PNC Bank 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

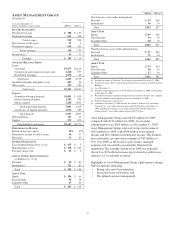

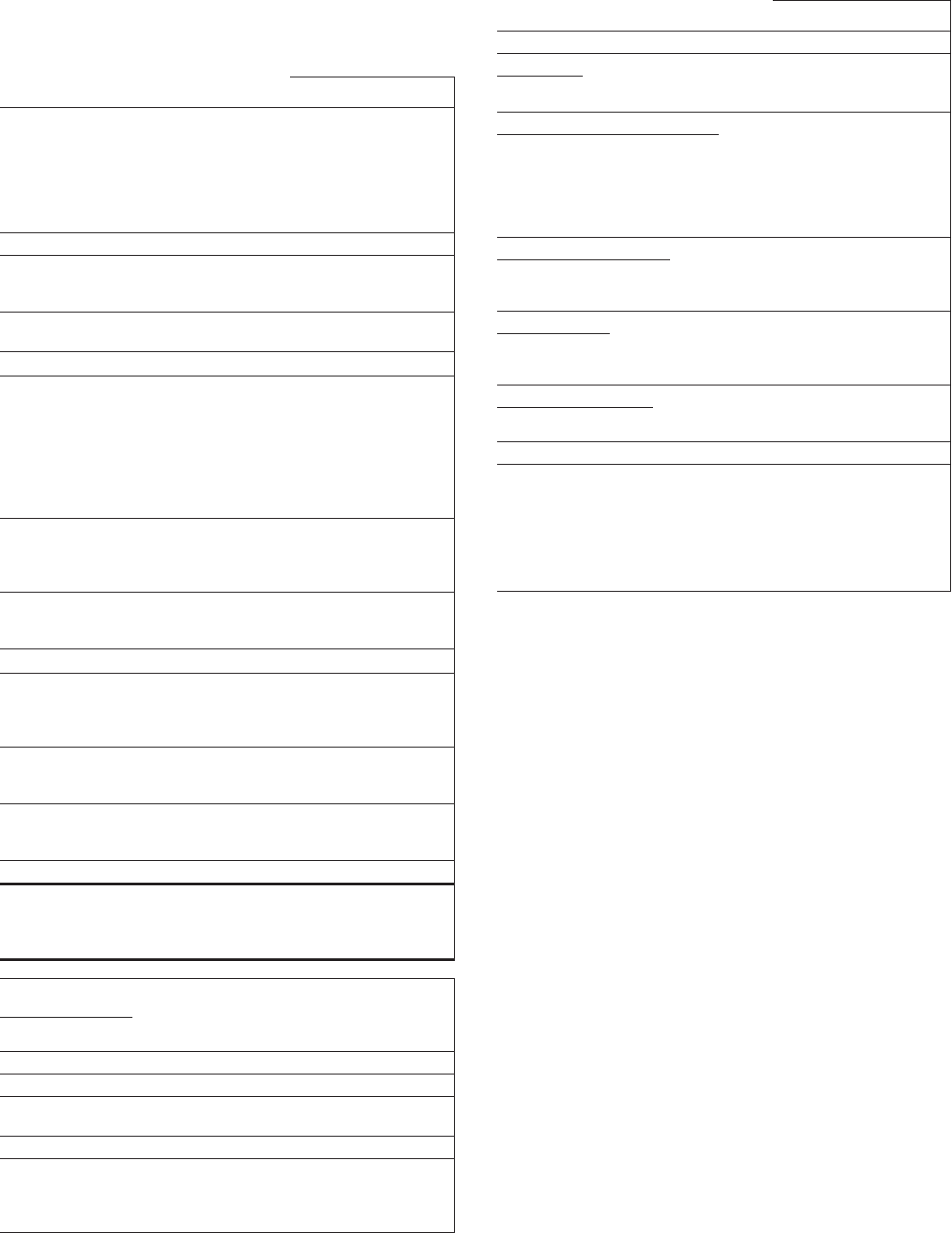

R

ETAIL

B

ANKING

(Unaudited)

