PNC Bank 2009 Annual Report Download - page 186

Download and view the complete annual report

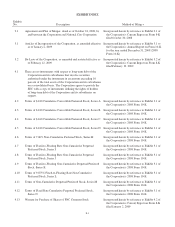

Please find page 186 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10.3 Amendment 2009-1 to the Corporation’s Supplemental Executive

Retirement Plan as amended and restated as of January 1, 2009

Filed herewith*

10.4 The Corporation’s ERISA Excess Pension Plan, as amended and

restated

Incorporated herein by reference to Exhibit 10.2 of

the Corporation’s 2nd Quarter 2004 Form 10-Q*

10.5 The Corporation’s ERISA Excess Pension Plan, as amended and

restated effective January 1, 2009

Incorporated herein by reference to Exhibit 10.4 to

the Corporation’s 2008 Form 10-K*

10.6 Amendment 2009-1 to the Corporation’s ERISA Excess Plan as

amended and restated as of January 1, 2009

Filed herewith*

10.7 The Corporation’s Key Executive Equity Program, as amended

and restated

Incorporated herein by reference to Exhibit 10.3 of

the Corporation’s 2nd Quarter 2004 Form 10-Q*

10.8 The Corporation’s Key Executive Equity Program, as amended

and restated effective January 1, 2009

Incorporated herein by reference to Exhibit 10.6 to

the Corporation’s 2008 Form 10-K*

10.9 Amendment 2009-1 to the Corporation’s Key Executive Equity

Program as amended and restated as of January 1, 2009

Filed herewith*

10.10 The Corporation’s Supplemental Incentive Savings Plan, as

amended and restated

Incorporated herein by reference to Exhibit 10.4 of

the Corporation’s 2nd Quarter 2004 Form 10-Q*

10.11 The Corporation’s Supplemental Incentive Savings Plan, as

amended and restated effective January 1, 2009

Incorporated herein by reference to Exhibit 4.3 to

the Registration Statement on Form S-8 filed by

the Corporation on January 22, 2009*

10.12 The Corporation’s Supplemental Incentive Savings Plan, as

amended and restated May 5, 2009

Incorporated herein by reference to Exhibit 10.61

to the Corporation’s Quarterly Report on Form

10-Q for the quarter ended June 30, 2009 (2nd

Quarter 2009 Form 10-Q)*

10.13 Amendment 2009-1 to the Corporation’s Supplemental Incentive

Savings Plan, as amended and restated May 5, 2009

Filed herewith*

10.14 The Corporation and Affiliates Deferred Compensation Plan, as

amended and restated

Incorporated herein by reference to Exhibit 10.7 of

the Corporation’s 2nd Quarter 2004 Form 10-Q*

10.15 The Corporation and Affiliates Deferred Compensation Plan, as

amended and restated effective January 1, 2009

Incorporated herein by reference to Exhibit 4.5 to

the Registration Statement on Form S-8 filed by

the Corporation on January 22, 2009*

10.16 The Corporation and Affiliates Deferred Compensation Plan, as

amended and restated May 5, 2009

Incorporated herein by reference to Exhibit 10.62 to

the Corporation’s 2nd Quarter 2009 Form 10-Q*

10.17 Amendment 2009-1 to the Corporation and Affiliates Deferred

Compensation Plan, as amended and restated May 5, 2009

Filed herewith*

10.18 AJCA transition amendments to the Corporation’s Supplemental

Incentive Savings Plan and the Corporation and Affiliates

Deferred Compensation Plan

Incorporated herein by reference to Exhibit 10.8 of

the Corporation’s Annual Report on Form 10-K

for the year ended December 31, 2005 (2005

Form 10-K)*

10.19 Further AJCA transition amendments to the Corporation and

Affiliates Deferred Compensation Plan

Incorporated herein by reference to Exhibit 10.12

to the Corporation’s 2008 Form 10-K*

10.20 The Corporation’s 2006 Incentive Award Plan, as amended and

restated

Incorporated herein by reference to Exhibit 10.53

of the Corporation’s Quarterly Report on Form

10-Q for the quarter ended March 31, 2008*

10.21 The Corporation’s 1997 Long-Term Incentive Award Plan, as

amended and restated

Incorporated herein by reference to Exhibit 10.5 of

the Corporation’s 2nd Quarter 2004 Form 10-Q*

E-3