PNC Bank 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

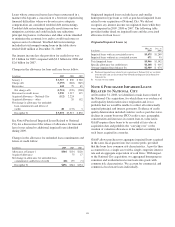

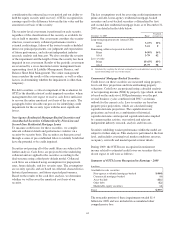

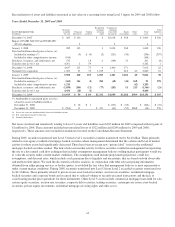

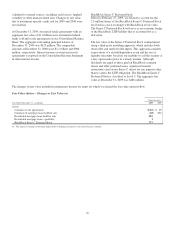

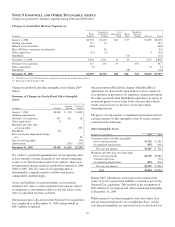

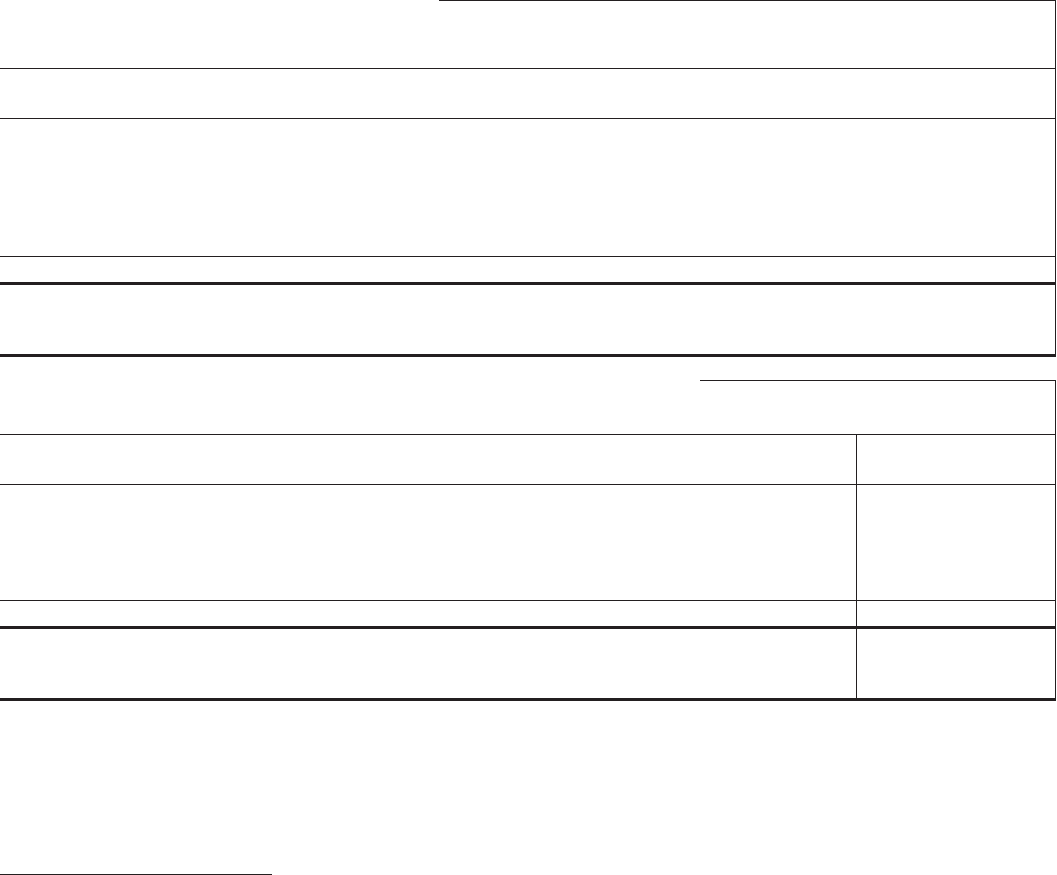

A detailed reconciliation of available for sale, trading securities and equity investments measured at fair value on a recurring basis

using Level 3 inputs for the year ended December 31, 2009 follows.

