PNC Bank 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTE

25 C

OMMITMENTS AND

G

UARANTEES

E

QUITY

F

UNDING

A

ND

O

THER

C

OMMITMENTS

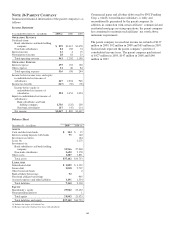

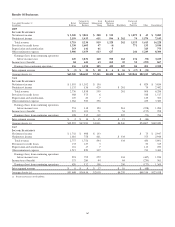

Our unfunded commitments at December 31, 2009 included

private equity investments of $453 million and other

investments of $66 million.

S

TANDBY

L

ETTERS OF

C

REDIT

We issue standby letters of credit and have risk participations

in standby letters of credit and bankers’ acceptances issued by

other financial institutions, in each case to support obligations

of our customers to third parties, such as remarketing

programs for customers’ variable rate demand notes. Net

outstanding standby letters of credit totaled $10.0 billion at

December 31, 2009 and $10.3 billion at December 31, 2008.

Based on PNC’s internal risk rating process for standby letters

of credit as of December 31, 2009, 86% of the net outstanding

balance had internal credit ratings of pass, indicating the

expected risk of loss is currently low compared to 88% as of

December 31, 2008, while 14% of the net outstanding balance

as of December 31, 2009 had internal risk ratings below pass,

indicating a higher degree of risk of default compared to 12%

as of December 31, 2008.

If the customer fails to meet its financial or performance

obligation to the third party under the terms of the contract or

there is a need to support a remarketing program, then upon

the request of the guaranteed party, we would be obligated to

make payment to them. The standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances outstanding on December 31, 2009 had terms

ranging from less than 1 year to 9 years. The aggregate

maximum amount of future payments PNC could be required

to make under outstanding standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances was $13.1 billion at December 31, 2009, of which

$6.1 billion support remarketing programs.

As of December 31, 2009, assets of approximately $1.0 billion

secured certain specifically identified standby letters of credit.

Approximately $3.1 billion in recourse provisions from third

parties was also available for this purpose as of December 31,

2009. In addition, a portion of the remaining standby letters of

credit and letter of credit risk participations issued on behalf

of specific customers is also secured by collateral or

guarantees that secure the customers’ other obligations to us.

The carrying amount of the liability for our obligations related

to standby letters of credit and risk participations in standby

letters of credit and bankers’ acceptances was $270 million at

December 31, 2009.

S

TANDBY

B

OND

P

URCHASE

A

GREEMENTS AND

O

THER

L

IQUIDITY

F

ACILITIES

We enter into standby bond purchase agreements to support

municipal bond obligations. At December 31, 2009, the

aggregate of our commitments under these facilities was $476

million. We also enter into certain other liquidity facilities to

support individual pools of receivables acquired by

commercial paper conduits including Market Street. At

December 31, 2009, our total commitments under these

facilities were $5.7 billion, of which $5.6 billion was related

to Market Street.

I

NDEMNIFICATIONS

We are a party to numerous acquisition or divestiture

agreements under which we have purchased or sold, or agreed

to purchase or sell, various types of assets. These agreements

can cover the purchase or sale of:

• Entire businesses,

• Loan portfolios,

• Branch banks,

• Partial interests in companies, or

• Other types of assets.

These agreements generally include indemnification

provisions under which we indemnify the third parties to these

agreements against a variety of risks to the indemnified parties

as a result of the transaction in question. When PNC is the

seller, the indemnification provisions will generally also

provide the buyer with protection relating to the quality of the

assets we are selling and the extent of any liabilities being

assumed by the buyer. Due to the nature of these

indemnification provisions, we cannot quantify the total

potential exposure to us resulting from them.

We provide indemnification in connection with securities

offering transactions in which we are involved. When we are

the issuer of the securities, we provide indemnification to the

underwriters or placement agents analogous to the

indemnification provided to the purchasers of businesses from

us, as described above. When we are an underwriter or

placement agent, we provide a limited indemnification to the

issuer related to our actions in connection with the offering

and, if there are other underwriters, indemnification to the

other underwriters intended to result in an appropriate sharing

of the risk of participating in the offering. Due to the nature of

these indemnification provisions, we cannot quantify the total

potential exposure to us resulting from them.

161