PNC Bank 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

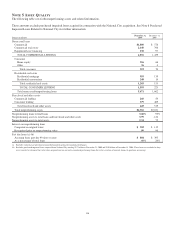

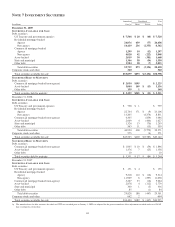

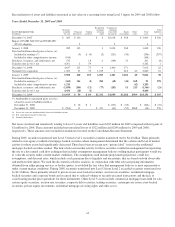

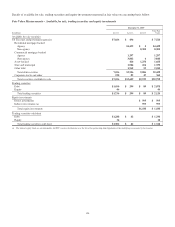

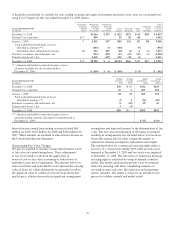

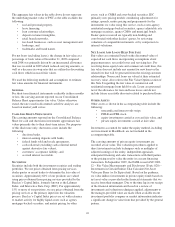

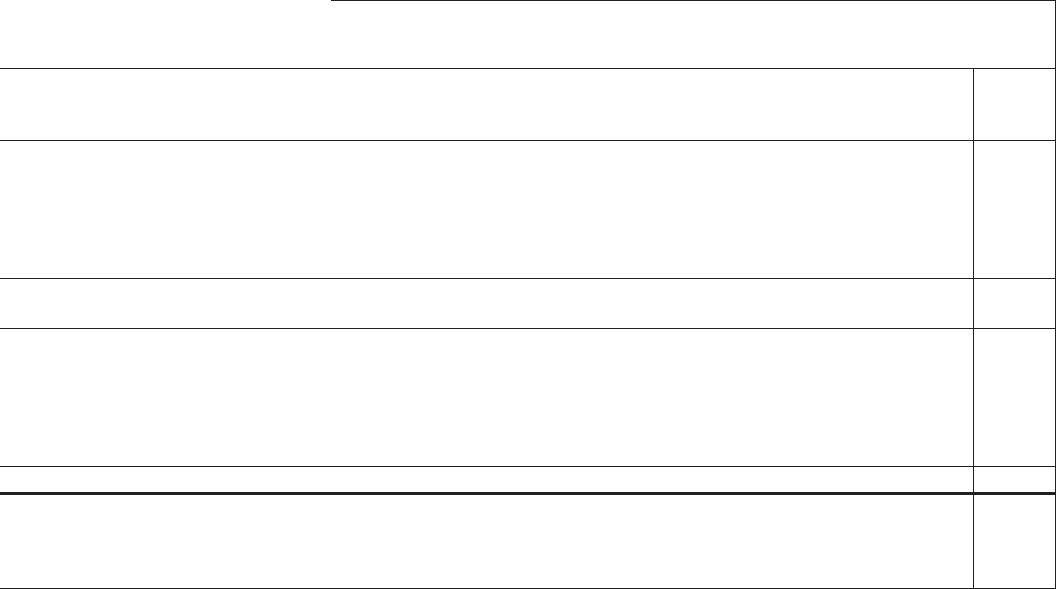

Reconciliations of assets and liabilities measured at fair value on a recurring basis using Level 3 inputs for 2009 and 2008 follow.

Years Ended December 31, 2009 and 2008

Level 3 Instruments Only

In millions

Securities

available

for sale

Financial

derivatives

Trading

securities

Residential

mortgage

servicing

rights

Commercial

mortgage

loans held

for sale (b)

Equity

investments

Other

assets

Total

assets

Total

liabilities

(c)

December 31, 2007 $ 285 $ 130 $ 4 $2,018 $ 568 $ 3,005 $ 326

Impact of FASB ASC 820 and FASB ASC

825-10 adoption 2 2 4

January 1, 2008 285 132 4 2,020 568 3,009 326

Total realized/unrealized gains or losses (a):

Included in earnings (*) (9) $ (4) (2) (251) (30) (296) (297)

Included in other comprehensive income (164) (164)

Purchases, issuances, and settlements, net 515 18 4 (369) 33 201 (8)

Transfers into Level 3, net 4,201 2 59 4,262 1

December 31, 2008 4,837 125 73 6 1,400 571 7,012 22

National City acquisition 1,063 35 32 1,019 1 610 40 2,800 16

January 1, 2009 5,900 160 105 1,025 1,401 1,181 40 9,812 38

Total realized/unrealized gains or losses (a):

Included in earnings (*) (563) 116 (2) 384 (68) (44) 268 91 278

Included in other comprehensive income 1,215 (12) 1,203

Purchases, issuances, and settlements, net (1,050) (206) (12) (77) (283) 51 213 (1,364) (21)

Transfers into Level 3, net 4,431 (20) (2) 4,409

December 31, 2009 $ 9,933 $ 50 $ 89 $1,332 $1,050 $1,188 $509 $14,151 $ 295

(*) Attributable to unrealized gains or losses

related to assets or liabilities held at:

December 31, 2008 $ 16 $ 1 $ (213) $ (50) $ (246) $ (37)

December 31, 2009 $ (563) 11 $ 351 (61) (52) $268 (46) 276

(a) Losses for assets are bracketed while losses for liabilities are not.

(b) Fair value option elected for this item.

(c) Financial derivatives.

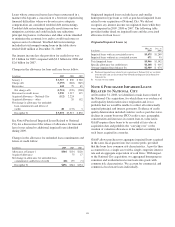

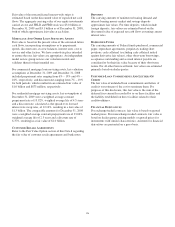

Net losses (realized and unrealized) relating to Level 3 assets and liabilities were $187 million for 2009 compared with net gains of

$1 million for 2008. These amounts included net unrealized losses of $322 million and $209 million for 2009 and 2008,

respectively. These amounts were included in noninterest income on the Consolidated Income Statement.

During 2009, securities transferred into Level 3 from Level 2 exceeded securities transferred out by $4.4 billion. These primarily

related to non-agency residential mortgage-backed securities where management determined that the volume and level of market

activity for these assets had significantly decreased. There have been no recent new “private label” issues in the residential

mortgage-backed securities market. The lack of relevant market activity for these securities resulted in management incorporating

the use of a discounted cash flow technique that includes assumptions management believes willing market participants would use

to value the security under current market conditions. The assumptions used include prepayment projections, credit loss

assumptions, and discount rates, which include a risk premium due to liquidity and uncertainty, that are based on both observable

and unobservable inputs. We used the discounted cash flow analysis, in conjunction with other relevant pricing information

obtained from either pricing services or broker quotes, to establish the fair value that management believes is most representative

under current market conditions. During 2008, securities transferred into Level 3 from Level 2 exceeded securities transferred out

by $4.3 billion. These primarily related to private issuer asset-backed securities, auction rate securities, residential mortgage-

backed securities and corporate bonds and occurred due to reduced volume of recently executed transactions and the lack of

corroborating market price quotations for these instruments. Other Level 3 assets include commercial mortgage loans held for sale,

certain equity securities, auction rate securities, corporate debt securities, trading securities, certain private-issuer asset-backed

securities, private equity investments, residential mortgage servicing rights and other assets.

119