PNC Bank 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

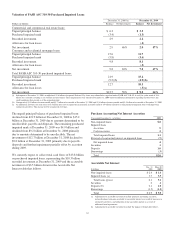

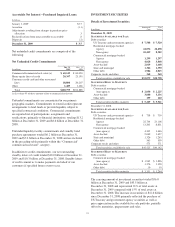

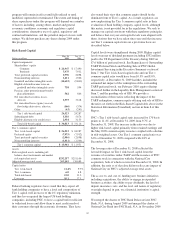

Valuation of FASB ASC 310-30 Purchased Impaired Loans

December 31, 2008 (a) December 31, 2009

Dollars in billions Balance Net Investment Balance Net Investment

Commercial and commercial real estate loans:

Unpaid principal balance $ 6.3 $ 3.5

Purchased impaired mark (3.4) (1.3)

Recorded investment 2.9 2.2

Allowance for loan losses (.2)

Net investment 2.9 46% 2.0 57%

Consumer and residential mortgage loans:

Unpaid principal balance 15.6 11.7

Purchased impaired mark (5.8) (3.6)

Recorded investment 9.8 8.1

Allowance for loan losses (.3)

Net investment 9.8 63% 7.8 67%

Total FASB ASC 310-30 purchased impaired loans:

Unpaid principal balance 21.9 15.2

Purchased impaired mark (9.2)(b) (4.9)(b)

Recorded investment 12.7 10.3

Allowance for loan losses (.5)(c)

Net investment $12.7 58% $ 9.8 64%

(a) Subsequent to December 31, 2008, an additional $2.6 billion of acquired National City loans were identified as impaired under FASB ASC 310-30. A total fair value mark of $1.8

billion was recorded, resulting in a $.8 billion net investment. These impairments were effective December 31, 2008 based on additional information regarding the borrowers and

credit conditions that existed as of the acquisition date.

(b) Comprised of $5.5 billion of nonaccretable and $3.7 billion of accretable at December 31, 2008 and $1.4 billion of nonaccretable and $3.5 billion of accretable at December 31, 2009.

(c) An additional allowance for loan losses of $.5 billion does not recognize the incremental accretable yield of $.9 billion related to certain purchased impaired loans with improving

estimated cash flows. This income will be recognized over time.

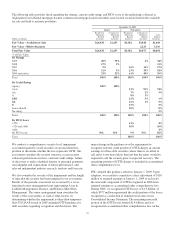

The unpaid principal balance of purchased impaired loans

declined from $21.9 billion at December 31, 2008 to $15.2

billion at December 31, 2009 due to amounts determined to be

uncollectible, payoffs and disposals. The remaining purchased

impaired mark at December 31, 2009 was $4.9 billion and

declined from $9.2 billion at December 31, 2008 primarily

due to amounts determined to be uncollectible. The net

investment of $12.7 billion at December 31, 2008 declined to

$9.8 billion at December 31, 2009 primarily due to payoffs,

disposals and further impairment partially offset by accretion

during 2009.

We currently expect to collect total cash flows of $13.8 billion

on purchased impaired loans, representing the $10.3 billion

recorded investment at December 31, 2009 and the accretable

net interest of $3.5 billion shown in the Accretable Net

Interest table that follows.

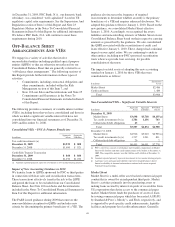

Purchase Accounting Net Interest Accretion

Year ended December 31- in billions 2009

Non-impaired loans $.8

Impaired loans

Accretion .9

Cash recoveries .2

Total impaired loans 1.1

Reversal of contractual interest on impaired loans (.7)

Net impaired loans .4

Securities .1

Deposits 1.0

Borrowings (.3)

Total $2.0

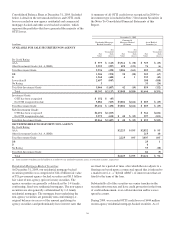

Accretable Net Interest

In billions

Dec. 31

2008

Dec. 31

2009

Non-impaired loans $ 2.4 $ 1.6

Impaired loans (a) 3.7 3.5

Total loans (gross) 6.1 5.1

Securities .2 .1

Deposits (b) 2.1 1.0

Borrowings (1.5) (1.2)

Total $ 6.9 $ 5.0

(a) Adjustments to accretable net interest include purchase accounting accretion,

reclassifications from non-accretable to accretable interest as a result of increases in

estimated cash flows, and reductions in the accretable amount as a result of

additional loan impairments.

(b) Adjustments to accretable net interest include the impact of branch divestitures.

32