PNC Bank 2009 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

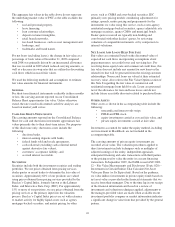

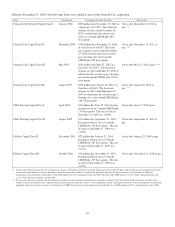

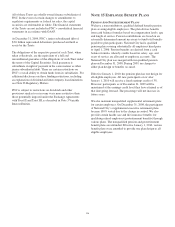

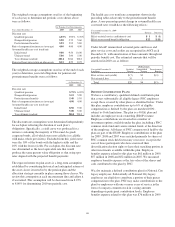

Effective December 31, 2008, the following Trusts were added as part of the National City acquisition.

Trust Date Formed Description of Capital Securities Redeemable

National City Preferred Capital Trust I January 2008 $500 million due December 10, 2043 at

a fixed rate of 12.00%. The fixed rate

remains in effect until December 10,

2012 at which time the interest rate

resets to 3-month LIBOR plus 861

basis points.

On or after December 10, 2012 at

par. **

National City Capital Trust II November 2006 $750 million due November 15, 2066

at a fixed rate of 6.625%. The fixed

rate remains in effect until November

15, 2036 at which time the securities

pay a floating rate of one-month

LIBOR plus 229 basis points.

On or after November 15, 2011 at

par. ***

National City Capital Trust III May 2007 $500 million due May 25, 2067 at a

fixed rate of 6.625%. The fixed rate

remains in effect until May 25, 2047 at

which time the securities pay a floating

rate of one-month LIBOR plus 212.63

basis points.

On or after May 25, 2012 at par. ***

National City Capital Trust IV August 2007 $518 million due August 30, 2067 at a

fixed rate of 8.00%. The fixed rate

remains in effect until September 15,

2047 at which time the securities pay a

floating rate of one-month LIBOR plus

348.7 basis points.

On or after August 30, 2012 at

par. ***

MAF Bancorp Capital Trust I April 2005 $30 million due June 15, 2035 bearing

an interest rate of 3-month LIBOR plus

175 basis points. The rate in effect at

December 31, 2009 was 2.004%.

On or after June 15, 2010 at par.

MAF Bancorp Capital Trust II August 2005 $35 million due September 15, 2035

bearing an interest rate of 3-month

LIBOR plus 140 basis points. The rate

in effect at December 31, 2009 was

1.654%.

On or after September 15, 2010 at

par.

Fidelity Capital Trust II December 2003 $22 million due January 23, 2034

bearing an interest rate of 3-month

LIBOR plus 285 basis points. The rate

in effect at December 31, 2009 was

3.131%.

On or after January 23, 2009 at par.

Fidelity Capital Trust III October 2004 $30 million due November 23, 2034

bearing an interest rate of 3-month

LIBOR plus 197 basis points. The rate

in effect at December 31, 2009 was

2.237%.

On or after November 23, 2009 at par.

** We may only redeem or repurchase the trust preferred securities of National City Preferred Capital Trust I prior to December 10, 2012, subject to having received proceeds from the

issuance of certain qualified securities and subject to the other terms and conditions set forth in the applicable replacement capital covenant. As of December 31, 2009, the

beneficiaries of this limitation are the holders of our $700 million of 6.875% subordinated notes due 2019. The Trust holds $500 million of 8.729% junior subordinated notes and

3.271% Stock Purchase Contracts issued by PNC.

*** We may only redeem or repurchase the trust preferred securities of, and our junior subordinated notes payable to, National City Capital Trust II, III and IV more than 10 years in

advance of their legal maturity dates, subject to having received proceeds from the issuance of certain qualified securities and subject to the other terms and conditions set forth in the

applicable replacement capital covenant. As of December 31, 2009, the beneficiaries of this limitation are the holders of our $700 million of 6.875% subordinated notes due 2019.

135