PNC Bank 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

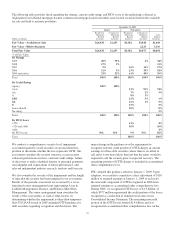

program will remain in effect until fully utilized or until

modified, superseded or terminated. The extent and timing of

share repurchases under this program will depend on a number

of factors including, among others, market and general

economic conditions, economic and regulatory capital

considerations, alternative uses of capital, regulatory and

contractual limitations, and the potential impact on our credit

ratings. We did not purchase any shares during 2009 under

this program.

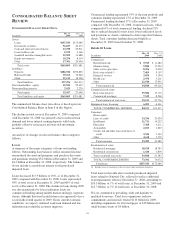

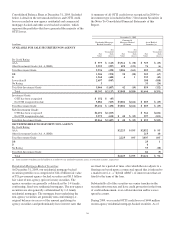

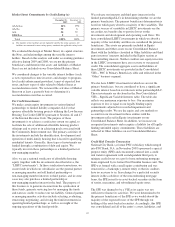

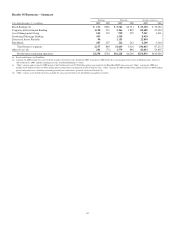

Risk-Based Capital

Dollars in millions

Dec. 31

2009

Dec. 31

2008

Capital components

Shareholders’ equity

Common $ 21,967 $ 17,490

Preferred 7,975 7,932

Trust preferred capital securities 2,996 2,898

Noncontrolling interests 1,611 1,506

Goodwill and other intangible assets (10,652) (9,800)

Eligible deferred income taxes on

goodwill and other intangible assets 738 594

Pension, other postretirement benefit

plan adjustments 542 666

Net unrealized securities losses,

after-tax 1,575 3,618

Net unrealized losses (gains) on cash

flow hedge derivatives, after-tax (166) (374)

Other (63) (243)

Tier 1 risk-based capital 26,523 24,287

Subordinated debt 5,356 5,676

Eligible allowance for credit losses 2,934 3,153

Total risk-based capital $ 34,813 $ 33,116

Tier 1 common capital

Tier 1 risk-based capital $ 26,523 $ 24,287

Preferred equity (7,975) (7,932)

Trust preferred capital securities (2,996) (2,898)

Noncontrolling interests (1,611) (1,506)

Tier 1 common capital $ 13,941 $ 11,951

Assets

Risk-weighted assets, including off-

balance sheet instruments and market

risk equivalent assets $232,257 $251,106

Adjusted average total assets 263,103 138,689

Capital ratios

Tier 1 risk-based 11.4% 9.7%

Tier 1 common 6.0 4.8

Total risk-based 15.0 13.2

Leverage 10.1 17.5

Federal banking regulators have stated that they expect all

bank holding companies to have a level and composition of

Tier 1 capital well in excess of the 4% regulatory minimum,

and they have required the largest US bank holding

companies, including PNC, to have a capital buffer sufficient

to withstand losses and allow them to meet credit needs of

their customers through the economic downturn. They have

also stated their view that common equity should be the

dominant form of Tier 1 capital. As a result, regulators are

now emphasizing the Tier 1 common capital ratio in their

evaluation of bank holding company capital levels, although

this metric is not provided for in the regulations. We seek to

manage our capital consistent with these regulatory principles,

and believe that our year-end capital levels were aligned with

them. Actions that we have taken since year-end that increase

our Tier 1 common capital ratio on a pro forma basis are

described below.

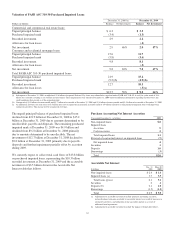

Capital levels were strengthened during 2009. Higher capital

levels were net of dividend payments including $332 million

paid to the US Department of the Treasury during 2009 on

$7.6 billion of preferred stock. See Repurchase of Outstanding

TARP Preferred Stock and Pending Sale of PNC Global

Investment Servicing in the Executive Summary section of

Item 7. Our Tier 1 risk-based capital ratio and our Tier 1

common capital ratio would have been 10.3% and 8.0%,

respectively, at December 31, 2009 had they included the

estimated net impact of the redemption of the outstanding

TARP preferred stock, our February 2010 equity offering

discussed further in the Liquidity Risk Management section of

Item 7, and the pending sale of GIS. We provide a

reconciliation of these ratios reflecting the impact of the

TARP redemption, common equity offering and sale of GIS to

the ratios set forth in the Risk-Based Capital table above in the

Statistical Information (Unaudited) section in Item 8 of this

Report.

PNC’s Tier 1 risk-based capital ratio increased by 170 basis

points to 11.4% at December 31, 2009 from 9.7% at

December 31, 2008. The increase in the ratio was due to

higher risk-based capital primarily from retained earnings and

the May 2009 common equity issuance coupled with a decline

in risk-weighted assets. Our Tier 1 common capital ratio was

6.0% at December 31, 2009 compared with 4.8% at

December 31, 2008.

The leverage ratio at December 31, 2008 reflected the

favorable impact on Tier 1 risk-based capital from the

issuance of securities under TARP and the issuance of PNC

common stock in connection with the National City

acquisition, both of which occurred on December 31, 2008. In

addition, the ratio as of that date did not reflect any impact of

National City on PNC’s adjusted average total assets.

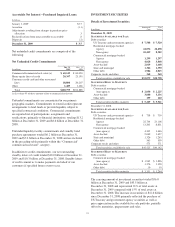

The access to, and cost of, funding new business initiatives

including acquisitions, the ability to engage in expanded

business activities, the ability to pay dividends, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in part, on a financial institution’s capital

strength.

We merged the charter of PNC Bank Delaware into PNC

Bank, N.A. during August 2009 and merged the charter of

National City Bank into PNC Bank, N.A. in November 2009.

39