PNC Bank 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

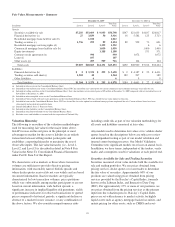

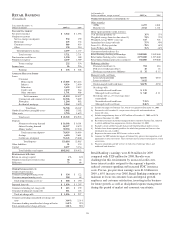

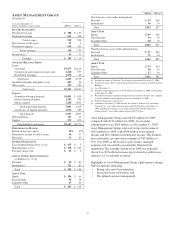

Results Of Businesses – Summary

Year ended December 31 - in millions

Earnings Revenue Average Assets (a)

2009 2008 2009 2008 2009 2008

Retail Banking (b) $ 136 $328 $ 5,721 $2,731 $ 65,320 $ 32,922

Corporate & Institutional Banking 1,190 215 5,266 1,859 84,689 47,050

Asset Management Group 105 119 919 559 7,341 3,001

Residential Mortgage Banking 435 1,328 8,420

Distressed Assets Portfolio 84 1,153 22,844

BlackRock 207 207 262 261 6,249 4,240

Total business segments 2,157 869 14,469 5,410 194,863 87,213

Other (b) (c) (d) 201 (73) 1,579 886 82,013 54,807

Results from continuing operations $2,358 $796 $16,228 $6,296 $276,876 $142,020

(a) Period-end balances for BlackRock.

(b) Amounts for 2009 include the results of the 61 branches divested by early September 2009. Amounts for 2008 reflect the reclassification of the results of Hilliard Lyons, which we

sold on March 31, 2008, and the related gain on sale, from Retail Banking to “Other.”

(c) “Other” earnings and revenue for 2009 include a $687 million after-tax ($1.076 billion pretax) gain related to the BlackRock/BGI transaction and “Other” earnings for 2009 also

includes $274 million of after-tax ($421 million pretax) integration costs primarily related to National City. “Other” earnings for 2008 includes $422 million of after-tax ($649 million

pretax) integration costs, including conforming provision for credit losses, primarily related to National City.

(d) “Other” average assets include securities available for sale associated with asset and liability management activities.

49