PNC Bank 2009 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

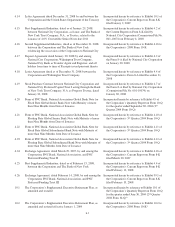

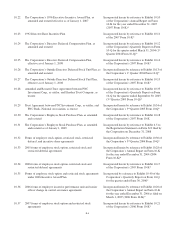

S

UMMARY

O

F

L

OAN

L

OSS

E

XPERIENCE

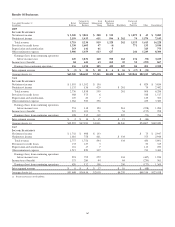

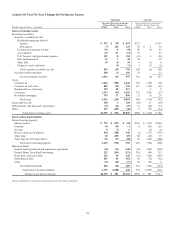

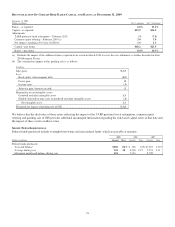

Year ended December 31 - dollars in millions 2009 2008 2007 2006 2005

Allowance for loan and lease losses – January 1 $ 3,917 $ 830 $ 560 $ 596 $ 607

Charge-offs

Commercial (1,276) (301) (156) (108) (52)

Commercial real estate (510) (165) (16) (3) (1)

Equipment lease financing (149) (3) (14) (29)

Consumer (961) (143) (73) (52) (45)

Residential real estate (259) (6) (3) (2)

Total charge-offs (3,155) (618) (245) (180) (129)

Recoveries

Commercial (a) 181 53 30 19 82

Commercial real estate 38 1011 1

Equipment lease financing 27 151

Consumer 105 15 14 15 15

Residential real estate 93

Total recoveries 444 79 45 40 99

Net charge-offs (a) (2,711) (539) (200) (140) (30)

Provision for credit losses (b) 3,930 1,517 315 124 21

Acquired allowance – National City (112) 2,224

Acquired allowance – other 20 152 23

Net change in allowance for unfunded loan commitments and letters of credit 48 (135) 3 (20) (25)

Allowance for loan and lease losses – December 31 $ 5,072 $3,917 $ 830 $ 560 $ 596

Allowance as a percent of December 31:

Loans 3.22% 2.23% 1.21% 1.12% 1.21%

Nonperforming loans 89 236 183 350 299

As a percent of average loans

Net charge-offs (a) 1.64 .74 .32 .28 .06

Provision for credit losses 2.37 2.09 .50 .25 .04

Allowance for loan and lease losses 3.06 5.38 1.33 1.13 1.26

Allowance as a multiple of net charge-offs (a) 1.87x 7.27x 4.15x 4.00x 19.87x

(a) Amounts for 2005 reflect the impact of a $53 million loan recovery in that year. Excluding this recovery, net charge-offs would have been .18% of average loans and the allowance as

a multiple of net charge-offs would have been 7.18x.

(b) Amount for 2008 included a $504 million conforming provision for credit losses related to National City.

