PNC Bank 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

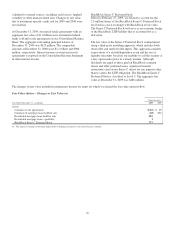

validated to external sources, including yield curves, implied

volatility or other market related data. Changes in fair value

due to instrument-specific credit risk for 2009 and 2008 were

not material.

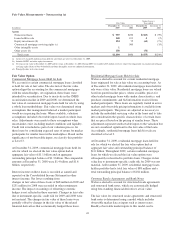

At December 31, 2009, structured resale agreements with an

aggregate fair value of $1.0 billion were included in federal

funds sold and resale agreements on our Consolidated Balance

Sheet. The aggregate outstanding principal balance at

December 31, 2009 was $925 million. The comparable

amounts at December 31, 2008 were $1.1 billion and $980

million, respectively. Interest income on structured resale

agreements is reported on the Consolidated Income Statement

in other interest income.

BlackRock Series C Preferred Stock

Effective February 27, 2009, we elected to account for the

2.9 million shares of the BlackRock Series C Preferred Stock

received in a stock exchange with BlackRock at fair value.

The Series C Preferred Stock will serve as an economic hedge

of the BlackRock LTIP liability that is accounted for as a

derivative.

The fair value of the Series C Preferred Stock is determined

using a third-party modeling approach, which includes both

observable and unobservable inputs. This approach considers

expectations of a default/liquidation event and the use of

liquidity discounts based on our inability to sell the security at

a fair, open market price in a timely manner. Although

dividends are equal to those paid on BlackRock common

shares and other preferred series, significant transfer

restrictions exist on our Series C shares for any purpose other

than to satisfy the LTIP obligation. The BlackRock Series C

Preferred Stock is classified as Level 3. The aggregate fair

value at December 31, 2009 was $486 million.

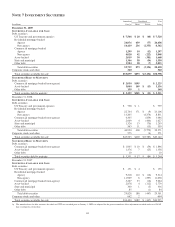

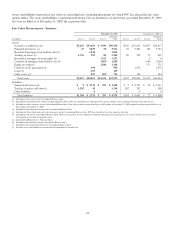

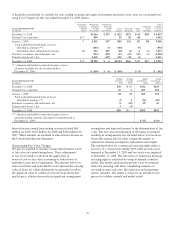

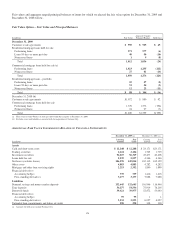

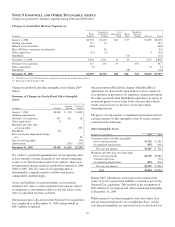

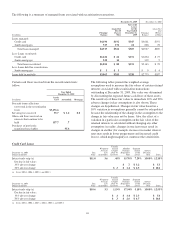

The changes in fair value included in noninterest income for items for which we elected the fair value option follow.

Fair Value Option – Changes in Fair Value (a)

Gains (Losses)

Year Ended December 31 - in millions 2009 2008

Assets

Customer resale agreements $ (26) $69

Commercial mortgage loans held for sale (68) (251)

Residential mortgage loans held for sale 405

Residential mortgage loans—portfolio 1

BlackRock Series C Preferred Stock 275

(a) The impact on earnings of offsetting hedged items or hedging instruments is not reflected in these amounts.

123