PNC Bank 2009 Annual Report Download - page 35

Download and view the complete annual report

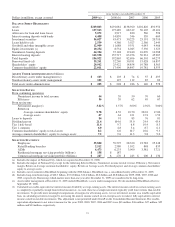

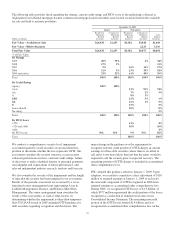

Please find page 35 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our loan portfolio continued to be diversified among

numerous industries and types of businesses. The loans that

we hold are also concentrated in, and diversified across, our

principal geographic markets.

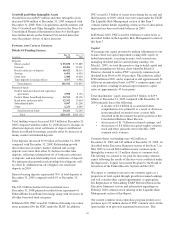

Commercial lending is the largest category and is the most

sensitive to changes in assumptions and judgments underlying

the determination of the allowance for loan and lease losses.

We have allocated $3.4 billion, or 66%, of the total allowance

for loan and lease losses at December 31, 2009 to these loans.

We allocated $1.7 billion, or 34%, of the remaining allowance

at that date to consumer lending. This allocation also

considers other relevant factors such as:

(a) Actual versus estimated losses,

(b) Regional and national economic conditions,

(c) Business segment and portfolio concentrations,

(d) Industry conditions,

(e) The impact of government regulations, and

(f) Risk of potential estimation or judgmental errors,

including the accuracy of risk ratings.

Higher Risk Loans

Our loan portfolio contains higher risk loans that are more

likely to result in credit losses. We established specific and

pooled reserves on the total commercial lending category,

including higher risk loans, of $3.4 billion at December 31,

2009. This represented approximately two-thirds of the total

allowance for loan and lease losses of $5.1 billion at that date.

The remaining one-third of the allowance for loan and lease

losses pertained to the total consumer lending category. This

category of loans is more homogenous in nature and has

certain characteristics that can be assessed at a total portfolio

level in terms of loans representing higher risk. We do not

consider government insured/government guaranteed loans to

be higher risk as we do not believe these loans will result in a

significant loss because of their structure. These loans are

excluded from the following assessment of higher risk loans.

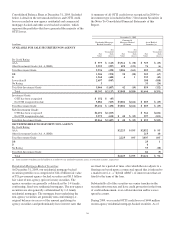

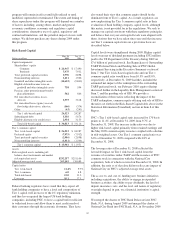

Our home equity lines of credit and installment loans

outstanding totaled $35.9 billion at December 31, 2009. In this

portfolio, we consider the higher risk loans to be those with a

recent FICO credit score of less than or equal to 660 and a

loan-to-value ratio greater than 90%. Such loans totaled $1.2

billion or approximately 3% of the total home equity line and

installment loans at December 31, 2009. These higher risk

loans were concentrated in our geographic footprint with 28%

in Pennsylvania, 14% in Ohio, 11% in New Jersey, 7% in

Illinois, 6% Missouri, and 5% in Kentucky, with the

remaining loans dispersed across several other states. Option

ARM loans and negative amortization loans in this portfolio

were not significant. Within the higher risk home equity

portfolio, approximately 10% are in some stage of

delinquency and 5% are in late stage (90+ days) delinquency

status.

In our $18.2 billion residential mortgage portfolio, loans with

a recent FICO credit score of less than or equal to 660 and a

loan-to-value ratio greater than 90% totaled $.8 billion and

comprised approximately 5% of this portfolio at December 31,

2009. Twenty-two percent of the higher risk loans are located

in California, 13% in Florida, 10% in Illinois, 8% in

Maryland, 5% in Pennsylvania, and 5% in New Jersey, with

the remaining loans dispersed across several other states.

Option ARM loans and negative amortization loans in this

portfolio were not significant. Within the higher risk

residential mortgage portfolio of $.8 billion, approximately

53% are in some stage of delinquency and 41% are in 90+

days late stage delinquency status.

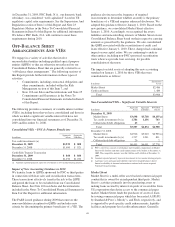

Within our home equity lines of credit, installment loans and

residential mortgage portfolios, approximately 5% of the

aggregate $54.1 billion loan outstandings at December 31,

2009 have loan-to-value ratios in excess of 100%. The impact

of housing price depreciation is reflected in the allowance for

loans and lease losses as a result of the consumer reserve

methodology process. The consumer reserve process is

sensitive to collateral values which in turn affect loan loss

severity. While our consumer reserve methodology strives to

reflect all significant risk factors, there is an element of

uncertainty associated with, but not limited to, potential

imprecision in the estimation process due to the inherent time

lag of obtaining information such as housing price

depreciation. We provide additional reserves where

appropriate to provide coverage for losses attributable to such

risks.

We obtain updated property values annually for select

residential mortgage loan portfolios. We are expanding this

valuation process to update the property values on the

majority of our real estate secured consumer loan portfolios.

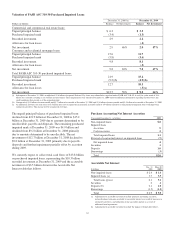

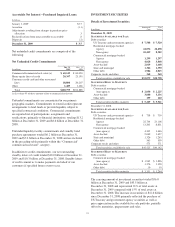

Information related to purchased impaired loans, purchase

accounting accretion and accretable net interest recognized

during 2009 in connection with our acquisition of National

City follows.

31