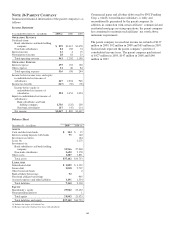

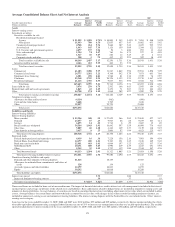

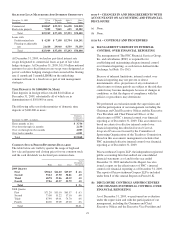

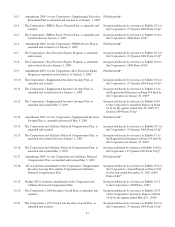

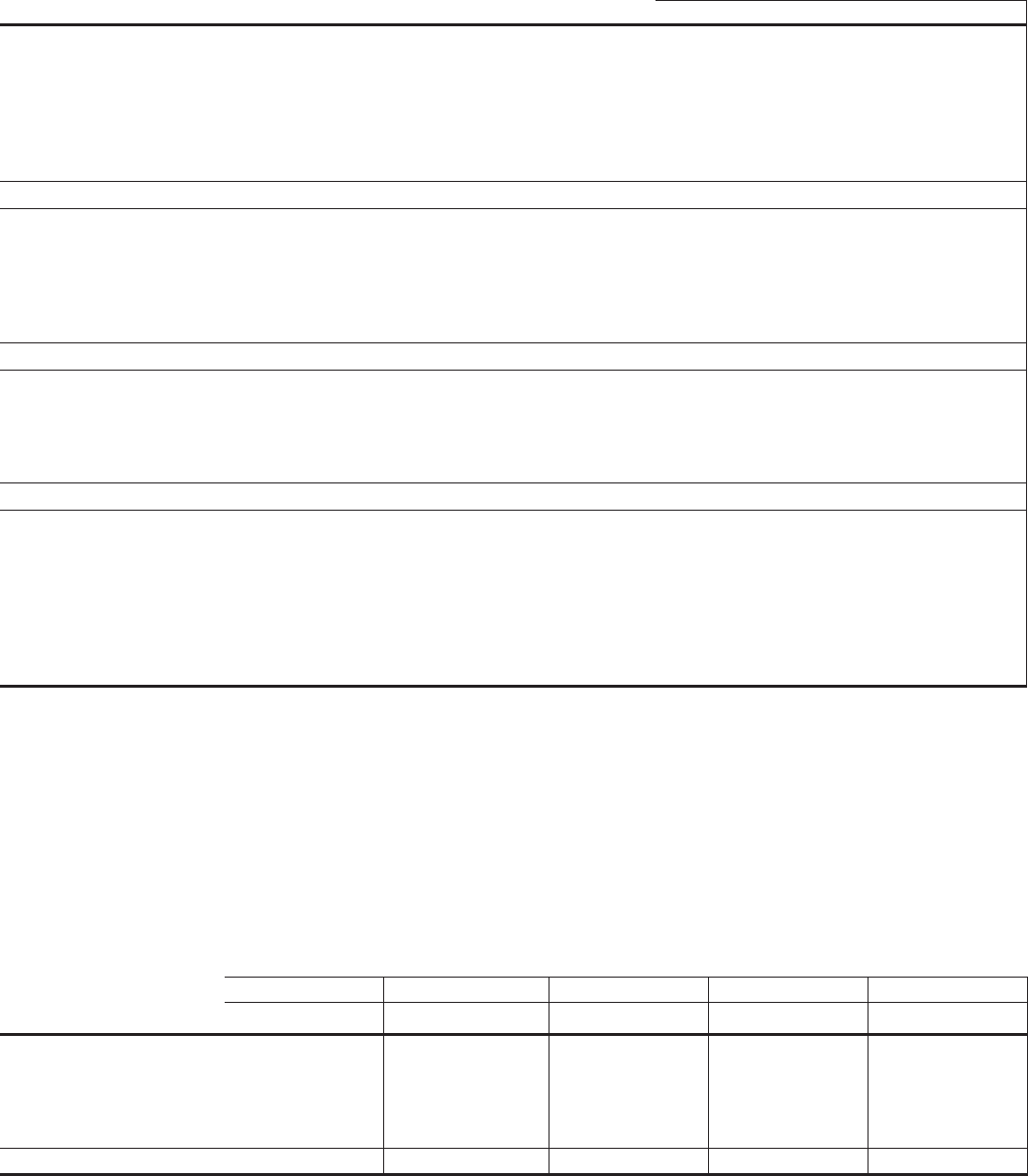

The following table presents the assignment of the allowance for loan and lease losses and the categories of loans as a percentage

of total loans. Changes in the allocation over time reflect the changes in loan portfolio composition, risk profile and refinements to

reserve methodologies. For purposes of this presentation, a portion of the allowance for loan and lease losses has been assigned to

loan categories based on the relative specific and pool allocation amounts to provide coverage for probable losses not covered in

specific, pool and consumer reserve methodologies related to qualitative and measurement factors. At December 31, 2009, the

portion of the reserves for these factors was zero.

A

LLOCATION

O

F

A

LLOWANCE

F

OR

L

OAN AND

L

EASE

L

OSSES

2009 2008 2007 2006 2005

December 31

Dollars in millions Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans

Commercial $1,869 34.8% $1,668 39.4% $564 42.4% $447 41.7% $492 39.9%

Commercial real estate 1,305 14.7 833 14.7 153 13.0 30 7.0 32 6.4

Equipment lease financing 171 3.9 179 3.7 36 3.7 48 5.6 41 5.7

Consumer 957 34.0 929 29.9 68 26.9 28 33.1 24 33.1

Residential real estate 770 12.6 308 12.3 9 14.0 7 12.6 7 14.9

Total $5,072 100.0% $3,917 100.0% $830 100.0% $560 100.0% $596 100.0%

173