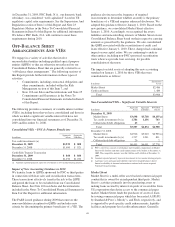

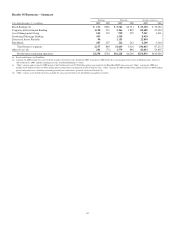

Year ended December 31

Dollars in millions 2009 (a) 2008

I

NCOME

S

TATEMENT

Net interest income $ 3,522 $ 1,594

Noninterest income

Service charges on deposits 930 359

Brokerage 245 152

Consumer services 886 416

Other 138 210

Total noninterest income 2,199 1,137

Total revenue 5,721 2,731

Provision for credit losses 1,330 388

Noninterest expense 4,169 1,789

Pretax earnings 222 554

Income taxes 86 226

Earnings $ 136 $ 328

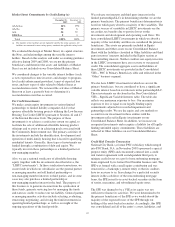

A

VERAGE

B

ALANCE

S

HEET

Loans

Consumer

Home equity $ 27,403 $13,263

Indirect 4,036 2,050

Education 5,625 2,012

Credit cards 2,239 264

Other consumer 1,791 468

Total consumer 41,094 18,057

Commercial and commercial real estate 12,306 5,029

Floor plan 1,264 992

Residential mortgage 2,064 2,029

Total loans 56,728 26,107

Goodwill and other intangible assets 5,842 5,192

Other assets 2,750 1,623

Total assets $ 65,320 $32,922

Deposits

Noninterest-bearing demand $ 16,308 $ 9,191

Interest-bearing demand 18,357 8,073

Money market 39,394 17,220

Total transaction deposits 74,059 34,484

Savings 6,610 2,681

Certificates of deposit 53,145 15,800

Total deposits 133,814 52,965

Other liabilities 51 333

Capital 8,497 3,334

Total liabilities and equity $142,362 $56,632

P

ERFORMANCE

R

ATIOS

Return on average capital 2% 10%

Noninterest income to total revenue 38 42

Efficiency 73 66

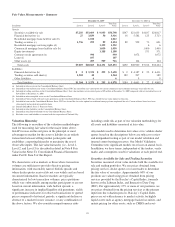

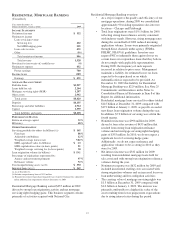

O

THER

I

NFORMATION

(b)

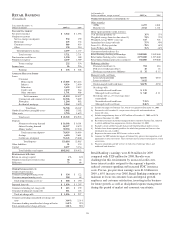

Credit-related statistics:

Commercial nonperforming assets $ 324 $ 122

Consumer nonperforming assets 284 68

Total nonperforming assets (c) $ 608 $ 190

Impaired loans (d) $ 1,056 $ 1,297

Commercial lending net charge-offs $ 415 $ 139

Consumer lending net charge-offs 611 118

Total net charge-offs $ 1,026 $ 257

Commercial lending annualized net charge-off

ratio 3.06% 2.31%

Consumer lending annualized net charge-off ratio 1.42% .59%

Total annualized net charge-off ratio 1.81% .98%

At December 31

Dollars in millions, except as noted 2009 (a) 2008

O

THER

I

NFORMATION

(

CONTINUED

)(b)

Other statistics:

ATMs 6,473 4,041

Branches (e) 2,512 1,141

Home equity portfolio credit statistics:

% of first lien positions (f) 35% 37%

Weighted average loan-to-value ratios (f) 74% 73%

Weighted average FICO scores (g) 727 726

Annualized net charge-off ratio .75% .49%

Loans 30 – 89 days past due .78% .68%

Loans 90 days past due .76% .62%

Customer-related statistics (h):

Retail Banking checking relationships 5,042,000 2,402,000

Retail online banking active customers 2,771,000 1,215,000

Retail online bill payment active customers 766,000 379,000

Brokerage statistics:

Financial consultants (i) 704 414

Full service brokerage offices 40 23

Brokerage account assets (billions) $32 $15

Managed credit card loans:

Loans held in portfolio $2,556 $330

Loans securitized 1,622

Total managed credit card loans $4,178 $330

Net charge-offs:

Securitized credit card loans $ 131

Managed credit card loans $ 340 $11

Net charge-offs as a % of average loans

(annualized):

Securitized credit card loans 7.31%

Managed credit card loans 8.46% 4.17%

(a) Includes the impact of National City, which we acquired on December 31, 2008.

(b) Presented as of December 31 except for net charge-offs and annualized net

charge-off ratios.

(c) Includes nonperforming loans of $597 million at December 31, 2009 and $176

million at December 31, 2008.

(d) Recorded investment of purchased impaired loans related to National City, adjusted

to reflect additional loan impairments effective December 31, 2008.

(e) Excludes certain satellite branches that provide limited products and/or services.

(f) Includes loans from acquired portfolios for which lien position and loan-to-value

information was not available.

(g) Represents the most recent FICO scores we have on file.

(h) Amounts for 2009 include the impact of National City prior to the completion of all

application system conversions. These amounts may be refined subsequent to system

conversions.

(i) Financial consultants provide services in full service brokerage offices and

traditional bank branches.

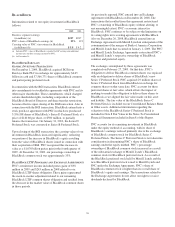

Retail Banking’s earnings were $136 million for 2009

compared with $328 million for 2008. Results were

challenged in this environment by increased credit costs,

lower interest credits assigned to the segment’s deposits,

reduced consumer spending and increased FDIC insurance

costs. Pre-tax, pre-provision earnings were $1.6 billion for

2009, a 65% increase over 2008. Retail Banking continues to

maintain its focus on customer, loan and deposit growth,

employee and customer satisfaction, investing in the business

for future growth, as well as disciplined expense management

during this period of market and economic uncertainty.

50