PNC Bank 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

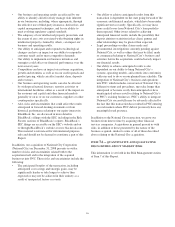

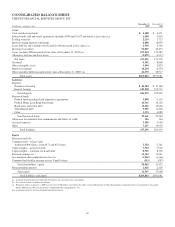

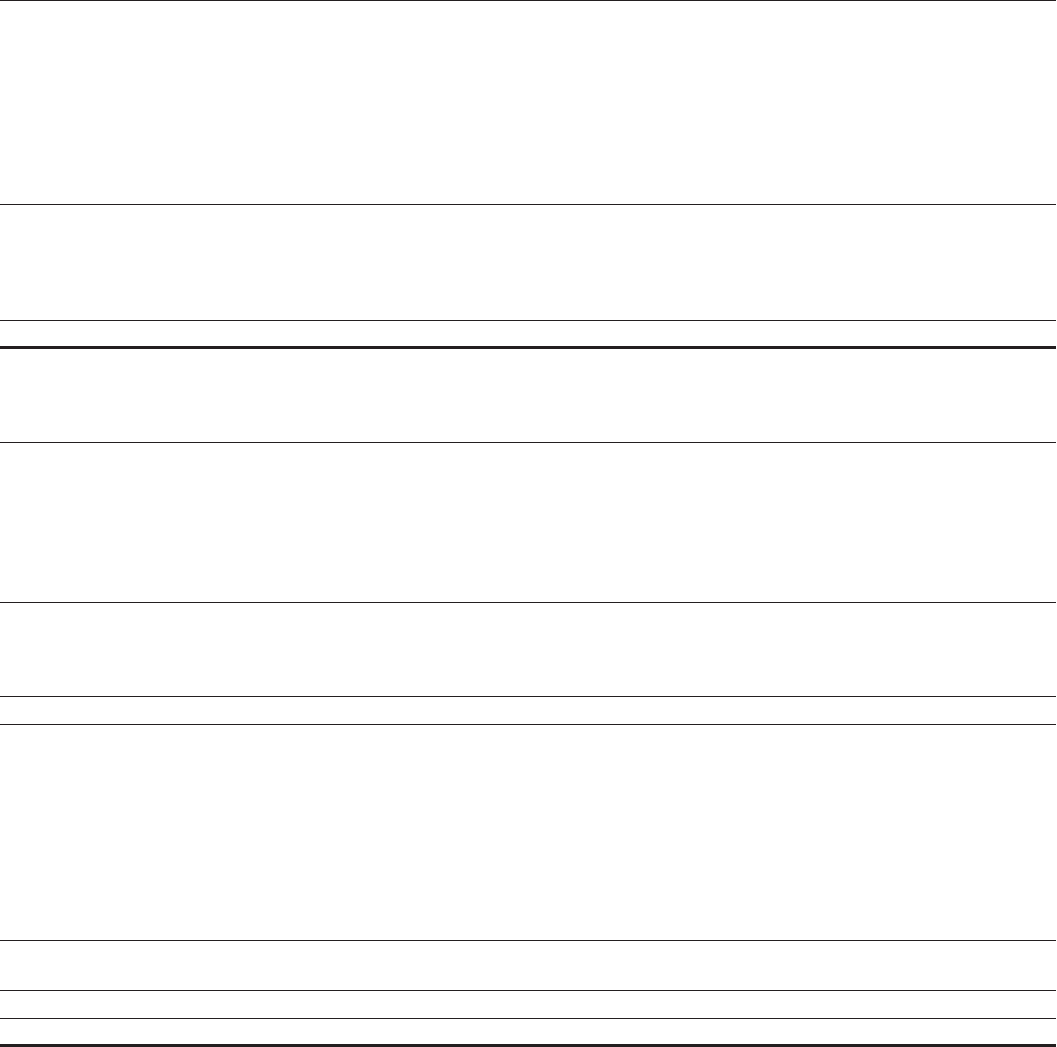

CONSOLIDATED BALANCE SHEET

THE PNC FINANCIAL SERVICES GROUP, INC.

In millions, except par value

December 31

2009

December 31

2008

Assets

Cash and due from banks $ 4,288 $ 4,471

Federal funds sold and resale agreements (includes $990 and $1,072 measured at fair value) (a) 2,390 1,856

Trading securities 2,124 1,725

Interest-earning deposits with banks 4,488 14,859

Loans held for sale (includes $2,062 and $1,400 measured at fair value) (a) 2,539 4,366

Investment securities 56,027 43,473

Loans (includes $88 measured at fair value at December 31, 2009) (a) 157,543 175,489

Allowance for loan and lease losses (5,072) (3,917)

Net loans 152,471 171,572

Goodwill 9,505 8,868

Other intangible assets 3,404 2,820

Equity investments 10,254 8,554

Other (includes $486 measured at fair value at December 31, 2009) (a) 22,373 28,517

Total assets $269,863 $291,081

Liabilities

Deposits

Noninterest-bearing $ 44,384 $ 37,148

Interest-bearing 142,538 155,717

Total deposits 186,922 192,865

Borrowed funds

Federal funds purchased and repurchase agreements 3,998 5,153

Federal Home Loan Bank borrowings 10,761 18,126

Bank notes and senior debt 12,362 13,664

Subordinated debt 9,907 11,208

Other 2,233 4,089

Total borrowed funds 39,261 52,240

Allowance for unfunded loan commitments and letters of credit 296 344

Accrued expenses 3,590 3,949

Other 7,227 14,035

Total liabilities 237,296 263,433

Equity

Preferred stock (b)

Common stock – $5 par value

Authorized 800 shares, issued 471 and 452 shares 2,354 2,261

Capital surplus – preferred stock 7,974 7,918

Capital surplus – common stock and other 8,945 8,328

Retained earnings (c) 13,144 11,461

Accumulated other comprehensive loss (c) (1,962) (3,949)

Common stock held in treasury at cost: 9 and 9 shares (513) (597)

Total shareholders’ equity 29,942 25,422

Noncontrolling interests 2,625 2,226

Total equity 32,567 27,648

Total liabilities and equity $269,863 $291,081

(a) Amounts represent items for which the Corporation has elected the fair value option.

(b) Par value less than $.5 million at each date.

(c) Retained earnings at January 1, 2009 was increased $110 million representing the after-tax noncredit portion of other-than-temporary impairment losses recognized in net income

during 2008 that has been reclassified to accumulated other comprehensive loss.

See accompanying Notes To Consolidated Financial Statements.

89