PNC Bank 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

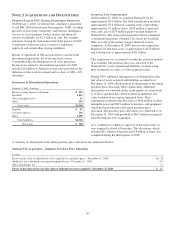

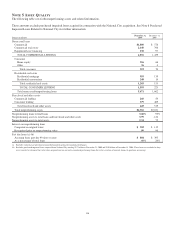

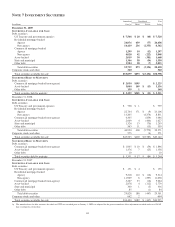

Condensed Statement of National City Net Assets

Acquired

The following condensed statement of net assets reflects the

revised values assigned to National City net assets as of the

December 31, 2008 acquisition date. The net assets acquired

are net of the cash paid by National City to its warrant holders

of $379 million.

In millions

Assets

Cash and due from banks $ 2,144

Federal funds sold and resale agreements 7,335

Trading assets, interest-earning deposits with banks,

and other short-term investments 9,244

Loans held for sale 2,185

Investment securities 13,327

Net loans 95,919

Other intangible assets 2,266

Equity investments 2,001

Other assets 13,665

Total assets $148,086

Liabilities

Deposits $103,594

Federal funds purchased and repurchase agreements 3,523

Other borrowed funds 22,138

Other liabilities 13,724

Total liabilities $142,979

Net assets acquired $ 5,107

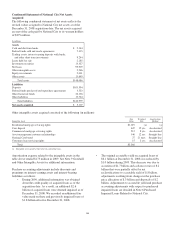

Other intangible assets acquired consisted of the following (in millions):

Intangible Asset

Fair

Value

Weighted

Life

Amortization

Method

Residential mortgage servicing rights $1,019 (a) (a)

Core deposit 647 12 yrs. Accelerated

Commercial mortgage servicing rights 212 8 yrs. Accelerated

Asset management customer relationships 346 12 yrs. Straight-line

National City brand 27 21 mos. Straight-line

Consumer loan servicing rights 15 2 yrs. Accelerated

Total $2,266

(a) Intangible asset carried at fair value on a recurring basis.

Amortization expense related to the intangible assets in the

table above totaled $173 million in 2009. See Note 9 Goodwill

and Other Intangible Assets for additional information.

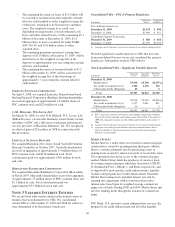

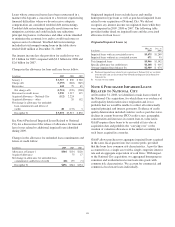

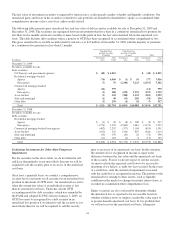

Purchase accounting adjustments include discounts and

premiums on interest-earning assets and interest-bearing

liabilities as follows:

• During 2009, additional information was obtained

about the credit quality of acquired loans as of the

acquisition date. As a result, an additional $2.6

billion of acquired loans were deemed impaired as of

December 31, 2008. We recorded an additional fair

value mark on these and previously impaired loans of

$1.8 billion effective December 31, 2008.

• The original accretable yield on acquired loans of

$6.1 billion at December 31, 2008 was reduced by

$1.0 billion during 2009. This decrease was due to

accretion of $1.7 billion and cash recoveries of $.2

billion that were partially offset by net

reclassifications to accretable yield of $.8 billion,

adjustments resulting from changes in the purchase

price allocation of $.3 billion and disposals of $.2

billion. Adjustments to accretable yield and purchase

accounting adjustments with respect to purchased

impaired loans are detailed in Note 6 Purchased

Impaired Loans Related to National City.

104