PNC Bank 2009 Annual Report Download - page 58

Download and view the complete annual report

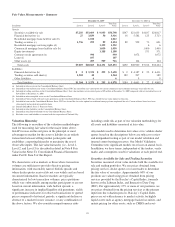

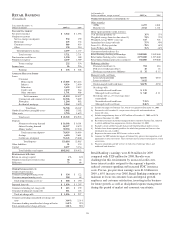

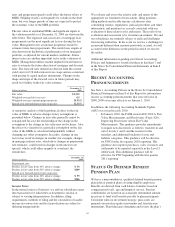

Please find page 58 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Other noninterest income was $518 million for 2009, an

increase of $565 million from 2008 primarily due to the

National City acquisition.

• Operating lease revenues were $106 million in 2009,

largely due to the National City acquisition. The

combined leasing operations are the 5th largest bank-

affiliated leasing company.

• Valuation and sale income related to our commercial

mortgage loans held for sale, net of hedges, were

$107 million in 2009 compared with losses of $197

million in 2008. Inventory carried at fair value at

December 31, 2009 was $1.1 billion, reduced from

$1.4 billion at December 31, 2008.

• Gains on sales of loans related to our portfolio

management activities were $95 million in 2009. We

sold approximately $1.4 billion of commitments

during 2009.

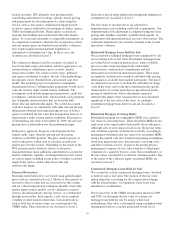

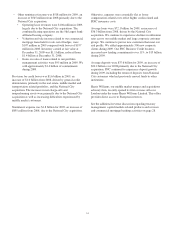

Provision for credit losses was $1.6 billion in 2009, an

increase of $1.0 billion from 2008, driven by general credit

deterioration, primarily in the real estate, middle market and

transportation related portfolios, and the National City

acquisition. The increases in net charge-offs and

nonperforming assets were primarily due to the National City

acquisition as well as increasing difficulties experienced by

middle market customers.

Noninterest expense was $1.8 billion for 2009, an increase of

$855 million from 2008, due to the National City acquisition.

Otherwise, expenses were essentially flat as lower

compensation-related costs offset higher credit-related and

FDIC insurance costs.

Average loans were $72.1 billion for 2009, an increase of

$36.3 billion from 2008, driven by the National City

acquisition. We continue to experience declines in utilization

rates across our middle market and large corporate customer

groups. We continue to pursue new customers that meet our

risk profile. We added approximately 500 new corporate

clients during 2009. Our PNC Business Credit business

increased new lending commitments over 11%, to $15 billion,

during 2009.

Average deposits were $37.6 billion for 2009, an increase of

$20.2 billion over 2008 primarily due to the National City

acquisition. PNC continued to experience deposit growth

during 2009, including the return of deposits from National

City customers who had previously moved funds to other

institutions.

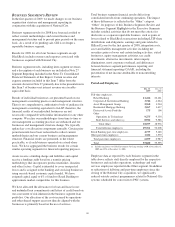

Harris Williams, our middle market merger and acquisitions

advisory firm, recently opened its first overseas office in

London under the name Harris Williams Limited. This office

provides direct access to European investors.

See the additional revenue discussion regarding treasury

management, capital markets-related products and services,

and commercial mortgage banking activities on page 28.

54