PNC Bank 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

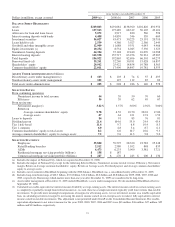

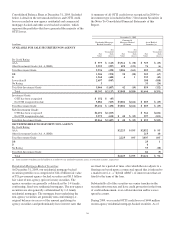

Our Consolidated Income Statement Review and Consolidated

Balance Sheet Review sections of this Item 7 describe in

greater detail the various items that impacted our results for

2009 and 2008.

L

INE OF

B

USINESS

H

IGHLIGHTS

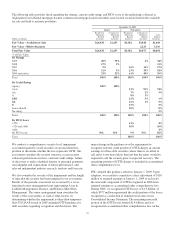

In the first quarter of 2009, we made changes to our business

organization structure and management reporting in

conjunction with the acquisition of National City.

Business segment results for 2008 and 2007 in this Report

have been reclassified to reflect current methodologies and

current business and management structure and to present all

periods on the same basis. As a result of its pending sale, GIS

is no longer a reportable business segment.

Results for 2009 for all of our business segments except

BlackRock reflect the impact of revenues and expenses

associated with businesses acquired with National City.

Highlights of results for 2009 and 2008 are included below.

We refer you to Item 1 of this Report under the captions

Business Overview and Review of Lines of Business for an

overview of our business segments and to the Business

Segments Review section of this Item 7 for a Results Of

Businesses – Summary table and further analysis of business

segment results for 2009 and 2008, including presentation

differences from Note 27 Segment Reporting in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

We provide a reconciliation of total business segment earnings

to PNC consolidated income from continuing operations as

reported on a GAAP basis in Note 27.

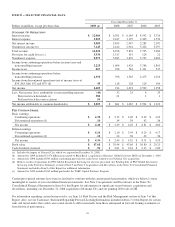

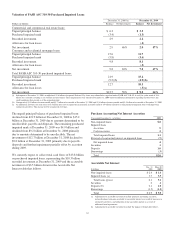

Retail Banking

Retail Banking’s earnings were $136 million for 2009

compared with $328 million for 2008. Results were

challenged in this environment by increased credit costs,

lower interest credits assigned to the segment’s deposits,

reduced consumer spending and increased FDIC insurance

costs. Pre-tax, pre-provision earnings were $1.6 billion for

2009, a 65% increase over 2008. Retail Banking continues to

maintain its focus on customer, loan and deposit growth,

employee and customer satisfaction, investing in the business

for future growth, as well as disciplined expense management

during this period of market and economic uncertainty.

Corporate & Institutional Banking

Corporate & Institutional Banking earned $1.2 billion in 2009

compared with $215 million in 2008. The acquisition of

National City positively impacted operating results as

revenues nearly tripled while noninterest expense

approximately doubled. As a result, operating leverage of $2.6

billion more than offset a $1.0 billion increase in the provision

for credit losses.

Asset Management Group

Asset Management Group earned $105 million for 2009

compared with $119 million for 2008. Asset Management

Group achieved strong total revenue of $919 million, with

$308 million in net interest income and $611 million in

noninterest income. The business increased pretax,

pre-provision earnings by $69 million or 35% over 2008, as

the business grew clients, managed expenses and successfully

executed the National City integration. The earnings decline

from 2008 was primarily driven by a $91 million increase in

provision for credit losses reflective of a weakened economy.

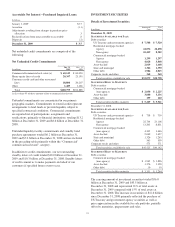

Residential Mortgage Banking

Residential Mortgage Banking earned $435 million in 2009

driven by strong loan origination activity and net mortgage

servicing rights hedging gains. This business segment consists

primarily of activities acquired with National City.

BlackRock

Our BlackRock business segment earned $207 million in both

2009 and 2008. These results reflect our share of BlackRock’s

reported GAAP earnings during both periods and the

additional income taxes on these earnings incurred by PNC.

Distressed Assets Portfolio

The Distressed Assets Portfolio had earnings of $84 million

for 2009. Earnings were largely driven by net interest income

of $1.1 billion. The provision for credit losses was $771

million in 2009, which reflected credit quality deterioration,

particularly in the commercial residential development and

consumer residential construction portfolios. Noninterest

expense was $246 million for 2009, comprised primarily of

costs associated with foreclosed assets and servicing costs.

Other

“Other” earnings were $201 million in 2009 compared with a

loss of $73 million in 2008. Results for 2009 included the

$687 million after-tax impact of the BlackRock/BGI gain

partially offset by the after-tax impact of other-than-temporary

impairment charges and alternative investment writedowns,

integration costs related primarily to the National City

acquisition, a special FDIC assessment, and equity

management losses.

“Other” for 2008 included the impact of integration costs,

including the National City conforming provision for credit

losses, totaling $422 million after taxes. In addition, net

securities losses in 2008 totaled $134 million after taxes.

These factors were partially offset by strong growth in net

interest income related to asset and liability management

activities, a gain related to PNC’s remaining BlackRock long-

term incentive plan programs (LTIP) shares obligation, the

reversal of a legal contingency reserve established in

connection with an acquisition due to a settlement, the partial

reversal of the Visa indemnification liability and the gain from

our sale of Hilliard Lyons.

26