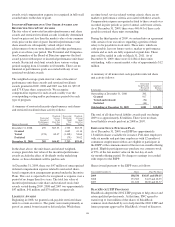

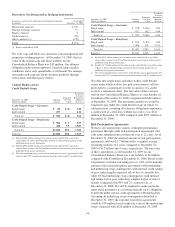

A description of the valuation methodologies used for assets

measured at fair value follows. There have been no changes in

the methodologies used at December 31, 2009 compared with

those in place at December 31, 2008:

• Money market, mutual funds and interests in

collective funds are valued at the net asset value of

the shares held by the pension plan at year-end.

• US government securities, other government

securities, corporate debt, common stock and

preferred stock are valued at the closing price

reported on the active market on which the individual

securities are traded.

• Limited partnerships are valued by investment

managers based on recent financial information used

to estimate fair value. Other investments held by the

pension plan include derivative financial instruments

and real estate, which are recorded at estimated fair

value as determined by third-party appraisals and

pricing models, and group annuity contracts which

are valued at fair value by discounting the related

cash flows based on current yields of similar

instruments with comparable durations considering

the credit-worthiness of the issuer.

These methods may result in fair value calculations that may

not be indicative of net realizable values or future fair values.

Furthermore, while the pension plan believes its valuation

methods are appropriate and consistent with other market

participants, the use of different methodologies or

assumptions to determine the fair value of certain financial

instruments could result in a different fair value measurement

at the reporting date.

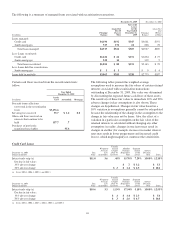

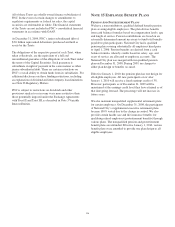

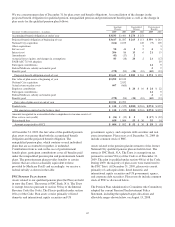

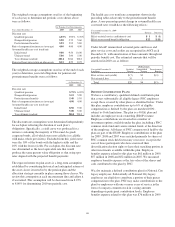

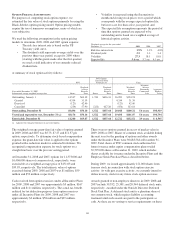

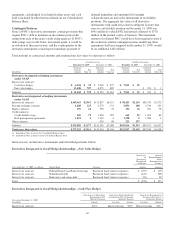

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2009:

Fair Value Measurements Using:

In millions

December 31, 2009

Fair Value

Quoted Prices in

Active Markets

For Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Cash $2 $2

Money market funds 334 285 $ 49

US government securities 200 73 127

Corporate debt 522 1 404 $117

Common and preferred stocks 498 198 300

Mutual funds 46 11 35

Interest in Collective Funds (a) 1,948 1,948

Limited partnerships 119 119

Other 52 844

Total $3,721 $578 $2,863 $280

(a) The benefit plans own commingled funds that invest in equity and fixed income securities. The commingled funds that invest

in equity securities seek to mirror the performance of the S&P 500 Index, Russell 3000 Index, Morgan Stanley Capital

International ACWI X US Index, and the Dow Jones U.S. Select Real Estate Securities Index. The commingled fund that

holds fixed income securities invests in domestic investment grade securities and seeks to mimic the performance of the

Barclays Aggregate Bond Index.

139