Level 3 Instruments Only

In millions

Residential

mortgage-

backed

agency

Residential

mortgage-

backed

non-agency

Commercial

mortgage-

backed

non-agency

Asset-

backed

State and

municipal

Other

debt

Corporate

stocks

and other

Total

available

for sale

securities

December 31, 2008 $3,304 $ 337 $ 833 $271 $ 34 $58 $ 4,837

National City acquisition $ 7 899 59 50 48 1,063

January 1, 2009 7 4,203 337 892 321 82 58 5,900

Total realized/unrealized gains or losses:

Included in earnings (**) (444) (6) (104) (9) (563)

Included in other comprehensive income (2) 616 627 (22) (2) 4 (6) 1,215

Purchases, issuances, and settlements, net (713) (253) (37) (23) (19) (5) (1,050)

Transfers into Level 3, net 4,640 (699) 525 (30) (5) 4,431

December 31, 2009 $ 5 $8,302 $ 6 $1,254 $266 $ 53 $47 $ 9,933

(**) Amounts attributable to unrealized gains or losses

related to available for sale securities held at

December 31, 2009: $ (444) $ (6) $ (104) $ (9) $ (563)

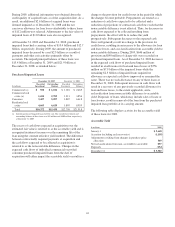

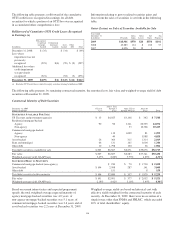

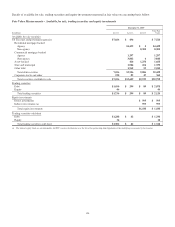

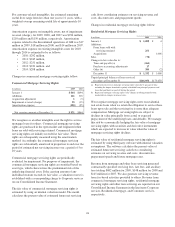

Level 3 Instruments Only

In millions

Trading

securities

debt

Trading

securities

equity

Equity

investments -

direct

Equity

investments -

indirect

December 31, 2008 $56 $ 17 $322 $249

National City acquisition 26 6 287 323

January 1, 2009 82 23 609 572

Total realized/unrealized gains or losses:

Included in earnings (**) (3) 1 (24) (20)

Purchases, issuances, and settlements, net 8 (20) 10 41

Transfers into Level 3, net 2 (4)

December 31, 2009 $89 $— $595 $593

(**) Amounts attributable to unrealized gains or losses

related to trading securities and equity investments held at

December 31, 2009: $ (33) $ (19)

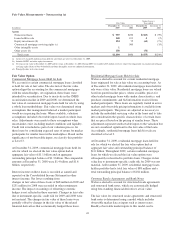

Interest income earned from trading securities totaled $61

million for 2009, $116 million for 2008 and $116 million for

2007. These amounts are included in other interest income on

the Consolidated Income Statement.

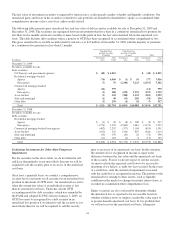

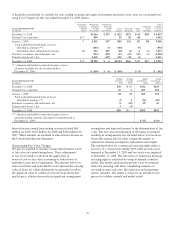

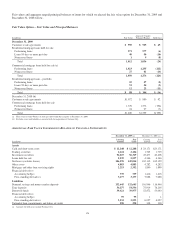

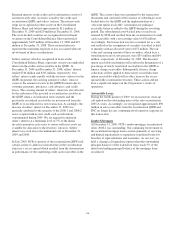

Nonrecurring Fair Value Changes

We may be required to measure certain other financial assets

at fair value on a nonrecurring basis. These adjustments

to fair value usually result from the application of

lower-of-cost-or-fair value accounting or write-downs of

individual assets due to impairment. The amounts below for

nonaccrual loans and loans held for sale represent the carrying

value of loans for which adjustments are primarily based on

the appraised value of collateral or based on an observable

market price, which often results in significant management

assumptions and input with respect to the determination of fair

value. The fair value determination of the equity investment

resulting in an impairment loss included below was based on

observable market data for other comparable entities as

adjusted for internal assumptions and unobservable inputs.

The amounts below for commercial servicing rights reflect a

recovery of a certain strata during 2009 while no strata were

impaired at December 31, 2009 and two strata were impaired

at December 31, 2008. The fair value of commercial mortgage

servicing rights is estimated by using an internal valuation

model. The model calculates the present value of estimated

future net servicing cash flows considering estimates of

servicing revenue and costs, discount rates and prepayment

speeds. Annually, this model is subject to an internal review

process to validate controls and model results.

121