PNC Bank 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.loss or losses which, in the aggregate, may significantly affect

personnel, property, financial objectives, or our ability to

continue to meet our responsibilities to our various

stakeholder groups.

PNC, through a subsidiary company, Alpine Indemnity

Limited, provides insurance coverage for its general liability,

automobile liability, management liability, fidelity,

employment practices liability, special crime, workers’

compensation, property and terrorism programs. PNC’s risks

associated with its participation as an insurer for these

programs are mitigated through policy limits and annual

aggregate limits. Risks in excess of Alpine’s policy limits and

annual aggregates are mitigated through the purchase of direct

coverage provided by various insurers up to limits established

by PNC’s Corporate Insurance Committee.

L

IQUIDITY

R

ISK

M

ANAGEMENT

Liquidity risk is the risk of potential loss if we were unable to

meet our funding requirements at a reasonable cost. We

manage liquidity risk at the bank and parent company to help

ensure that we can obtain cost-effective funding to meet

current and future obligations under both normal “business as

usual” and stressful circumstances.

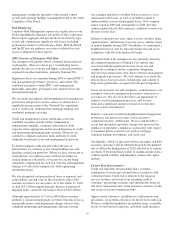

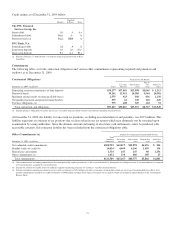

Our largest source of liquidity on a consolidated basis is the

deposit base that comes from our retail and corporate banking

businesses. Other borrowed funds come from a diverse mix of

short and long-term funding sources. Liquid assets and unused

borrowing capacity from a number of sources are also

available to maintain our liquidity position.

Liquid assets consist of short-term investments (Federal funds

sold, resale agreements, trading securities, and interest-earning

deposits with banks) and securities available for sale. At

December 31, 2009, our liquid assets totaled $59.8 billion,

with $23.4 billion pledged as collateral for borrowings, trust,

and other commitments.

Bank Level Liquidity

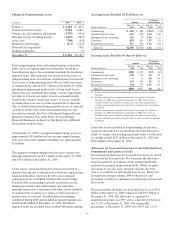

Spot and forward funding gap analyses are the primary metrics

used to measure and monitor bank liquidity risk. Funding gaps

represent the difference in projected sources of liquidity available

to offset projected uses. We calculate funding gaps for the

overnight, thirty day, ninety day, one-hundred eighty day and one

year time intervals. Risk limits are established within the

Liquidity Risk policy. Compliance is regularly reviewed by

management’s Asset and Liability Committee.

PNC Bank, N.A. can borrow from the Federal Reserve Bank

of Cleveland’s (Federal Reserve Bank) discount window to

meet short-term liquidity requirements. These borrowings are

secured by securities and commercial loans. PNC Bank, N.A.

is also a member of the Federal Home Loan Bank (FHLB)-

Pittsburgh and as such has access to advances from FHLB-

Pittsburgh secured generally by residential mortgage and other

mortgage-related loans. At December 31, 2009, our unused

secured borrowing capacity was $26.0 billion with the Federal

Reserve Bank and $9.3 billion with FHLB-Pittsburgh.

Total FHLB borrowings were $10.8 billion at December 31,

2009 compared with $18.1 billion at December 31, 2008.

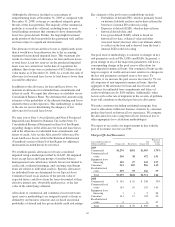

We can also obtain funding through traditional forms of

borrowing, including Federal funds purchased, repurchase

agreements, and short and long-term debt issuances. PNC

Bank, N.A. has the ability to offer up to $20 billion in senior

and subordinated unsecured debt obligations with maturities

of more than nine months. Through December 31, 2009, PNC

Bank, N.A. had issued $6.9 billion of debt under this program.

PNC Bank, N.A. also has the ability to offer up to $3.0 billion

of its commercial paper. As of December 31, 2009, there were

no issuances outstanding under this program.

As of December 31, 2009, there were $6.2 billion of bank

short- and long-term debt issuances with maturities of less

than one year.

In December 2009, as required by the FDIC, we prepaid

deposit insurance assessments covering the period October 1,

2009 through December 31, 2012. The amount of the

prepayment was $1.1 billion. While the resulting prepaid asset

does not require risk-based capital, it impacts our available

bank liquidity.

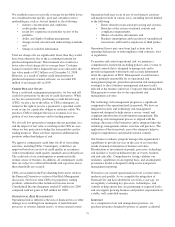

Parent Company Liquidity

Our parent company’s routine funding needs consist primarily

of dividends to PNC shareholders, share repurchases, debt

service, the funding of non-bank affiliates, and acquisitions.

Parent company liquidity guidelines are designed to help

ensure that sufficient liquidity is available to meet our funding

requirements over the succeeding 24-month period. Risk

limits for parent company liquidity are established within the

Enterprise Capital Management Policy. Compliance is

regularly reviewed by the Board of Director’s Joint Risk

Committee.

The principal source of parent company cash flow is the

dividends it receives from its subsidiary bank, which may be

impacted by the following:

• Bank-level capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

Also, there are statutory and regulatory limitations on the

ability of national banks to pay dividends or make other

capital distributions or to extend credit to the parent company

or its non-bank subsidiaries. See Note 23 Regulatory Matters

in the Notes To Consolidated Financial Statements in Item 8

of this Report for a further discussion of these limitations.

71