PNC Bank 2009 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

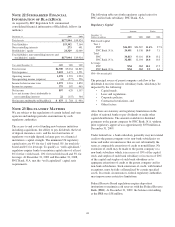

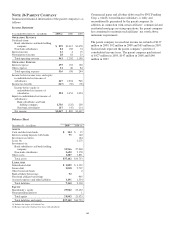

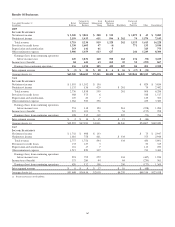

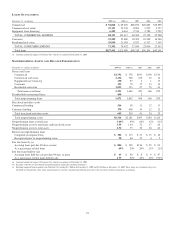

Statement Of Cash Flows

Year ended December 31 - in millions 2009 2008 2007

O

PERATING

A

CTIVITIES

Net income $ 2,447 $ 882 $ 1,467

Adjustments to reconcile net income

to net cash provided (used) by

operating activities:

Equity in undistributed net

(earnings) of subsidiaries (1,853) 172 (443)

Other 2,687 156 61

Net cash provided by operating

activities 3,281 1,210 1,085

I

NVESTING

A

CTIVITIES

Net capital returned from

(contributed to) subsidiaries (899) (8,298) (165)

Investment securities:

Sales and maturities 267 1,090

Purchases (228) (800)

Net cash received from (paid for)

acquisitions 51,431 (2,212)

Other (182) (104) (45)

Net cash used in investing

activities (1,037) (6,971) (2,132)

F

INANCING

A

CTIVITIES

Borrowings from non-bank

subsidiary 3,420 2,100 3,910

Repayments on borrowings from

non-bank subsidiary (4,274) (3,633) (1,432)

Other borrowed funds (1,166) 103

Preferred stock – TARP 7,275

Preferred stock – other 492

TARP warrant 304

Supervisory Capital Assessment

Program – common stock 624

Common and treasury stock 247 375 253

Acquisition of treasury stock (188) (234) (963)

Preferred stock cash dividends paid (388) (21)

Common stock cash dividends paid (430) (902) (806)

Net cash provided by (used in)

financing activities (2,155) 5,756 1,065

Increase (decrease) in cash and due

from banks 89 (5) 18

Cash and due from banks at

beginning of year 15 20 2

Cash and due from banks at

end of year $ 104 $15$20

N

OTE

27 S

EGMENT

R

EPORTING

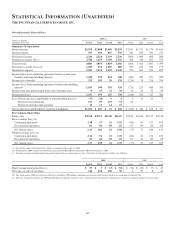

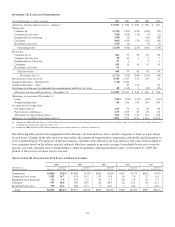

In the first quarter of 2009, we made changes to our business

organization structure and management reporting in

conjunction with the acquisition of National City.

Business segment results for 2008 and 2007 have been

reclassified to reflect current methodologies and current

business and management structure and to present those

periods on the same basis as 2009. As a result of its pending

sale, GIS is no longer a reportable business segment.

Results of individual businesses are presented based on our

management accounting practices and management structure.

There is no comprehensive, authoritative body of guidance for

management accounting equivalent to GAAP; therefore, the

financial results of our individual businesses are not

necessarily comparable with similar information for any other

company. We refine our methodologies from time to time as

our management accounting practices are enhanced and our

businesses and management structure change.

Financial results are presented, to the extent practicable, as if

each business operated on a stand-alone basis. As permitted

under GAAP, we have aggregated the business results for

certain similar operating segments for financial reporting

purposes.

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors. Capital is intended to cover unexpected

losses and is assigned to the banking and servicing businesses

using our risk-based economic capital model. We have

assigned capital to Retail Banking equal to 6% of funds to

approximate market comparables for this business.

We have allocated the allowances for loan and lease losses

and unfunded loan commitments and letters of credit based on

our assessment of risk inherent in each business segment’s

loan portfolio. Our allocation of the costs incurred by

operations and other shared support areas not directly aligned

with the businesses is primarily based on the use of services.

Total business segment financial results differ from

consolidated income from continuing operations. The impact

of these differences is reflected in the “Other” category in the

business segment tables. “Other” includes residual activities

that do not meet the criteria for disclosure as a separate

reportable business, including LTIP share distributions and

obligations, earnings and gains related to Hilliard Lyons for

the first quarter of 2008, integration costs, asset and liability

management activities including net securities gains or losses

and certain trading activities, exited businesses, equity

management activities, alternative investments, intercompany

eliminations, most corporate overhead, and differences

between business segment performance reporting and

165