PNC Bank 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

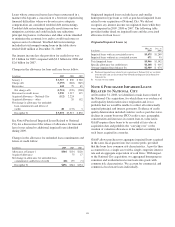

• The remaining discounts on loans of $5.1 billion will

be accreted to net interest income using the constant

effective yield method over the weighted average life

of the loans, estimated to be between two and three

years. The weighted average lives could vary

depending on prepayments, revised estimated cash

flows and other related factors. Of the remaining $5.1

billion of discounts at December 31, 2009, $3.5

billion relates to loans accounted for under FASB

ASC 310-30, and $1.6 billion relates to other

acquired loans.

• The remaining premiums on interest-earning time

deposits of $1.0 billion at December 31, 2009, will be

amortized over the weighted average life of the

deposits of approximately one year using the constant

effective yield method.

• The remaining discounts on borrowed funds of $1.2

billion at December 31, 2009, will be accreted over

the weighted average life of the borrowings of

approximately 7 years using the constant effective

yield method.

S

TERLING

F

INANCIAL

C

ORPORATION

On April 4, 2008, we acquired Lancaster, Pennsylvania-based

Sterling Financial Corporation (Sterling). Sterling shareholders

received an aggregate of approximately 4.6 million shares of

PNC common stock and $224 million of cash.

J.J.B. H

ILLIARD

, W.L.L

YONS

, LLC

On March 31, 2008, we sold J.J.B. Hilliard, W.L. Lyons, LLC

(Hilliard Lyons), a Louisville, Kentucky-based wholly-owned

subsidiary of PNC and a full-service brokerage and financial

services provider, to Houchens Industries, Inc. We recognized

an after-tax gain of $23 million in 2008 in connection with

this divestiture.

Y

ARDVILLE

N

ATIONAL

B

ANCORP

We acquired Hamilton, New Jersey-based Yardville National

Bancorp (Yardville) in October 2007. Yardville shareholders

received an aggregate of approximately 3.4 million shares of

PNC common stock and $156 million in cash. Total

consideration paid was approximately $399 million in stock

and cash.

M

ERCANTILE

B

ANKSHARES

C

ORPORATION

We acquired Mercantile Bankshares Corporation (Mercantile)

in March 2007. Mercantile shareholders received an aggregate

of approximately 53 million shares of PNC common stock and

$2.1 billion in cash. Total consideration paid was

approximately $5.9 billion in stock and cash.

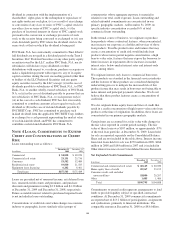

N

OTE

3V

ARIABLE

I

NTEREST

E

NTITIES

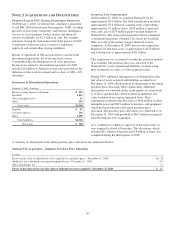

We are involved with various entities in the normal course of

business that were deemed to be VIEs. We consolidated

certain VIEs as of December 31, 2009 and 2008 for which we

were determined to be the primary beneficiary.

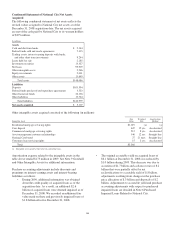

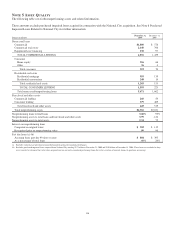

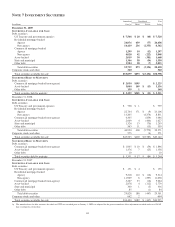

Consolidated VIEs – PNC Is Primary Beneficiary

In millions

Aggregate

Assets

Aggregate

Liabilities

Tax credit investments (a)

December 31, 2009 $1,933 $ 808

December 31, 2008 $1,690 $ 921

Credit Risk Transfer Transaction

December 31, 2009 $ 860 $ 860

December 31, 2008 $1,070 $1,070

(a) Amounts reported primarily represent investments in low income housing projects.

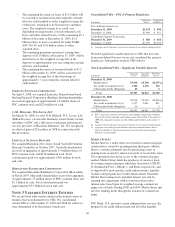

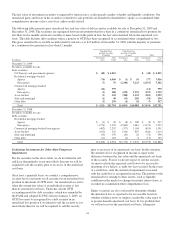

We hold significant variable interests in VIEs that have not

been consolidated because we are not considered the primary

beneficiary. Information on these VIEs follows:

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss

December 31, 2009

Market Street $3,698 $3,718 $6,155(a)

Tax credit investments (b) (c) 1,786 1,156 743

Collateralized debt obligations 23 2

Total $5,507 $4,874 $6,900

December 31, 2008

Market Street $4,916 $5,010 $6,965(a)

Tax credit investments (b) (c) 1,517 1,041 811

Collateralized debt obligations 20 2

Total $6,453 $6,051 $7,778

(a) PNC’s risk of loss consists of off-balance sheet liquidity commitments to Market

Street of $5.6 billion and other credit enhancements of $.6 billion at December 31,

2009. The comparable amounts were $6.4 billion and $.6 billion at December 31,

2008.

(b) Amounts reported primarily represent investments in low income housing projects.

(c) Aggregate assets and aggregate liabilities represent estimated balances due to

limited availability of financial information associated with certain acquired

National City partnerships.

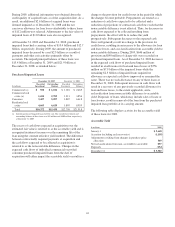

M

ARKET

S

TREET

Market Street is a multi-seller asset-backed commercial paper

conduit that is owned by an independent third party. Market

Street’s activities primarily involve purchasing assets or

making loans secured by interests in pools of receivables from

US corporations that desire access to the commercial paper

market. Market Street funds the purchases of assets or loans

by issuing commercial paper which has been rated A1/P1/F1

by Standard & Poor’s, Moody’s, and Fitch, respectively, and

is supported by pool-specific credit enhancements, liquidity

facilities and program-level credit enhancement. Generally,

Market Street mitigates its potential interest rate risk by

entering into agreements with its borrowers that reflect

interest rates based upon its weighted average commercial

paper cost of funds. During 2008 and 2009, Market Street met

all of its funding needs through the issuance of commercial

paper.

PNC Bank, N.A. provides certain administrative services, the

program-level credit enhancement and all of the liquidity

105