PNC Bank 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As part of the National City acquisition, PNC assumed

liability for the conversion of $1.4 billion of convertible senior

notes. Interest on these notes is payable semiannually at a

fixed rate of 4.0%. The maturity date of these notes is

February 1, 2011. PNC may not redeem these notes prior to

their maturity date. Holders may convert the notes, at their

option, prior to November 15, 2010 under certain

circumstances, including (i) if the trading price of the notes is

less than a defined threshold measured against the market

value of PNC common stock, (ii) any time after March 31,

2008, if the market price of PNC common stock exceeds

130% of the conversion price of the notes in effect on the last

trading day of the immediately preceding calendar quarter, or

(iii) upon the occurrence of certain specific events. After

November 15, 2010, the holders may convert their notes at

any time through the third scheduled trading date preceding

the maturity date. The initial conversion rate equals 2.0725

shares per $1,000 face value of notes. The conversion rate will

be subject to adjustment for stock splits, stock dividends, cash

dividends in excess of certain thresholds, stock repurchases

where the price exceeds market values, and certain other

events. Upon conversion, PNC will pay cash equal to the

principal balance of the notes and may issue shares of its

common stock for any conversion value, determined over a

40 day observation period, that exceeds the principal balance

of the notes being converted. The maximum number of net

common shares that PNC may be required to issue is

3.6 million shares, subject to potential adjustment in the case

of certain events, make-whole fundamental changes, or early

termination.

The holders of the convertible senior notes may elect: i) in the

case of a make-whole fundamental change, to convert the

notes prior to the effective time of such change, in which case

the conversion rate will be increased as provided by a formula

set forth in the indenture supplement governing the

convertible senior notes; or ii) upon the effective time of any

fundamental change, to require PNC to repurchase the

convertible senior notes at their principal amount plus accrued

but unpaid interest. Generally, a fundamental change includes

an acquisition of more than 50% of PNC’s common stock,

certain mergers, consolidations or other business

combinations, if PNC’s continuing directors are less than the

majority of the Board of Directors, a liquidation or

dissolution, or PNC’s common stock is not listed on any

US national securities exchange. These rights may discourage

a business combination or other transaction that is otherwise

favored by certain shareholders.

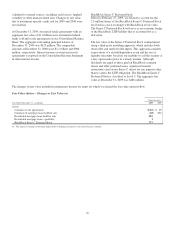

The $3.0 billion of junior subordinated debt included in the

above table represents the only debt redeemable prior to

maturity. The call price and related premiums are discussed in

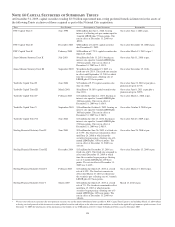

Note 14 Capital Securities of Subsidiary Trusts.

133