PNC Bank 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

rates and prepayment speeds could affect the future values of

MSRs. Hedging results can frequently be volatile in the short

term, but over longer periods of time are expected to protect

the economic value of the MSR portfolio.

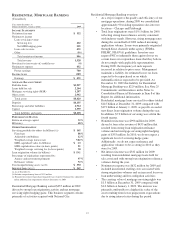

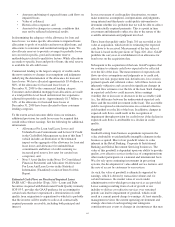

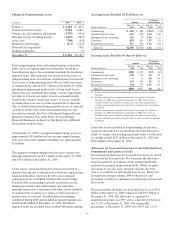

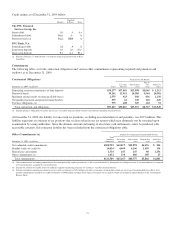

The fair value of residential MSRs and significant inputs to

the valuation model as of December 31, 2009 are shown in the

table below. The expected and actual rates of mortgage loan

prepayments are the most significant factors driving the fair

value. Management uses an internal proprietary model to

estimate future loan prepayments. This model uses empirical

data drawn from the historical performance of our managed

portfolio, as adjusted for current market conditions. Future

interest rates are another important factor in the valuation of

MSRs. Management utilizes market implied forward interest

rates to estimate the future direction of mortgage and discount

rates. The forward rates utilized are derived from the current

yield curve for US dollar interest rate swaps and are consistent

with pricing of capital markets instruments. Changes in the

shape and slope of the forward curve in future periods may

result in volatility in the fair value estimate.

Dollars in millions

December 31

2009

Fair value $1,332

Weighted-average life (in years) 4.5

Weighted-average constant prepayment rate 19.92%

Spread over forward interest rate swap rates 12.16%

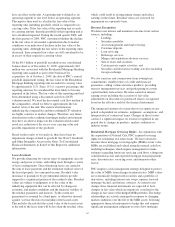

A sensitivity analysis of the hypothetical effect on the fair

value of MSRs to adverse changes in key assumptions is

presented below. Changes in fair value generally cannot be

extrapolated because the relationship of the change in the

assumption to the change in fair value may not be linear. Also,

the effect of a variation in a particular assumption on the fair

value of the MSRs is calculated independently without

changing any other assumption. In reality, changes in one

factor may result in changes in another (for example, changes

in mortgage interest rates, which drive changes in prepayment

rate estimates, could result in changes in the interest rate

spread), which could either magnify or counteract the

sensitivities.

Dollars in millions

December 31

2009

Prepayment rate:

Decline in fair value from 10% adverse change $56

Decline in fair value from 20% adverse change $109

Spread over forward interest rate swap rates:

Decline in fair value from 10% adverse change $55

Decline in fair value from 20% adverse change $106

Income Taxes

In the normal course of business, we and our subsidiaries enter

into transactions for which the tax treatment is unclear or

subject to varying interpretations. In addition, filing

requirements, methods of filing and the calculation of taxable

income in various state and local jurisdictions are subject to

differing interpretations.

We evaluate and assess the relative risks and merits of the

appropriate tax treatment of transactions, filing positions,

filing methods and taxable income calculations after

considering statutes, regulations, judicial precedent, and other

information, and maintain tax accruals consistent with our

evaluation of these relative risks and merits. The result of our

evaluation and assessment is by its nature an estimate. We and

our subsidiaries are routinely subject to audit and challenges

from taxing authorities. In the event we resolve a challenge for

an amount different than amounts previously accrued, we will

account for the difference in the period in which we resolve

the matter.

Additional information regarding our Critical Accounting

Policies and Judgments is found elsewhere in this Item 7 and

in the Notes To Consolidated Financial Statements in Item 8

of this Report.

R

ECENT

A

CCOUNTING

P

RONOUNCEMENTS

See Note 1 Accounting Policies in the Notes To Consolidated

Financial Statements in Item 8 of this Report for information

on new accounting pronouncements that were effective in

2008, 2009 or became effective on January 1, 2010.

In addition, the following Accounting Standards Update

(ASU) was issued in early 2010:

• In January 2010, the FASB issued ASU 2010-6, Fair

Value Measurements and Disclosures (Topic 820),

Improving Disclosures About Fair Value

Measurements. This guidance provides amendments

to require new disclosures as follows: transfers in and

out of Levels 1 and 2 and the reasons for the

transfers, and additional breakout of asset and

liability categories. This guidance will be effective

for PNC for the first quarter 2010 reporting. This

guidance also requires purchases, sales, issuances and

settlements to be reported separately in the Level 3

rollforward. This additional guidance will be

effective for PNC beginning with the first quarter

2011 reporting.

S

TATUS

O

F

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

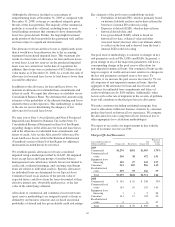

We have a noncontributory, qualified defined benefit pension

plan (plan or pension plan) covering eligible employees.

Benefits are derived from cash balance formulas based on

compensation levels, age and length of service. Pension

contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

Consistent with our investment strategy, plan assets are

primarily invested in equity investments and fixed income

instruments. Plan fiduciaries determine and review the plan’s

63