PNC Bank 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

pricing the loans. When available, valuation assumptions

included observable inputs based on whole loan sales.

Adjustments are made to these assumptions to account for

situations when uncertainties exist, including market

conditions and liquidity. Credit risk is included as part of our

valuation process for these loans by considering expected

rates of return for market participants for similar loans in the

marketplace. Based on the significance of unobservable

inputs, we classify this portfolio as Level 3.

Equity Investments

The valuation of direct and indirect private equity investments

requires significant management judgment due to the absence

of quoted market prices, inherent lack of liquidity and the

long-term nature of such investments. The carrying values of

direct and affiliated partnership interests reflect the expected

exit price and are based on various techniques including

publicly traded price, multiples of adjusted earnings of the

entity, independent appraisals, anticipated financing and sale

transactions with third parties, or the pricing used to value the

entity in a recent financing transaction. In September 2009,

the FASB issued ASU 2009-12 – Fair Value Measurements

and Disclosures (Topic 820) – Investments in Certain Entities

that Calculate Net Asset Value per Share (or Its Equivalent).

Based on the guidance, we value indirect investments in

private equity funds based on net asset value as provided in

the financial statements that we receive from their managers.

Due to the time lag in our receipt of the financial information

and based on a review of investments and valuation

techniques applied, adjustments to the manager-provided

value are made when available recent portfolio company

information or market information indicates a significant

change in value from that provided by the manager of the

fund. These investments are classified as Level 3.

Customer Resale Agreements

We account for structured resale agreements, which are

economically hedged using free-standing financial derivatives,

at fair value. The fair value for structured resale agreements is

determined using a model which includes observable market

data such as interest rates as inputs. Readily observable

market inputs to this model can be validated to external

sources, including yield curves, implied volatility or other

market-related data. These instruments are classified as

Level 2.

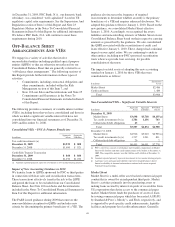

BlackRock Series C Preferred Stock

Effective February 27, 2009, we elected to account for the

approximately 2.9 million shares of the BlackRock Series C

Preferred Stock received in a stock exchange with BlackRock

at fair value. The Series C Preferred Stock economically

hedges the BlackRock LTIP liability that is accounted for as a

derivative. The fair value of the Series C Preferred Stock is

determined using a third-party modeling approach, which

includes both observable and unobservable inputs. This

approach considers expectations of a default/liquidation event

and the use of liquidity discounts based on our inability to sell

the security at a fair, open market price in a timely manner.

Due to the significance of unobservable inputs, this security is

classified as Level 3.

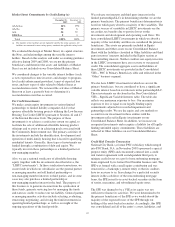

Level 3 Assets and Liabilities

Financial instruments are considered Level 3 when their

values are determined using pricing models, discounted cash

flow methodologies or similar techniques and at least one

significant model assumption or input is unobservable.

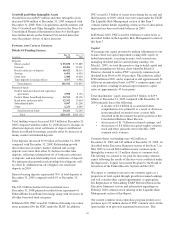

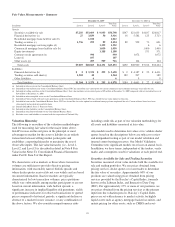

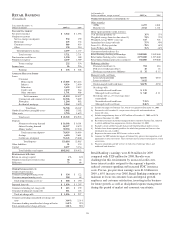

Level 3 Assets and Liabilities

Dollars in millions

Total

Level 3

Assets

Total

Level 3

Liabilities

% of Total

Assets

at Fair Value

% of Total

Liabilities

at Fair Value

%of

Consolidated

Assets

%of

Consolidated

Liabilities

December 31, 2009 $14,151 $295 22% 6% 5% < 1%

December 31, 2008 7,012 22 19% < 1% 2% < 1%

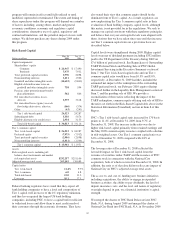

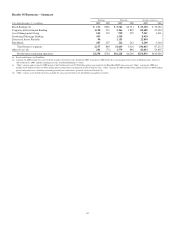

During 2009, securities transferred into Level 3 from Level 2

exceeded securities transferred out by $4.4 billion. Total

securities measured at fair value and classified in Level 3 at

December 31, 2009 and December 31, 2008 included securities

available for sale and trading securities consisting primarily of

non-agency residential mortgage-backed securities and asset-

backed securities where management determined that the

volume and level of activity for these assets had significantly

decreased. There have been no recent new “private label” issues

in the residential mortgage-backed securities market. The lack

of relevant market activity for these securities resulted in

management modifying its valuation methodology for the

instruments transferred in 2009. Other Level 3 assets include

certain commercial mortgage loans held for sale, certain equity

securities, auction rate securities, corporate debt securities,

private equity investments, residential mortgage servicing rights

and other assets.

47