PNC Bank 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

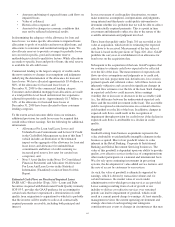

R

ESIDENTIAL

M

ORTGAGE

B

ANKING

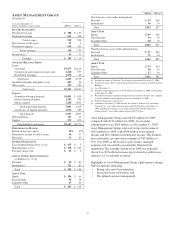

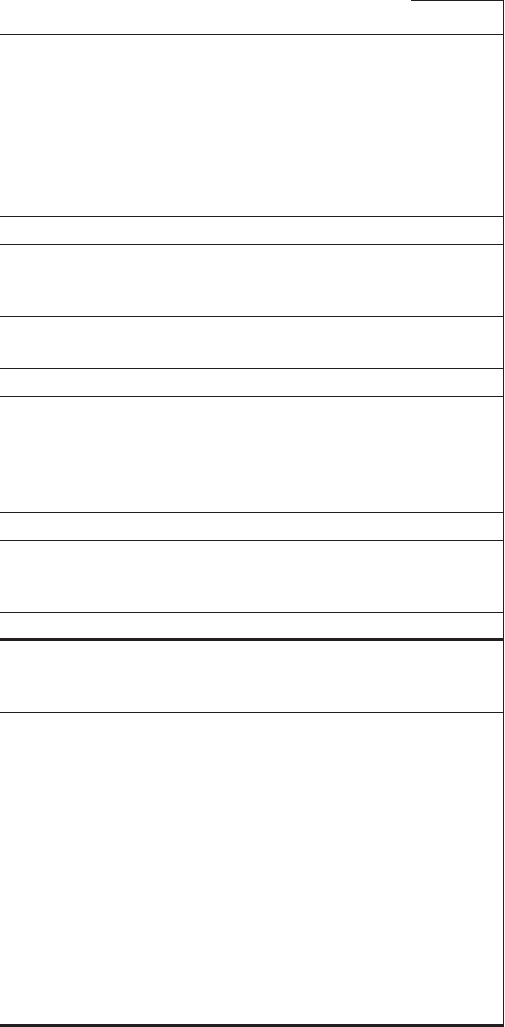

(Unaudited)

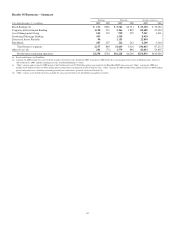

Year ended December 31

Dollars in millions, except as noted 2009

I

NCOME

S

TATEMENT

Net interest income $ 332

Noninterest income

Loan servicing revenue

Servicing fees 222

Net MSR hedging gains 355

Loan sales revenue 435

Other (16)

Total noninterest income 996

Total revenue 1,328

Provision for (recoveries of) credit losses (4)

Noninterest expense 632

Pretax earnings 700

Income taxes 265

Earnings $ 435

A

VERAGE

B

ALANCE

S

HEET

Portfolio loans $1,957

Loans held for sale 2,204

Mortgage servicing rights (MSR) 1,297

Other assets 2,962

Total assets $8,420

Deposits $4,135

Borrowings and other liabilities 2,924

Capital 1,359

Total liabilities and equity $8,418

P

ERFORMANCE

R

ATIOS

Return on average capital 32%

Efficiency 48%

O

THER

I

NFORMATION

Servicing portfolio for others (in billions) (a) $ 145

Fixed rate 88%

Adjustable rate/balloon 12%

Weighted average interest rate 5.82%

MSR capitalized value (in billions) $ 1.3

MSR capitalization value (in basis points) 91

Weighted average servicing fee (in basis points) 30

Loan origination volume (in billions) $ 19.1

Percentage of originations represented by:

Agency and government programs 97%

Refinance volume 72%

Total nonperforming assets (a) (b) $ 370

Impaired loans (a) (c) $ 369

(a) As of December 31.

(b) Includes nonperforming loans of $215 million.

(c) Recorded investment of purchased impaired loans related to National City, adjusted to

reflect additional loan impairments effective December 31, 2008.

Residential Mortgage Banking earned $435 million in 2009

driven by strong loan origination activity and net mortgage

servicing rights hedging gains. This business segment consists

primarily of activities acquired with National City.

Residential Mortgage Banking overview:

• As a step to improve the quality and efficiency of our

mortgage operations, during 2009 we consolidated

approximately 90 existing operations sites into two

locations – Chicago and Pittsburgh.

• Total loan originations were $19.1 billion for 2009,

reflecting strong loan refinance activity consistent

with industry trends. However, rising mortgage rates

during the second half of 2009 reduced incoming

application volume. Loans were primarily originated

through direct channels under agency (FNMA,

FHLMC, FHA/VA) guidelines. Investors may

request PNC to indemnify them against losses on

certain loans or to repurchase loans that they believe

do not comply with applicable representations.

During 2009, the frequency of such requests

increased in relation to prior years. Management

maintains a liability for estimated losses on loans

expected to be repurchased or on which

indemnification is expected to be provided. At

December 31, 2009 this liability for Residential

Mortgage Banking was $229 million. See Note 25

Commitments and Guarantees in the Notes to

Consolidated Financial Statements in Item 8 of this

Report for additional information.

• Residential mortgage loans serviced for others totaled

$145 billion at December 31, 2009 compared with

$173 billion at January 1, 2009, as payoffs exceeded

new direct loan origination volume during the year.

In addition, $7.9 billion of servicing was sold in the

fourth quarter.

• Noninterest income was $996 million for 2009,

driven by loan sales revenue of $435 million that

resulted from strong loan origination refinance

volume and net mortgage servicing rights hedging

gains of $355 million. In 2010, we do not expect a

significant level of servicing hedge gains.

Additionally, we do not expect refinance and

application volumes to be as strong in 2010 as they

were for 2009.

• Net interest income was $332 million for 2009

resulting from residential mortgage loans held for

sale associated with strong loan origination refinance

volumes during the year.

• Noninterest expense was $632 million for 2009 and

included incremental staffing costs associated with

strong origination volumes and an increased focus on

loan underwriting and loss mitigation activities.

• The carrying value of mortgage servicing rights was

$1.3 billion at December 31, 2009 compared with

$1.0 billion at January 1, 2009. The increase was

primarily attributable to a higher fair value of the

asset resulting from lower prepayment expectations

due to rising interest rates during the period.

57