PNC Bank 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

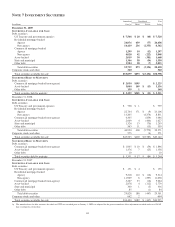

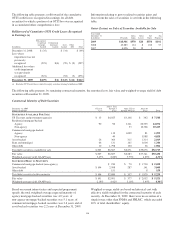

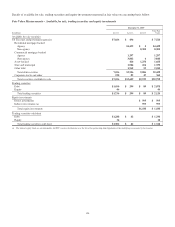

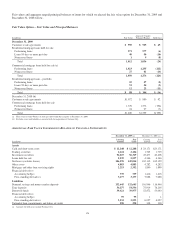

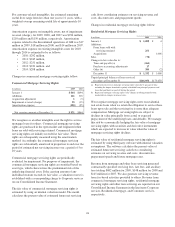

Fair Value Measurements – Nonrecurring (a)

Fair Value

Gains (Losses)

Year ended

In millions

December 31

2009

December 31

2008

December 31

2009

December 31

2008

Assets

Nonaccrual loans $ 939 $250 $(365) $ (99)

Loans held for sale 168 101 4(2)

Equity investments (b) 154 75 (64) (73)

Commercial mortgage servicing rights (c) 560 (35)

Other intangible assets 1

Other assets (d) 138 (50)

Total assets $1,400 $986 $(475) $(209)

(a) All Level 3 except $5 million in loans held for sale which are Level 2 at December 31, 2009.

(b) Includes LIHTC and other equity investments.

(c) No strata at fair value at December 31, 2009 and two strata at December 31, 2008. During 2009, we recorded a $35 million recovery of previous impairment on commercial mortgage

servicing rights. Refer to Note 9 Goodwill and Other Intangible Assets for additional information.

(d) Principally other real estate owned.

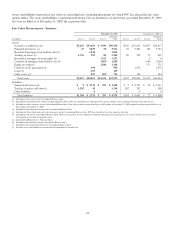

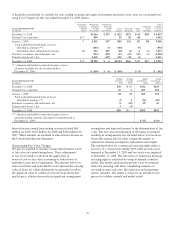

Fair Value Option

Commercial Mortgage Loans Held for Sale

We account for certain commercial mortgage loans classified

as held for sale at fair value. The election of the fair value

option aligns the accounting for the commercial mortgages

with the related hedges. At origination, these loans were

intended for securitization. Due to inactivity in the CMBS

securitization market in 2009 and 2008, we determined the

fair value of commercial mortgage loans held for sale by using

a whole loan methodology. Fair value was determined using

assumptions that management believed a market participant

would use in pricing the loans. When available, valuation

assumptions included observable inputs based on whole loan

sales. Adjustments were made to these assumptions when

uncertainties exist, including market conditions and liquidity.

Credit risk is included as part of our valuation process for

these loans by considering expected rates of return for market

participants for similar loans in the marketplace. Based on the

significance of unobservable inputs, we classify this portfolio

as Level 3.

At December 31, 2009, commercial mortgage loans held for

sale for which we elected the fair value option had an

aggregate fair value of $1.1 billion and an aggregate

outstanding principal balance of $1.3 billion. The comparable

amounts at December 31, 2008 were $1.4 billion and $1.6

billion, respectively.

Interest income on these loans is recorded as earned and

reported on the Consolidated Income Statement in other

interest income. Net losses resulting from

changes in fair value of these loans of $68 million in 2009 and

$251 million for 2008 were recorded in other noninterest

income. The impact on earnings of offsetting economic

hedges is not reflected in these amounts. Changes in fair value

due to instrument-specific credit risk for 2009 and 2008 were

not material. The changes in fair value of these loans were

partially offset by changes in the fair value of the related

financial derivatives that economically hedged these loans.

Residential Mortgage Loans Held for Sale

We have elected to account for certain residential mortgage

loans originated for sale at fair value on a recurring basis. As

of December 31, 2009, all residential mortgage loans held for

sale were at fair value. Residential mortgage loans are valued

based on quoted market prices, where available, prices for

other traded mortgage loans with similar characteristics, and

purchase commitments and bid information received from

market participants. These loans are regularly traded in active

markets and observable pricing information is available from

market participants. The prices are adjusted as necessary to

include the embedded servicing value in the loans and to take

into consideration the specific characteristics of certain loans

that are priced based on the pricing of similar loans. These

adjustments represent unobservable inputs to the valuation but

are not considered significant to the fair value of the loans.

Accordingly, residential mortgage loans held for sale are

classified as Level 2.

At December 31, 2009, residential mortgage loans held for

sale for which we elected the fair value option had an

aggregate fair value and outstanding principal balance of

$1.0 billion. Throughout 2009, certain residential mortgage

loans for which we elected the fair value option were

subsequently reclassified to portfolio loans. Changes in fair

value due to instrument-specific credit risk for 2009 was not

material. At December 31, 2009, residential mortgage loans

held in portfolio had a total fair value of $88 million and a

total outstanding principal balance of $104 million.

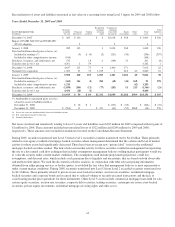

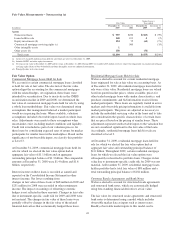

Customer Resale Agreements and Bank Notes

We have elected to account for structured resale agreements

and structured bank notes, which are economically hedged

using free-standing financial derivatives at fair value.

The fair value for structured resale agreements and structured

bank notes is determined using a model which includes

observable market data as inputs such as interest rates.

Readily observable market inputs to this model can be

122