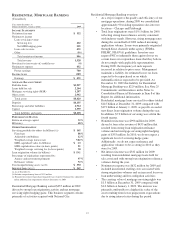

PNC Bank 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management, testing the operation of the internal control

system and reporting findings to management and to the Audit

Committee of the Board.

Risk Monitoring

Corporate Risk Management reports on a regular basis to our

Board regarding the enterprise risk profile of the Corporation.

These reports aggregate and present the level of risk by type

of risk and communicate significant risk issues, including

performance relative to risk tolerance limits. Both the Board

and the EC provide guidance on actions to address key risk

issues as identified in these reports.

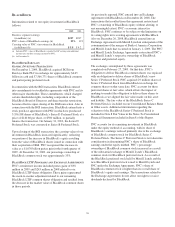

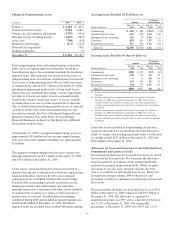

2009 Overview of Enterprise-Wide Risk

Our enterprise risk profile reflects continued deterioration in

credit quality, albeit at a slower pace. Contributing factors

include the adverse economy and higher credit risk portfolios

acquired from other institutions, primarily National City.

Significant effort was expended during 2009 to embed PNC’s

risk management governance, processes, and culture. The

combined enterprise is under PNC’s risk management

philosophy, principles, governance and corporate-level risk

management program.

We also made investments and strengthened risk management

governance and practices in areas where we did not have a

significant presence prior to the National City acquisition,

such as credit card, residential first mortgage lending, and

residential mortgage servicing.

Credit risk management actions undertaken across the

combined enterprise include further refinement of

underwriting standards, continued reductions in credit

exposure where appropriate and increased frequency of credit

risk monitoring and management activities. However, we

continue to originate and renew loans and lines of credit

within the boundaries of our risk management framework.

To further mitigate credit risk and reduce the pace of

deterioration, we continue to exit certain lending areas and

liquidate certain loan portfolios. Where we have chosen not to

retain the risk, it is either because it did not fit within our

desired moderate risk profile, or because we are not being

adequately compensated for such risk. Our exit and liquidation

strategy is to effectively mitigate risk while optimizing

shareholder return.

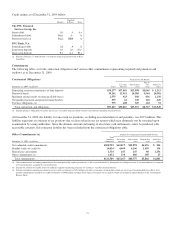

We also designated certain purchased loans as impaired, and

reduced their carrying value to the net present value of the

amounts we believe we can collect. As of December 31, 2009,

we had $15.2 billion unpaid principal balance of purchased

impaired loans, carried on our balance sheet at $10.3 billion.

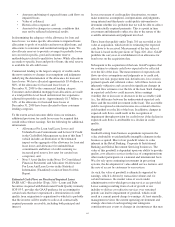

Although approximately 11% of our $56 billion securities

portfolio is sub-investment grade, we believe the risk of loss is

manageable given credit impairment charges taken to date,

continued monitoring and management, and stress testing.

Our earnings enabled us to further bolster reserves to cover

anticipated credit losses, as well as strengthen capital to

further insulate us from unanticipated losses. New common

equity issued in 2009 and subsequently in 2010, provides

cushion against the risk that economic conditions worsen over

the next several years.

Relative to the prior two years, there was less volatility in the

capital markets, stabilization of security prices, and the return

of market liquidity during 2009. Nonetheless we maintained a

heightened sense of alert by reducing market risk and are in

compliance with all of our market risk limits.

Operational risk at the enterprise level is primarily driven by

the continued integration of National City and the risks

associated with the significant increase in our size and

complexity resulting from this acquisition. Integration

objectives have been met to date, due to effective management

and integration governance. We will continue to evaluate the

effectiveness of key processes, technologies and controls to

help assure performance at expected levels post-integration.

Given our increased size and complexity, modifications to our

enterprise-wide risk management governance and practices

are in process. We also view Basel II as an opportunity to

enhance our risk management practices, and we have

dedicated a significant amount of resources for the next

several years to this initiative.

Industry events have resulted in heightened risk management

governance and practices in areas such as incentive

compensation plans. Additionally, the pace and breadth of

recent and anticipated regulatory changes has increased our

emphasis on regulatory compliance, particularly with respect

to consumer products and services such as mortgage,

consumer lending, investments, and credit card.

Our liquidity, which we increased with recent equity and debt

issuances and expect will be further bolstered by the planned

sale of GIS in the third quarter of 2010, allowed us to redeem

our Series N Preferred Stock within 14 months and provides a

cushion should volatility and illiquidity return to the capital

markets.

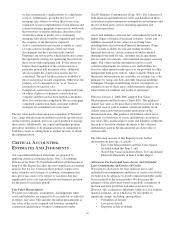

C

REDIT

R

ISK

M

ANAGEMENT

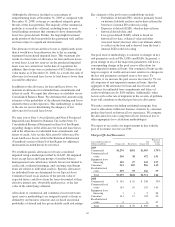

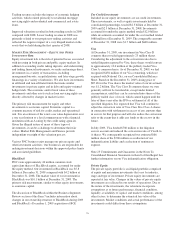

Credit risk represents the possibility that a customer,

counterparty or issuer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities, and entering into financial

derivative transactions and certain guarantee contracts. Credit

risk is one of our most significant risks.

Approved risk tolerances, in addition to credit policies and

procedures, set portfolio objectives for the level of credit risk.

We have established guidelines for problem loans, acceptable

levels of total borrower exposure, and other credit measures.

66