PNC Bank 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

consideration the estimated recovery period and our ability to

hold the equity security until recovery, OTTI is recognized in

earnings equal to the difference between the fair value and the

amortized cost basis of the security.

The security-level assessment is performed on each security,

regardless of the classification of the security as available for

sale or held to maturity. Our assessment considers the security

structure, recent security collateral performance metrics,

external credit ratings, failure of the issuer to make scheduled

interest or principal payments, our judgment and expectations

of future performance, and relevant independent industry

research, analysis and forecasts. We also consider the severity

of the impairment and the length of time the security has been

impaired in our assessment. Results of the periodic assessment

are reviewed by a cross-functional senior management team

representing Asset & Liability Management, Finance, and

Balance Sheet Risk Management. The senior management

team considers the results of the assessments, as well as other

factors, in determining whether the impairment is other-than-

temporary.

For debt securities, a critical component of the evaluation for

OTTI is the identification of credit-impaired securities, where

management does not expect to receive cash flows sufficient

to recover the entire amortized cost basis of the security. The

paragraphs below describe our process for identifying credit

impairment for the security types with the most significant

losses.

Non-Agency Residential Mortgage-Backed Securities and

Asset-Backed Securities Collateralized by First-Lien and

Second-Lien Residential Mortgage Loans

To measure credit losses for these securities, we compile

relevant collateral details and performance statistics on a

security-by-security basis. The securities are then processed

through a series of pre-established filters to identify bonds that

have the potential to be credit impaired.

Securities not passing all of the credit filters are subjected to

further analysis. Cash flows are projected for the underlying

collateral and are applied to the securities according to the

deal structure using a third-party default model. Collateral

cash flows are estimated using assumptions for prepayment

rates, future defaults, and loss severity rates. The assumptions

are security specific and are based on collateral characteristics,

historical performance, and future expected performance.

Based on the results of the cash flow analysis, we determine

whether we will recover the amortized cost basis of our

security.

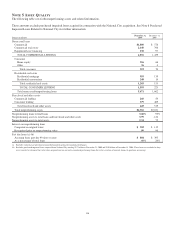

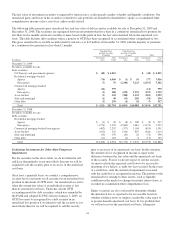

The key assumptions used for assessing credit impairment on

prime and Alt-A non-agency residential mortgage-backed

securities and asset-backed securities collateralized by first

and second-lien residential mortgage loans as of December 31,

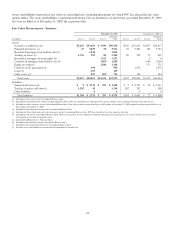

2009 are detailed in the table below.

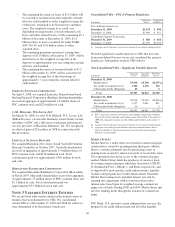

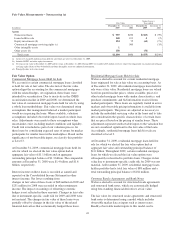

December 31, 2009 Range

Weighted-

average (a)

Long-term prepayment rate (annual CPR)

Prime 7-15% 12%

Alt-A 7-15 9

Remaining collateral expected to default

Prime 0-50% 16%

Alt-A 3-79 42

Loss severity

Prime 15-65% 45%

Alt-A 25-75 58

(a) Calculated by weighting the relevant assumption for each individual security by the

current outstanding cost basis of the security.

Commercial Mortgage-Backed Securities

Credit losses on these securities are measured using property-

level cash flow projections and forward-looking property

valuations. Cash flows are projected using a detailed analysis

of net operating income (NOI) by property type which, in turn,

is based on the analysis of NOI performance over the past

several business cycles combined with PNC’s economic

outlook for the current cycle. Loss severities are based on

property price projections, which are calculated using

capitalization rate projections. The capitalization rate

projections are based on a combination of historical

capitalization rates and expected capitalization rates implied

by current market activity, our outlook and relevant

independent industry research, analysis and forecasts.

Securities exhibiting weaker performance within the model are

subject to further analysis. This analysis is performed at the loan

level, and includes assessing local market conditions, reserves,

occupancy, rent rolls and master/special servicer details.

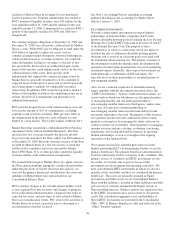

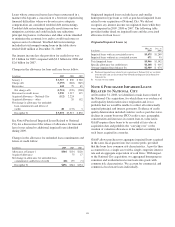

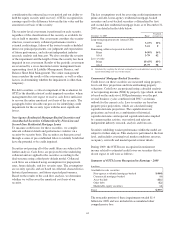

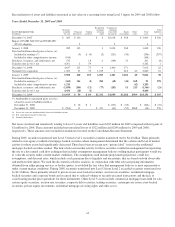

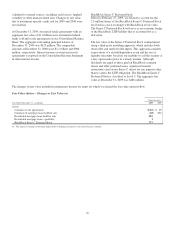

During 2009, the OTTI losses recognized in noninterest

income related to estimated credit losses on securities that we

do not expect to sell were as follows:

Summary of OTTI Losses Recognized in Earnings - 2009

In millions

Available for sale securities:

Non-agency residential mortgage-backed $(444)

Commercial mortgage-backed (6)

Asset-backed (111)

Other debt (12)

Marketable equity securities (4)

Total $(577)

The noncredit portion of these impairments totaled $1.4

billion for 2009 and was included in accumulated other

comprehensive loss.

115