PNC Bank 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTES

T

O

C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

T

HE

PNC F

INANCIAL

S

ERVICES

G

ROUP

,I

NC

.

B

USINESS

PNC is one of the largest diversified financial services

companies in the United States and is headquartered in

Pittsburgh, Pennsylvania.

PNC has businesses engaged in retail banking, corporate and

institutional banking, asset management, residential mortgage

banking and global investment servicing, providing many of

its products and services nationally and others in PNC’s

primary geographic markets located in Pennsylvania, Ohio,

New Jersey, Michigan, Maryland, Illinois, Indiana, Kentucky,

Florida, Missouri, Virginia, Delaware, Washington, D.C., and

Wisconsin. PNC also provides certain investment servicing

internationally.

As described in Note 1 Accounting Policies and Note 2

Acquisitions and Divestitures, PNC acquired National City

Corporation (National City) on December 31, 2008.

N

OTE

1A

CCOUNTING

P

OLICIES

B

ASIS

O

F

F

INANCIAL

S

TATEMENT

P

RESENTATION

Our consolidated financial statements include the accounts of

the parent company and its subsidiaries, most of which are

wholly owned, and certain partnership interests and variable

interest entities.

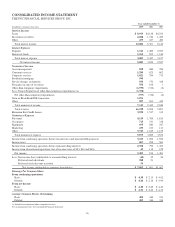

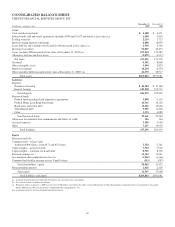

We acquired National City on December 31, 2008. Our

Consolidated Balance Sheet as of December 31, 2009 and

2008 and other information as of and subsequent to

December 31, 2008 included in these consolidated financial

statements reflects the impact of National City. Also, the

Consolidated Income Statement for all years presented and

related Notes to Consolidated Financial Statements reflect the

global investment servicing business as discontinued

operations. See Note 2 Acquisitions and Divestitures.

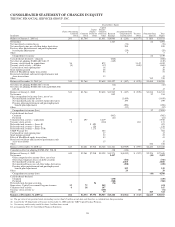

We prepared these consolidated financial statements in

accordance with accounting principles generally accepted in

the United States of America. We have eliminated

intercompany accounts and transactions. We have also

reclassified certain prior year amounts to conform with the

2009 presentation, including reclassifications required in

connection with the adoption of new guidance impacting the

accounting and reporting of noncontrolling interests in

consolidated financial statements. These reclassifications did

not have a material impact on our consolidated financial

condition or results of operations.

Effective July 1, 2009, the Financial Accounting Standards

Board (FASB) issued Statement of Financial Accounting

Standards No. (SFAS) 168, “The FASB Accounting Standards

Codification TM and the Hierarchy of Generally Accepted

Accounting Principles—a replacement of FASB Statement

No. 162.” The FASB Accounting Standards CodificationTM

(FASB ASC) is the single source of authoritative

nongovernmental generally accepted accounting principles

(GAAP) in the United States of America. The FASB ASC was

effective for financial statements that cover interim and annual

periods ending after September 15, 2009. Technical references

to GAAP included in these Notes To Consolidated Financial

Statements are provided under the new FASB ASC structure.

We have considered the impact on these consolidated

financial statements of events occurring subsequent to

December 31, 2009.

U

SE

O

F

E

STIMATES

We prepare the consolidated financial statements using

financial information available at the time, which requires us

to make estimates and assumptions that affect the amounts

reported. Our most significant estimates pertain to our

allowance for loan and lease losses, impaired loans, fair value

measurements, including security valuations and residential

mortgage servicing rights, and revenue recognition. Actual

results may differ from the estimates and the differences may

be material to the consolidated financial statements.

I

NVESTMENT IN

B

LACK

R

OCK

,I

NC

.

We account for our investment in the common stock, Series B

and Series D Preferred Stocks of BlackRock (both deemed to

be in substance common stock) under the equity method of

accounting. On January 31, 2010, the Series D Preferred Stock

was converted to Series B Preferred Stock. The investment in

BlackRock is reflected on our Consolidated Balance Sheet in

the caption Equity investments, while our equity in earnings

of BlackRock is reported on our Consolidated Income

Statement in the caption Asset management.

On February 27, 2009, PNC’s obligation to deliver BlackRock

common shares in connection with BlackRock’s long-term

incentive plan programs was replaced with an obligation to

deliver shares of BlackRock’s new Series C Preferred Stock.

The 2.9 million shares of Series C Preferred Stock were

acquired from BlackRock in exchange for common shares on

that same date. Since these preferred shares were not deemed

to be in substance common stock, we elected to account for

these preferred shares at fair value and the changes in fair

value will offset the impact of marking-to-market the

obligation to deliver these shares to BlackRock. Our

investment in the BlackRock Series C Preferred Stock is

included on the Consolidated Balance Sheet in the caption

Other assets.

92