PNC Bank 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

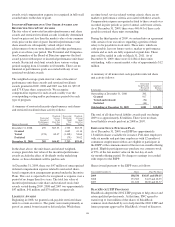

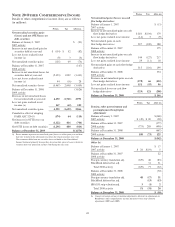

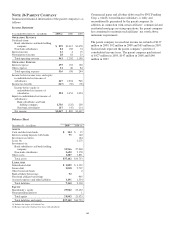

As of December 31, 2009 and 2008, we had a liability for

uncertain tax positions excluding interest and penalties of

$227 million and $257 million, respectively. A reconciliation

of the beginning and ending balance of unrecognized tax

benefits is as follows:

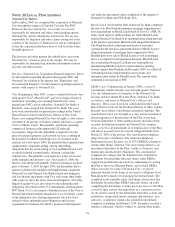

Changes in Unrecognized Tax Benefits

In millions 2009 2008 2007

Balance of gross unrecognized tax

benefits at January 1 $257 $57 $49

Increases:

Positions taken during a prior period 22 203(a) 52(b)

Positions taken during the current

period 26 1

Decreases:

Positions taken during a prior period (39) (3) (2)

Settlements with taxing authorities (34) (39)

Reductions resulting from lapse of

statute of limitations (5) (4)

Balance of gross unrecognized tax

benefits at December 31 $227 $257 $ 57

(a) Includes $202 million acquired from National City.

(b) Includes $42 million acquired from Mercantile.

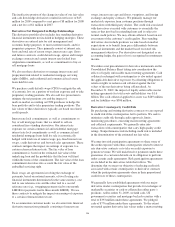

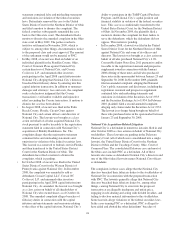

December 31, 2009 – In millions 2009

Unrecognized tax benefits related to:

Acquired companies within measurement period:

Permanent differences $5

Other:

Temporary differences 37

Permanent differences 185

Total $227

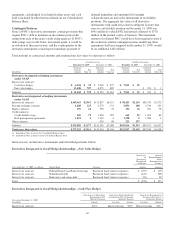

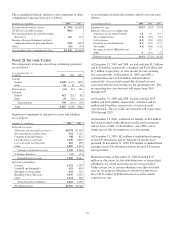

Any changes in the amounts of unrecognized tax benefits

related to temporary differences would result in a

reclassification to deferred tax liability; any changes in the

amounts of unrecognized tax benefits related to other

permanent differences (per above table) would result in an

adjustment to income tax expense and therefore our effective

tax rate. The unrecognized tax benefits related to other

permanent items above that if recognized would affect the

effective tax rate is $162 million. This is less than the total

amount of unrecognized tax benefit related to permanent

differences because a portion of those unrecognized benefits

relate to state tax matters.

It is reasonably possible that the liability for uncertain tax

positions could increase or decrease in the next twelve months

due to completion of tax authorities’ exams or the expiration

of statutes of limitations. Management estimates that the

liability for uncertain tax positions could decrease by $44

million within the next twelve months.

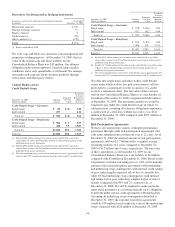

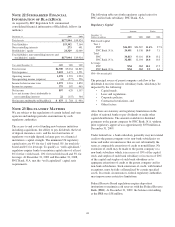

The consolidated federal income tax returns of The PNC

Financial Services Group, Inc. and subsidiaries through 2003

have been audited by the Internal Revenue Service (IRS) and

we have resolved all disputed matters through the IRS appeals

division. The IRS is currently examining the 2004 through

2006 consolidated federal income tax returns of The PNC

Financial Services Group, Inc. and subsidiaries and we expect

that examination to conclude, with all adjustments being

agreed to, in the first half of 2010. We expect the IRS to begin

its examination of our 2007 and 2008 consolidated federal

income tax returns during 2010.

The consolidated federal income tax returns of National City

through 2004 have been audited by the IRS and we have

resolved all matters through the IRS Appeals division. The

formal closing agreement is not yet executed. The IRS has

completed field examination of the 2005 through 2007

consolidated federal income tax returns of National City and

unresolved issues will be appealed. We expect the 2008

federal income tax return to begin being audited later in 2010.

California, Delaware, District of Columbia, Florida, Illinois,

Indiana, Maryland, Missouri, New Jersey, New York, and

New York City are principally where we were subject to state

and local income tax. Audits currently in process for these

states include: California (2003-2005), Illinois (2004-2007),

Indiana (2004-2007), Missouri (2003-2005), New York (2001-

2006), and New York City (2005-2007). In the ordinary

course of business we are routinely subject to audit by the

taxing authorities of states and at any given time a number of

audits will be in process. The years remaining open under the

statute of limitations for assessing income taxes is 2006 or

2007 and later for most state and local jurisdictions.

Our policy is to classify interest and penalties associated with

income taxes as income tax expense. For 2009, we had net

recoveries of $24 million of gross interest and penalties

reducing income tax expense. The total accrued interest and

penalties at December 31, 2009 and December 31, 2008 was

$144 million and $164 million, respectively.

154