PNC Bank 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Our business and operating results are affected by our

ability to identify and effectively manage risks inherent

in our businesses, including, where appropriate, through

the effective use of third-party insurance, derivatives, and

capital management techniques, and by our ability to

meet evolving regulatory capital standards.

• The adequacy of our intellectual property protection, and

the extent of any costs associated with obtaining rights in

intellectual property claimed by others, can impact our

business and operating results.

• Our ability to anticipate and respond to technological

changes can have an impact on our ability to respond to

customer needs and to meet competitive demands.

• Our ability to implement our business initiatives and

strategies could affect our financial performance over the

next several years.

• Competition can have an impact on customer acquisition,

growth and retention, as well as on our credit spreads and

product pricing, which can affect market share, deposits

and revenues.

• Our business and operating results can also be affected

by widespread natural disasters, terrorist activities or

international hostilities, either as a result of the impact on

the economy and capital and other financial markets

generally or on us or on our customers, suppliers or other

counterparties specifically.

• Also, risks and uncertainties that could affect the results

anticipated in forward-looking statements or from

historical performance relating to our equity interest in

BlackRock, Inc. are discussed in more detail in

BlackRock’s filings with the SEC, including in the Risk

Factors sections of BlackRock’s reports. BlackRock’s

SEC filings are accessible on the SEC’s website and on

or through BlackRock’s website at www.blackrock.com.

This material is referenced for informational purposes

only and should not be deemed to constitute a part of this

Report.

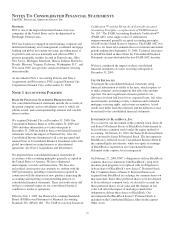

In addition, our acquisition of National City Corporation

(National City) on December 31, 2008 presents us with a

number of risks and uncertainties related both to the

acquisition itself and to the integration of the acquired

businesses into PNC. These risks and uncertainties include the

following:

• The anticipated benefits of the transaction, including

anticipated cost savings and strategic gains, may be

significantly harder or take longer to achieve than

expected or may not be achieved in their entirety as a

result of unexpected factors or events.

• Our ability to achieve anticipated results from this

transaction is dependent on the state going forward of the

economic and financial markets, which have been under

significant stress recently. Specifically, we may incur

more credit losses from National City’s loan portfolio

than expected. Other issues related to achieving

anticipated financial results include the possibility that

deposit attrition or attrition in key client, partner and

other relationships may be greater than expected.

• Legal proceedings or other claims made and

governmental investigations currently pending against

National City, as well as others that may be filed, made

or commenced relating to National City’s business and

activities before the acquisition, could adversely impact

our financial results.

• Our ability to achieve anticipated results is also

dependent on our ability to bring National City’s

systems, operating models, and controls into conformity

with ours and to do so on our planned time schedule. The

integration of National City’s business and operations

into PNC, which includes conversion of National City’s

different systems and procedures, may take longer than

anticipated or be more costly than anticipated or have

unanticipated adverse results relating to National City’s

or PNC’s existing businesses. PNC’s ability to integrate

National City successfully may be adversely affected by

the fact that this transaction has resulted in PNC entering

several markets where PNC did not previously have any

meaningful retail presence.

In addition to the National City transaction, we grow our

business from time to time by acquiring other financial

services companies. Acquisitions in general present us with

risks, in addition to those presented by the nature of the

business acquired, similar to some or all of those described

above relating to the National City acquisition.

ITEM

7A –

QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK

This information is set forth in the Risk Management section

of Item 7 of this Report.

86